It’s a busy day at SoftBank HQ in Tokyo today. Fresh from confirming the much-anticipated sale of a majority stake in games giant Supercell, SoftBank also announced the somewhat surprise departure of President and COO Nikesh Arora, the man who had been primed to take the top spot from SoftBank Chairman and CEO Masayoshi Son.

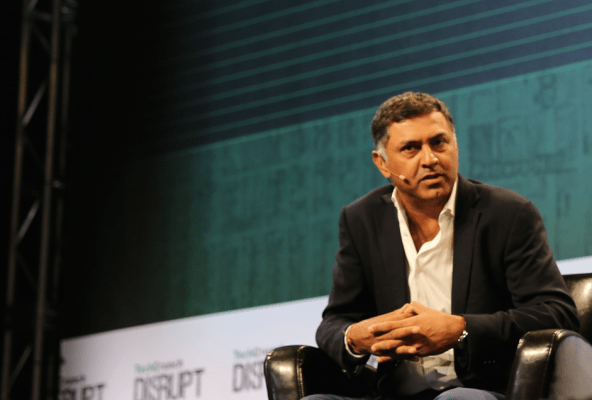

Former Google executive Arora — who spoke at TechCrunch Disrupt in San Francisco last year — came under pressure earlier this year when a group of anonymous shareholders criticized him for being overpaid and underperforming in a letter to management.

Despite that challenge, Arora’s position seemed to be safe. Yesterday, SoftBank published the findings of a review that found the claims against him to be “without merit.” Despite that vote of confidence, India-born Arora — who is one of the highest paid executives on the planet with a reported annual salary of $73 million — has resigned from his position at the telecom giant.

In a brief statement, SoftBank suggested that a disagreement over the timing of his accession to CEO is the reason for his departure:

Masayoshi Son, Chairman & CEO of SBG, had been considering Arora as a strong candidate for succession. Son’s intention was to keep leading the Group in various aspects for the time being, while Arora wished to start taking over the lead in a few years’ time. The difference of expected timelines between the two leads to Arora’s resignation from the position of Representative Director and Director of SBG with the expiration of the term of office and his next steps.

Arora is largely credited with leading SoftBank’s investment spree in India, where it put money into Ola, Snapdeal, OYO Rooms and others, and startup deals in the U.S.. It remains to be seen how SoftBank’s investment strategy will look without him leading things.

These are new times for SoftBank. In addition to offloading its shares in Supercell for a price of around $8.6 billion, it has cashed out most of its holding in GungHo, another game maker, and it is selling $7.9 billion in Alibaba shares, its first trade of that stock ever. The deals are part of Son’s vision for “SoftBank 2.0”, and much of the capital is expected to go towards paying off SoftBank’s debt, which went as high as 11.9 trillion yen ($107 billion) at the end of March thanks to expenses associated with its U.S. mobile business Sprint.

This is a very different approach to the last couple of years since Arora, who bought $483 million in SoftBank shares as part of a “personal bet” on the company, joined its ranks. Arora himself confirmed further information, primarily than Son intended to retain the CEO for longer than (it seems) was originally agreed.