U.S. venture investors tapped the brakes but did not carry out a sharp slowdown in Series A and B deal-making in the second quarter and first half of 2016, according to preliminary data from CrunchBase.

Average Series A rounds in the second quarter increased year-over-year. Second-quarter 2016 Series A rounds averaged $9.5 million, up from $9 million in Q2 of 2015. Median dollars for a second quarter Series A raise in 2016 was $7 million, up from $6 million in 2015.

In contrast, average Series B rounds contracted some in 2016. For the second quarter the average deal size came down from $22 million to $20 million year-over-year, an 8 percent reduction in average size. Median dollars were the same for second quarter 2016 and 2015 at $15 million.

As in past quarters, a high portion of the largest early-stage fundings went to life science companies developing breakthrough therapeutics platforms. Internet and technology companies also closed some big rounds, particularly in fintech, healthcare services and cloud computing.

“We’re not seeing a marked contraction in early-stage funding, particularly at Series A,” said CrunchBase CEO Jager McConnell. “The number of rounds has come down, but values have held up as investors continue to go after compelling opportunities and look to secure early mover advantage in big markets.”

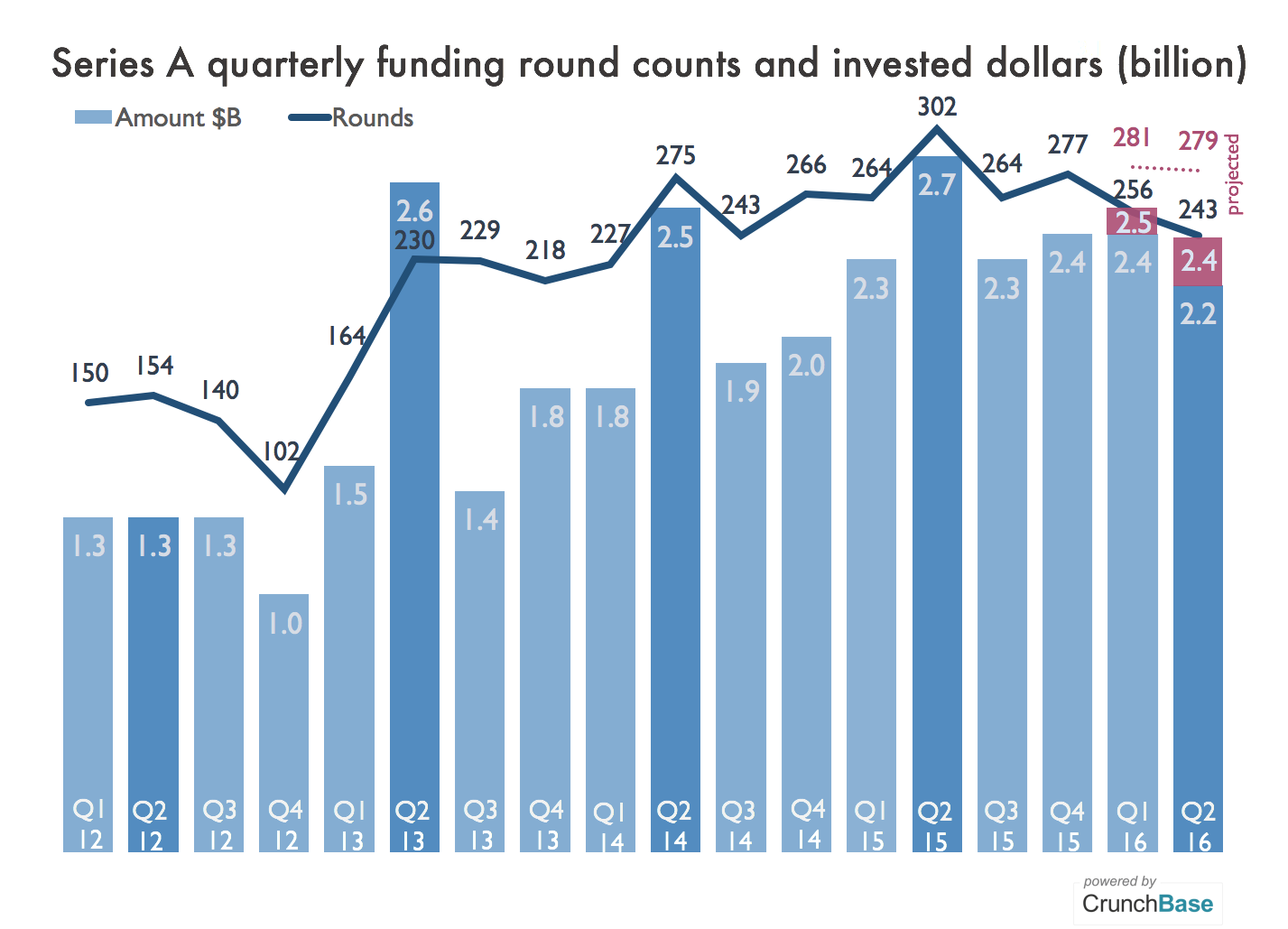

Series A

Reported Series A investments totaled $2.2 billion for the second quarter and $4.6 billion for the first half of the year. The number of reported rounds totaled 243 for the second quarter and 499 for the first half of the year. This compares with 566 rounds for the first half of 2015 with startups raising $4.9 billion.

Projected Series A investment for the second quarter and first half is $2.4 billion and $4.9 billion, respectively, based on the historical pattern of about 15-18 percent of funding amounts at that stage being reported after end-of-quarter. That’s down slightly from $2.7 billion and flat at $4.9 billion in the same periods last year. Projected Series A counts are slightly down around six rounds for the first half of 2016.

