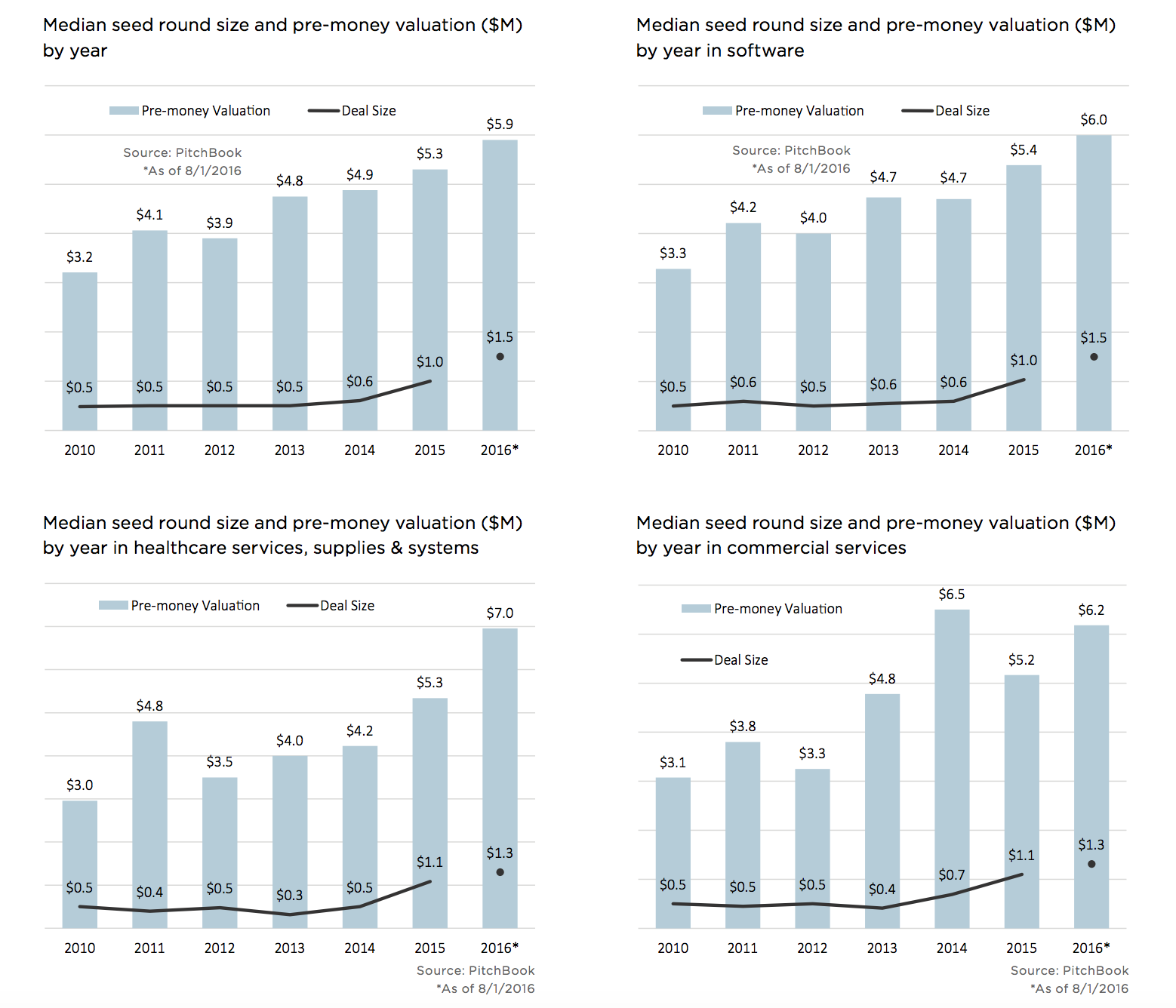

Investors are valuing seed-stage startups at the highest levels ever, according to a new report published by the private deals database Pitchbook. According to its analysis, the pre-money valuation for a seed-stage company reached $5.9 million in the first half of this year, an 11 percent increase from the end of 2015 and a whopping 84 percent increase from 2010 figures. At the same time, the median seed round size increased 50 percent year-over-year to $1.5 million, up from $480,000 recorded in 2010.

So what’s up? Pitchbook has its theories. It points to the wave of dedicated seed-stage firms to emerge on the scene in recent years, right alongside a growing number of accelerators, the most famous of which remain Techstars, Y Combinator and 500 Startups. (You may not be surprised to learn that there are roughly 160 accelerators now up and running in the U.S. alone, according to biz school professors Yael Hochberg of Rice University and Susan Cohen of the University of Richmond, who’ve taken up the daunting task of starting to rank them every year.)

Pitchbook also notes that while valuations are up, the number of seed-stage companies getting funded is down, suggesting that those companies that do attract funding have better businesses than some of the startups that raised seed funding in recent years.

