When you hear “startup,” you probably think of Facebook, Airbnb or Uber before Casper or Blue Bottle Coffee. But while companies that produce tangible goods like food and clothing receive less media attention, they’re proving just as innovative as their more high-profile tech counterparts.

In fact, Warby Parker and Everlane, two retail startups, ranked higher than Airbnb and Snapchat on Fast Company’s The Most Innovative Companies of 2016.

Consumers are demanding new products with healthier, more transparent ingredients, lower environmental burdens and greater social impacts — and startups are better positioned to meet these demands than more established, conservative corporations. Consequently, small brands are eating away at big brands’ market share, and M&A activity is skyrocketing.

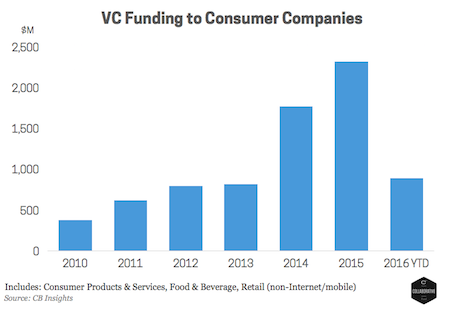

As a result, early-stage consumer startups are catching the attention of venture capitalists who have traditionally focused on higher multiple sectors like tech. Only 5-10 percent of venture capital dollars go to consumer companies, versus more than 50 percent for technology startups (despite each individually representing around 20 percent of the U.S. stock market). That said, funding is accelerating and is on track to reach $1.8 billion in 2016, a 185 percent increase since 2011, according to data from CB Insights.

As more investors pay attention to the unique opportunity in consumer startups, it’s important to recognize that the criteria for evaluating these startups must also be unique. Here are some of the features I look for.

Aspirational and on-trend

First and foremost, companies must be aligned with value-driven consumer trends toward simple, authentic products. This means healthy, natural ingredients, sustainable sourcing, convenient distribution and packaging and a personalized customer experience. These features aren’t just preferences, they’re priorities for which customers are willing to pay — and pay well. In its American Pantry Study, Deloitte found that 81 percent of Americans are willing to pay a premium for healthier products, and 55 percent are willing to pay more for eco-friendly options.

Brands also must create an aspirational image to appeal to highly selective millennial consumers who use products to help promote their own personal brand. As Nicholas Fereday of Rabobank says in, Dude, where’s my consumer?:

The aspirational masses are increasingly following the trends of the rich and elite, and this has led to a democratization of premium consumption trends. The rising sales of super-premium wines, the widespread availability of quality Arabica coffee at regular fast food outlets such as McDonald’s and Dunkin’ Donuts, and the continued rise in sales of organic foods are all examples of this.

Digital fluency

Companies must be able to leverage the power of the internet in order to market to, engage with and distribute to customers who are increasingly reliant on their digital devices. According to a Watershed Communications study on the media habits of millennials, 84 percent of Gen Yers feel they can describe in just one sentence a food or beverage brand they discovered, and 86 percent determine “brand fit” immediately after being exposed to a product.

It’s not sufficient for brands merely to be digitally competent; they must be digitally fluent.

More than ever, companies must effectively and consistently articulate their brand mission to the consumer. To do this, they must be able to communicate via the channels that are most frequented by their customers — most notably, social media.

But it’s not sufficient for brands merely to be digitally competent; they must be digitally fluent. While big brands still spend twice as much on TV advertising as internet marketing (despite the fact that Americans already spend more time using the internet than watching television), these companies are beginning to appreciate the network effects of social media and are spending record premiums on acquisition through Facebook, Twitter and Instagram.

When it comes to digital marketing, the new class of CPG startups must do better than generic Facebook ads by creating unique content and meaningful collaborations. When Califia Farms posts a recipe for pumpkin spiced lattes on Pinterest or Warby Parker shares a fan’s bespectacled Instagram selfie, they are not just marketing to their consumer, they’re crafting a brand image. Social media and YouTube influencers are comparable in favorability and awareness to many top celebrities — and successful startups are working with them to build buzz around their products.

Companies also must be adept at optimizing digital distribution channels. As customers increasingly purchase products online and value a consistent brand image, selling directly to the consumer via e-commerce becomes more and more valuable. This is the “digitally native vertical integration” model that Warby Parker, Casper and Everlane all used to upend industries bloated by wholesalers.

