Look! Another notable funding round for a fintech startup in Southeast Asia, after Singapore-based Funding Societies raised a $7.5 million Series A round for its take on marketplace lending.

Sequoia India — the VC firm’s fund that invests in Southeast Asian companies — led the investment, which included angel investors.

Launched in June 2015, Funding Societies is similar to established U.S. companies like Lending Club, which allow anyone to provide money for a loan with the potential to get it back alongside interest. The Singaporean company differentiates itself slightly by calling itself a “peer-to-business” platform. That essentially means that it currently only provides loans for SMEs, rather than consumers, although that could change in the future when it has higher volumes.

Fund Societies is active in Singapore and (as ‘Modalku’) Indonesia — Southeast Asia’s most developed economy and its largest economy, respectively — where it is rivaled by the likes of Capital Match and MoolahSense.

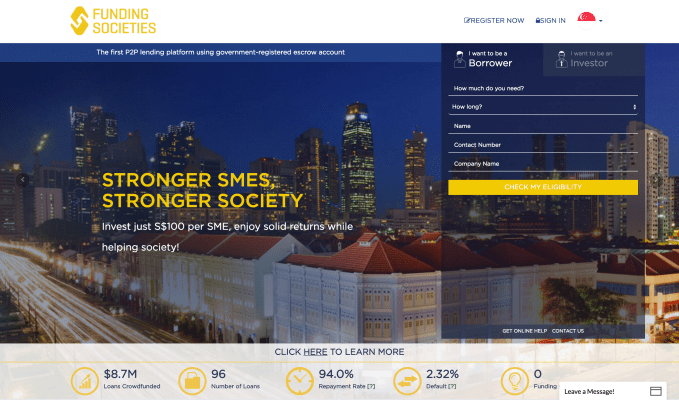

The company said it has paid out $8.7 million to date across 96 loans. It claims a 94 percent repayment rate which CEO Kelvin Teo touted as its most notable data point since it shows reliability over volume.

“We’re not the biggest in Singapore, but we have done the most term loans because we take the approach that over-lending to a person will come and bite you in terms of defaults,” he explained.

As for fine details: Funding Societies is primarily focused on working capital loans. In Singapore, the average loan size is SG$90,000 ($67,000) while that falls to SG$25,000 ($18,500) in Indonesia.

It charges a loan origination feed to the borrower (3-4 percent in Singapore, 5-6 percent in Indonesia) and a 1 percent monthly fee to the lender. It claims an approval rate of between 15-25 percent for loan applicants.

Expansion and regulation

Teo told TechCrunch that the company is working to expand its service to Malaysia, where it has a handful of employees and an application to operate locally is pending regulator feedback.

Those two areas — expansion to Malaysia and regulation generally — are among the key focuses for the money it just raised. Teo explained that the industry is still so young in the region, and it has bulked up on finances in anticipation of the demands of new regulations that is incoming.

He highlighted the importance of compliance by stressing that that even just raising money from investors required “an unbelievable” number of law firms.

“Industry regulation has been announced in Singapore, but it will still take some investment to reach that level of compliance,” he said.

Likewise, in Indonesia, he said the company is working with regulators to introduce a framework to regulate peer-based lending.

Competitive societies

Teo foresaw plenty of competition coming to market — that is why he and co-founder Reynold Wijaya launched the company in 100 days last year while they were in the U.S. completing their studies at Harvard University.

“If we had waited until we graduated [this year,] we’d have been too late to the market,” he said.

Not only was being early important to grasp the early opportunity, Teo argued, but timing was critical since he believes that the financial implication of regulations will put many competitors without funding out of business.

“If they haven’t fundraised in this period, platforms in this region will face difficulties to be compliant in their operations,” he said. “We expect the market to overheat in the next six months and then [there to be] consolidation.”

Outside of compliance and expansion — which includes expanding beyond capital city Jakarta in Indonesia — Funding Societies is planning to invest in its product. Right now, it has an iOS app for lenders and an Android app for businesses seeking loans — it is hard to ignore that Apple’s devices generally capture the more affluent portion of society in Asia, hence this decision — but Teo said there are plans to streamline its services for borrowers and lenders, add more services “make investment options that are tailored to investor needs.”

That sounds like a lot, and the company has already grown to some 70 employees, but the Funding Societies CEO insists that the company is matching startup-style growth with the responsibility that comes with providing financial products.

“We and our investors take the view in building slow and steady, instead of pushing hyper-growth, [which is] when default rates come and hit you.

“To be profitable, you need to achieve scale and that takes time,” he added, explaining that the company has a “two-to-three-year” target to reach breakeven.