Every startup that gives employees option grants has to comply with 409A, a section of the U.S. tax code that was established in late 2004 and basically states that a company has to pay tax on some of the compensation it defers, including those options. The 409A valuations are a way to get to their value.

Unfortunately, for much of the last 12 years, such 409A valuations have proven expensive, not to mention incredibly confusing. Accounting specialists initially charged startups north of $10,000 per audit, until a sudden glut of specialists drove prices down fivefold. Meanwhile, many founders still don’t know precisely how valuation firms arrive at a particular number. Appraisers typically look at a company’s costs (meaning its assets and liabilities), its income, and/or the valuations of companies with similar financial and operating characteristics. But there’s little transparency into the whole process.

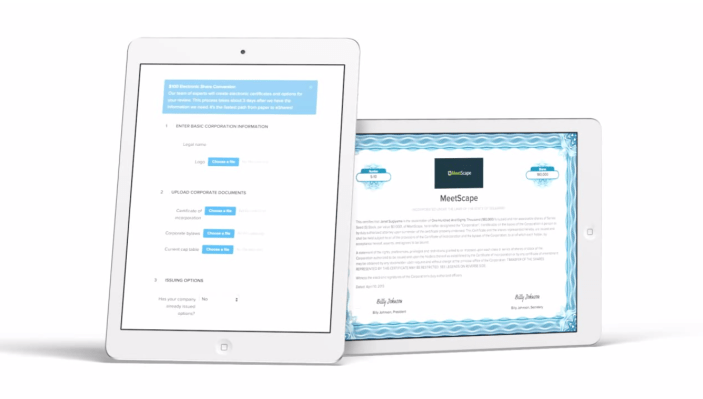

That’s not accidental or necessary, says Henry Ward, the cofounder and CEO of eShares, an 80-person Mountain View, Ca., startup that now works with more than 4,000 companies, digitizing their paper stock certificates along with stock options, warrants, and derivatives to create a real-time picture of who owns what. In fact, starting today, eShares is charging just $25 a month for its own wholly transparent 409A service. It’s also open sourcing its valuation models for startups that might like to manage the process themselves.

We talked with Ward yesterday about the new service and what it may presage.

TC: There’s so much confusion about 409A valuations, including how they compare with a company’s fair market value. Is there an easy way to understand how the two work together?

HW: In theory, and arguably in practice, a 409A valuation tends to run at a discount of 25 percent to the [value of a company’s] preferred shares. But as a company matures and heads towards an IPO, the 409A starts to converge toward the price that [investors have assigned it in its most recent funding round].

TC: Why do you think confusion around 409A valuations has persisted for so long?

HW: It’s consulting. When the IRS created this standard in the mid 2000s, they documented a set of models that you could use that would pass its requirements. Financial analysts got a hold of these models and they basically turned them into a trade secret. As more people ran into the business [to service startups], prices fell, but nobody solved the tech piece of it. Everyone was just hiring people to do cheaper and cheaper work.

TC: Does that include you? You started offering 409A valuations as part of a bundled service a couple of years ago.

HW: A 409A typically costs around $2,000. We outsourced the work to our own partners, then amortized our cost over the year by charging startups monthly for the service, which made it easier for them to pay. But the business model was quite similar. We were the intermediary, the distributor. Now we’ve built valuation models into eShares so that we can generate [409A valuations] through our own platform, meaning we can significantly reduce costs. We can provide the service for $25 per month or startups can download the models and do the work and have us sign it on our platform.

TC: And you’ll vouch for both your subscribers and this latter group if the IRS comes knocking?

HW: We have the company’s back. It’s our name on the report, so yes, we’d be taking the risk, as would any 409A valuation company.

TC: You recently posted an offer letter on Medium. The public message was that eShares will tell every employee everything there is to know about eShare’s cap table, from how many options he or she owns to whether or not there are any ratchets or punitive preferences, to what that person’s holdings will or won’t be worth in a variety of scenarios. Do you see a day when other companies do the same? Startup employees are clearly growing tired of being left in the dark.

HW: I was really surprised by how much reception there was [around that post]. A lot of CEOs asked me for a similar template and for advice on how to create a waterfall analysis that would help them. It’s largely why we came up with this new [409A] service. It has all of that information.

I do think there’s a push for transparency from employees, and I think those who respond will have an easier time recruiting, which will force those companies that are less transparent [to follow suit].

TC: Whenever you open source anything, you run the risk that people won’t pay for your services. Why isn’t that a concern, or is it?

HW: We’d love to not make money on valuations. We think it’s a tax on business. We’d much rather make money on our software.