The new insurance company, Lemonade, is finally able to take the covers off of its radical (and pretty freaking cool) insurance plans.

The company has received its initial license in New York as the first step in its plan to roll out nationwide.

Its launch is a challenge to traditional insurers and a definitive sign that the technology disruptions that have shaken the banking industry are coming for insurance as well.

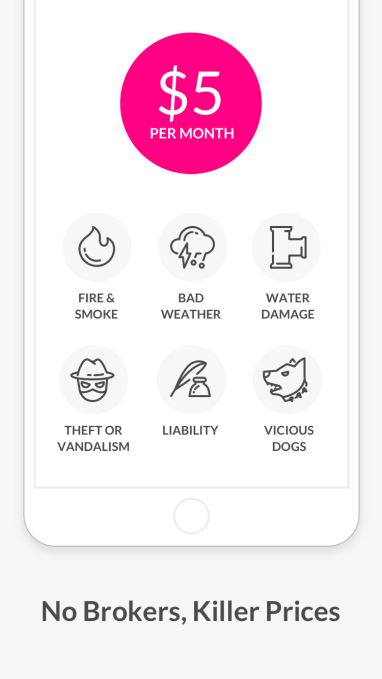

Lemonade’s policies for renters and homeowners insurance start at $5 and $35 a month, respectively. Those prices are two to four times less than the industry standard.

The company uses the full compliment of buzz words to describe its machine learning-based, algorithmically driven, technology that it claims can better and more quickly approve and pay out claims to policy holders at a lower price.

Price and technology aren’t the only things that separates Lemonade from traditional insurers. The company also has created a payout system where policy holders designate a non-profit that can receive payouts from their unclaimed insurance.

Price and technology aren’t the only things that separates Lemonade from traditional insurers. The company also has created a payout system where policy holders designate a non-profit that can receive payouts from their unclaimed insurance.

Each year, any money leftover from the insurance policy (called the “underwriting profit” in industry terms) is donated to a cause during what Lemonade calls its annual “giveback” period.

Initially the company wanted to payout these underwriting profits directly to its policy holders, but under current law, that wasn’t possible (don’t worry folks, Lemonade is looking to change the law).

“Our initial application to the department was to give the money back to consumers. They were not going to do it as the laws are currently drafted,” said Daniel Schreiber (no relation). “Spiritually our idea is that it’s not our money it’s your money… that’s something that the law is not drafted to support.”

That Giveback policy (in any form) is more than just a perk for policyholders, it’s a benefit to the company as well, according to the thinking among Lemonade’s executives.

The biggest problem that drives up insurance premiums is fraud. According to estimates provided by Lemonade, fraud eats up as much as 38% of all of the money paid into traditional insurers, and can inflate premiums by $1,300.

At Lemonade, the hypothesis is that policyholders are less likely to make fraudulent claims if they know their money is going to be paid out to a charity that they’ve selected themselves.

“You’re not screwing some big amorphous nameless company,” Schreiber said. “You’re screwing your local charity.”

Or to put it more… philosophically, as aid Professor Dan Ariely, Chief Behavioral Officer, Lemonade, does:

Knowing that every dollar denied to you in claims is a dollar more to your insurer, brings out the worst in us all… Since we don’t pocket unclaimed money, we can be trusted to pay claims fast and hassle-free. As for our customers, knowing fraud harms a cause they believe in, rather than an insurance company they don’t, brings out their better nature too. Everyone wins.

The insurer may be new, but it’s taking some very retro precautions. It’s rated by the traditional ratings agencies and is backed by reinsurers including Warren Buffett’s insurance company within Berkshire Hathaway and Lloyd’s of London.

And it’s making its money in a pretty traditional way — by taking a 20% cut of all of the money paid into policies.

As for the decision to launch in New York first, Schreiber explained that a company has to be regulated and licensed in one state before it could be admitted to others.

“Our expectation is that expanding to other states should happen relatively quickly,” he said.