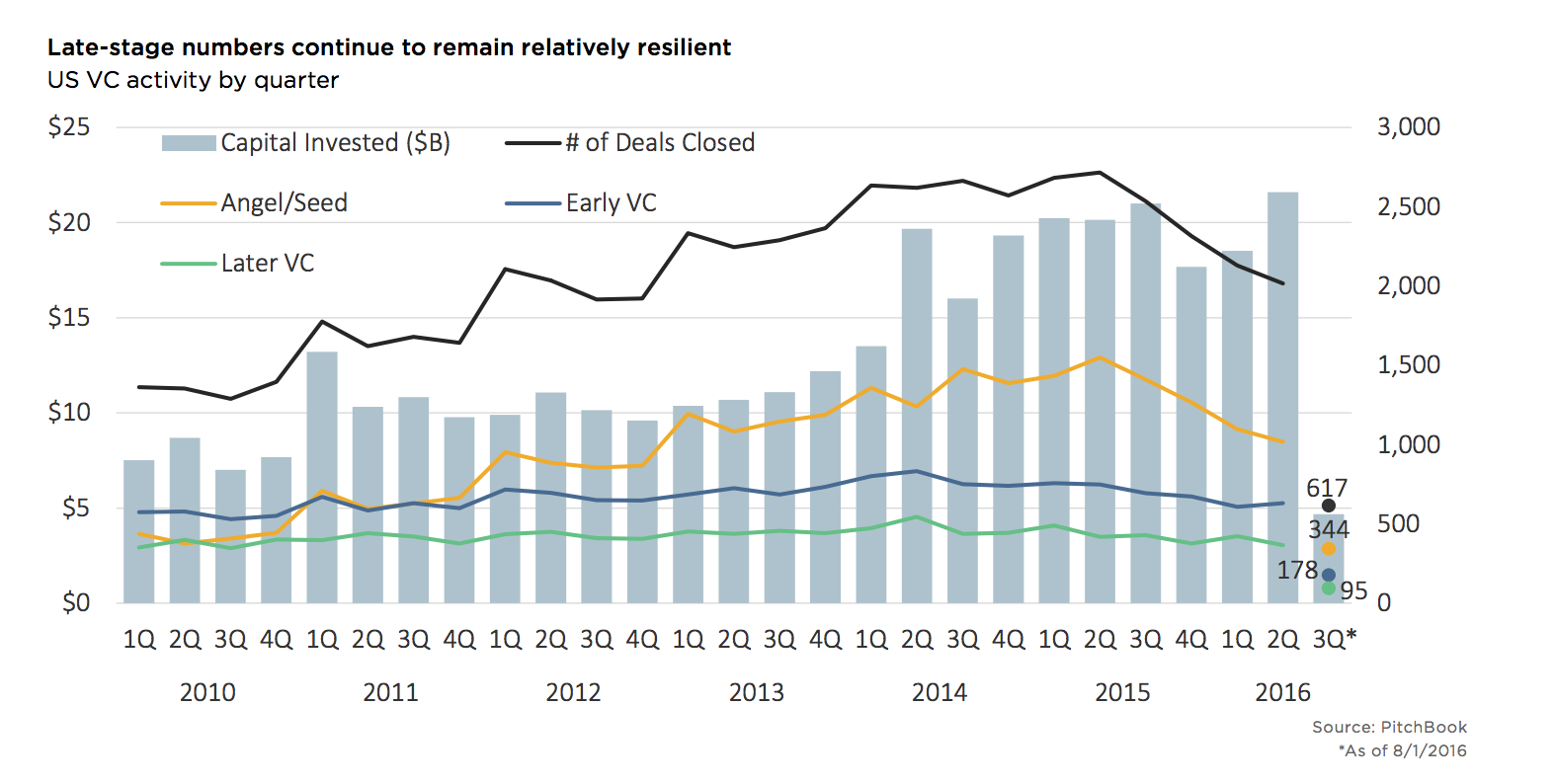

Perhaps more surprising about Pitchbook’s newest report on valuations is its conclusion that valuation levels for later-stage companies are also at their highest levels on record. According to its findings, the median Series C valuation in the first half of 2016 reached $90 million, which is 16 percent higher than it was in the first half of 2015. The median Series D valuation is similarly higher: 13 percent year-over-year to $200 million.

What about the narrative that the down rounds are on the rise, particularly as mutual and hedge funds and other non-traditional sources of venture capital retrench from the market? Pitchbook suggests there has been a “considerable” decline in Series D activity, but that valuations for the perceived winners mostly just keep increasing.

In fact, it says the number of down rounds in the first half of this year are up just 1 percent over the number of completed deals by this time last year. In addition, it says a whopping 76 percent of venture financings have involved a higher valuation than the company’s previous round.

The optimist in us wants to proffer that these statistics suggest a so-called flight to quality. Just as likely: Despite feeling more trepidatious than in recent years, those with capital aren’t sure where else to invest it right now. Pitchbook estimates there was $95 million in “dry powder” available to VCs as of the end of 2015. Meanwhile, the first quarter of this year — when 67 U.S. venture firms raised more than $14 billion — ranked as the strongest quarter for dollars raised since the second quarter of 2006, when 79 funds raised $14.3 billion.

You can check out the full report right here if you’re also interested in trying to figure out what’s happening.