Smartphone sales have peaked, but if you’re looking for places in the world where the trend is still upwards and the surface is just being scratched, then Southeast Asia is one region to keep in mind.

Sales growth may be slowing in the U.S., Europe and China where most consumers already own a smartphone, but the revolution is still very much underway in emerging markets. India is one such place — smartphone sales were up 17 percent year-on-year in the most recent quarter — and IDC reported this week that sales in Southeast Asia rose 6.5 percent year-on-year. That’s smaller than India, sure, but the movement is upwards.

Southeast Asia counts a cumulative population of more than 600 million, yet smartphone sales across its seven largest countries reached 100 million (for the first time) in 2015. There’s clearly a lot of growth to be had here, and sales touched 28 million in Q2 2016 — up a hefty 18.1 percent on the previous quarter.

IDC didn’t break out its figures based on countries, but we know that Indonesia is the largest market, followed by Thailand and the Philippines — they accounted for 29, 22 and 14 percent of sales in 2015, respectively.

There are some interesting insights to glean from IDC’s Q2 2016 data.

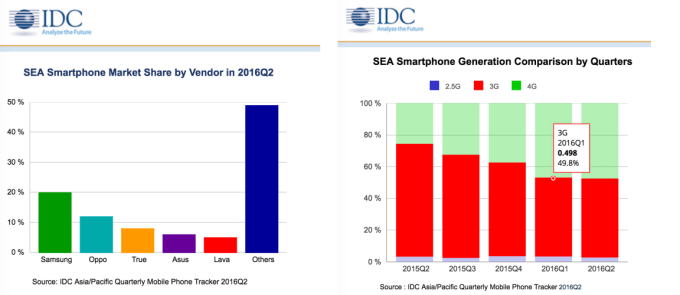

Some 68 percent of devices sold were priced below $150. Samsung’s Galaxy J series topped the charts, and gave the Korean phone maker the lead with 20 percent of smartphone sales across Southeast Asia in the three-month period.

Like India, Chinese brands are providing fierce competition in the region, with Oppo sitting in second with 12 percent marketshare. Thai operator True came in second — which is remarkable given it sells phones in just one country — ahead of Asus and India’s Lava, which is also working closely with operators in Thailand.

Finally, while the rest of the world has moved to 4G (and beyond) 3G devices still dominate in Southeast Asia. Part of that is again due to the influence of Thailand, where operators are migrating 2G customers to 3G with some very attractive deals — the same trend that propelled True and Lava’s marketshare.

Growth is slower in Southeast Asia, but the longer term potential is high. Earlier this year, a report co-authored by Google and Temasek found that 3.8 million people come online for the first time in the region each month. Mobile is the primary access platform, and IDC foresees that over time more expensive devices will see sales grow as those new internet users seek to upgrade their smartphone.

“With the rise of replacement users in Southeast Asia seeking to upgrade their handsets in order to cope with the latest usage and apps, vendors will need to increase the market availability of handsets with better specs that come at slightly higher prices, which the buyers are willing to invest in for a better usage experience,” said IDC analyst Jensen Ooi.

Ooi added that we can expect Chinese smartphone makers to attack the $150-250 market segment aggressively in response to that demand.