Repeat customers

Very few companies can survive if they need to repurchase their customers on every transaction. Metrics differ by category, but as a general rule it costs 5x to 7x more to acquire a new customer than to retain an existing one, so loyal customers are paramount for success.

Subscription models like Dollar Shave Club are the mode du jour for optimizing customer retention, because repetition is built into the model. It’s a straightforward way to ensure customers keep coming back, but it doesn’t work for every category, particularly while Amazon continues to loom large.

The environment has been increasingly supportive of consumer goods startups since millennials began earning their own paychecks and making decisions about how to spend their money.

Another good tactic for enticing repeat customers is to focus on “zero-sum markets” like razors or pet food, where a customer typically only uses one brand — versus, say, handbags or snack food, where a customer purchases products from multiple brands.

But high customer loyalty can be achieved without subscription models or zero-sum markets by consistently taking a “customer-first” approach and creating a positive experience from the moment a consumer is exposed to the brand to the moment they purchase and use the product. Warby Parker allows customers to try on multiple glasses at home before making a purchase; Casper mattresses arrive in a convenient box; and Everlane offers one-hour delivery in a few major cities. These are all methods for enhancing the customer experience from start to finish.

Differentiation

The number of new products in the U.S. has more than doubled since 2000, creating a plethora of choice for the consumer. With so many options for protein bars or craft beers, startups must differentiate themselves in order to be successful.

And that differentiation must be meaningful. Adding superficial features like rotating gizmos and flashing lights — a default strategy for legacy brands like P&G when they wanted to raise prices in the past — just doesn’t cut it anymore.

While taglines like “Uber for Restaurants” or “Tinder for Sneakers” may seem tempting, consumer startups can’t just transfer proven tech models to a new space. To succeed in today’s highly competitive environment, consumer startups need a brand new idea and some unfair advantage to set themselves apart.

In other words, a company should be uniquely qualified to solve a specific problem with a new solution. Even if a startup can achieve market supremacy, it’s perpetually challenged by copycat products from other emerging startups or line extensions from big brands, so it must have some “edge” to maintain a defensive advantage. Fortunately, this edge can take many forms: sourcing advantages, an experienced team and proprietary IP are just a few examples of unfair advantages a company can have over the competition.

Realistic valuations and growth targets

Although many consumer categories are scaling faster than ever, the growth trajectory is still typically not as steep as traditional venture capital investments. Consumer startups seeking funding often try to mimic the valuations of more popular technology verticals, but the profile for CPG and retail is profoundly different, so the financial projections and valuations should be, as well.

The expectation of tech-like growth has been the death knell for a great many consumer products companies, which may be forced to cut corners and compromise on quality in order to meet unrealistic investor demands. For consumer and retail companies with revenues over $1 million, valuations should typically be no more than one to four times LTM net revenue. Earlier-stage companies should base growth targets and valuations on comparable company metrics. As Ryan Caldbeck, CEO of CircleUp, points out in The Best Way to Set the Valuation of Your Company, unrealistic valuations can lead to drawn out fundraises and disappointed investors.

Healthy margins

By cutting out wholesalers, lowering overhead costs and using savvy marketing techniques, consumer startups can be successful on narrower margins than legacy corporations, but gross margins should still be at least 40-60 percent across most categories.

Much more than technology, consumer goods are highly dependent on real-world uncertainties, like fluctuating commodity prices or supply chain disruptions, which can increase a startup’s COGS and thus negatively impact the bottom line — so healthy margins are imperative for downside protection.

Technology companies are frequently able to raise capital, grow and even get acquired without ever achieving profitability, but strong unit economics are vital for physical goods. In fact, many potential acquirers will look at a startup’s margins before they even consider metrics like EBITDA or net income.

It’s a great time to invest… don’t miss it

The environment has been increasingly supportive of consumer goods startups since millennials began earning their own paychecks and making decisions about how to spend their money (around 2005). As millennials mature and continue to drive consumer trends, startups that are better able to capitalize on these trends are scaling faster and bigger than ever. This growth is catching the attention of venture capitalists (for investments) and big brands (for acquisition) alike. It’s no surprise that M&A activity hit an all-time high of $238 billion last year — twice as much as tech.

But although the growth path for consumer startups is getting steeper, the model remains distinct from traditional venture capital investments and requires an entirely separate type of due diligence. The biggest mistake an investor can make is to ignore these differences. The second biggest mistake is to miss the opportunity altogether.