Fintech companies are continuing to draw interest from investors in Asia. The latest company to pull in financing is Airwallex, a China-Australia startup that specializes in cross-border transactions.

The Melbourne-headquartered company this week announced a $3 million seed round led by Chinese investment Gobi Partners, with participation from angel investors Huashan Capital One and Billy Tam, CEO of China’s Easylink Payments.

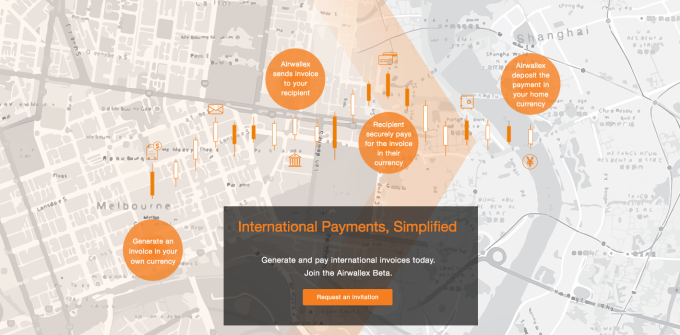

The startup aims to ease the headache and cost of cross-border purchases by enabling consumers to buy items from outside of their country using their local currency. In essence it uses the same principles as London-based Transferwise in that it reduces the costs that both merchants and consumers eat up when is the two parties are using different currencies.

Airwallex CEO and co-founder Jack Zhang came upon the idea after growing tired of the additional cost of importing goods from overseas for a coffee shop business that he invested in while working for banks in Australia. Zhang, formerly with ANZ and NAB, decided that tech could provide a better solution and he founded Airwallex alongside four other co-founders, including CTO Jacob Dai and COO Lucy Yueting Liu, who spent time working foreign exchange for Barclays Bank.

Zhang told TechCrunch in an interview that this pre-Series A round was wrapped up particularly quickly, taking just two weeks to close.

“There’s a big opportunity here in Asia especially as the e-commerce is really taking off worldwide,” he said. “E-commerce players aren’t satisfied in their own country, and want to go global.”

The company uses inter-bank exchanges to trade forex at a mid-market rate, something which Zhang said can save its clients as much as 90 percent on their foreign exchange rates.

The service is in a closed beta right now and is expected to launch within a month, it is currently waiting on regulatory approval in Australia. The concept is similar to Braintree or Stripe, a system that sits behind the merchant — invisible to end-customers — through which payment is made. Airwallex itself will make money via a transaction fee based on the volume of payments it handles.

The company has around 20 people in Melbourne, its main office, with a dozen staff in China and a handful based in Hong Kong. Zhang said the new funds will be used mainly on marketing, hiring and product development, Airwallex is also developing a wallet solution that will enable customers and merchants to hold multiple currencies at the same time.

China, Hong Kong and Australia are the young company’s initial focus markets, but it has plans to expand to Singapore, Japan and Korea. The company is aiming to raise a Series A round before the end of the year to help finance that expansion.