The biotech category drew the largest share of funding of any sector in the second quarter, with $275 million in Series A rounds. Next was the healthcare category, comprising health services, IT and devices, with $252 million in Series A funding, security, with $129 million, and e-commerce with $114 million.

The second quarter totals were boosted by a number of particularly large Series A rounds, which also raised round size averages. Some of the biggest Series A funding recipients included:

- Bright Health, provider of tech-enabled consumer health plans ($80 million)

- Aptinyx, developer of therapies for brain and nervous system disorders ($65 million)

- Vacasa, a vacation property management company ($35 million)

- Better Mortgage, an online mortgage platform ($30 million)

- Takt, a developer of customer engagement software ($30 million)

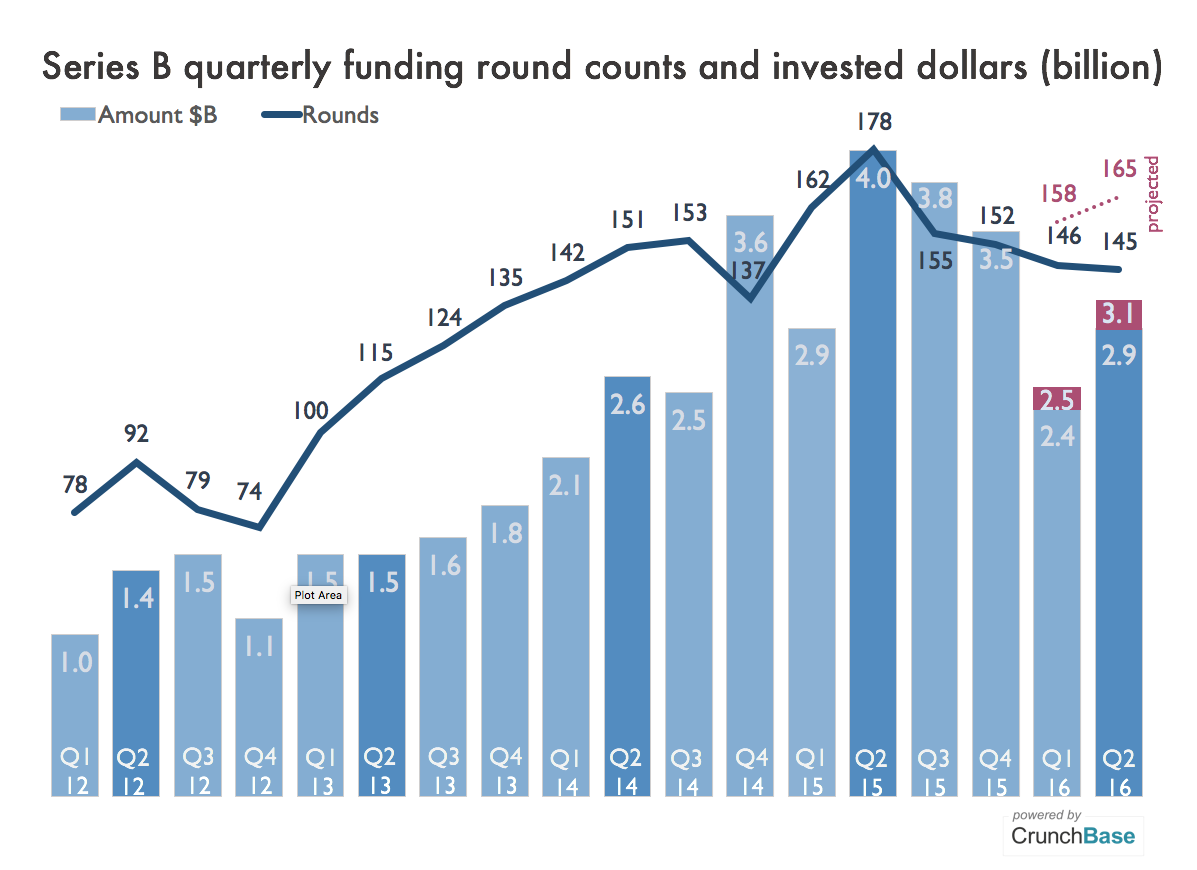

Series B

Reported Series B investments totaled $2.9 billion for the second quarter and $5.3 billion for the first half of the year. The number of reported rounds totaled 145 for the second quarter and 291 for the first half of the year. This compares with 340 rounds for the first half of 2015 with startups raising $6.9 billion.

Projected Series B investment for the second quarter and first half is $3.1 billion and $5.6 billion, based on the historical pattern that 12-15 percent of deals at that stage get reported after the end of the quarter. That’s down from $4 billion and $6.9 billion in the year-ago periods. Projected Series B counts are also down around 17 rounds for the first half of 2016.

The biotech sector drew the largest amount of Series B funding in the second quarter among industry categories tracked by CrunchBase, with $674 million invested. SaaS companies came in second, drawing $242 million in Series B fundraises, followed by healthcare with $201 million.

The second quarter totals were boosted by a number of particularly large Series B rounds, which also raised round size averages. Some of the biggest Series B funding recipients included:

- Human Longevity, a genomic diagnostics and cell therapy provider ($220 million)

- Hyperloop One, a next-generation transportation startup ($80 million)

- Dyn, a provider of internet performance management tools ($50 million)

- Luxe, a valet parking app, ($50 million)

Counts are down slightly for the first half of 2016 compared to the first half of 2015. Projected invested dollars are flat for Series A and down 18 percent ($1.3 billion) for Series B for the first half of the year. Amid all the talk of market turmoil, Series A is holding up while Series B has seen valuations and invested dollars come down.

CrunchBase will follow up on this report with a look at later-stage funding for the first half of 2016 compared to 2015.