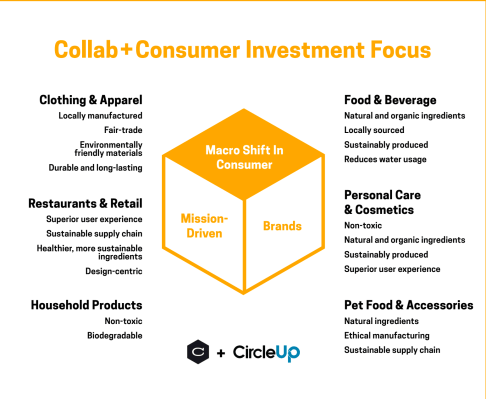

Collaborative Fund is launching a new fund today. Called the Collab+Consumer fund, it’s part of Collaborative Fund’s third $70 million fund that’s geared toward finding companies that make consumer goods — like food and clothing.

To be sure, the space is heating up. There are emerging companies focused on single products and businesses, like coffee shops that are increasingly getting venture financing. For example, Blue Bottle Coffee — a Collaborative Fund investment — most recently raised $70 million in a venture financing round. And there are subscription services for consumer goods, like ipsy, which recently raised $100 million, that are also attracting a lot of interest.

“Consumers are just getting smarter about how those products are being sourced, what are the chemicals and ingredients being used in those products,” Collaborative Fund founder Craig Shapiro said. “With that transparency and information you’re seeing a shift toward independent, locally sourced, sustainable, organic products. A lot of these trends are undeniable, are kind of the areas we’re gonna be a little more aggressive in.”

The firm will be working with CircleUp, one of its investments, to isolate the best potential consumer-goods companies. The benefit of consumer goods, founder Rory Eakin says, is that there already will be some data as to whether they will be successful compared to some pre-market software-driven companies.

“As a VC, trying to gather all that data and synthesize it in a way to make an informed investment decision, the nice thing about doing this in consumer there’s a lot more data to analyze,” Shapiro said. “Unlike a tech investment, much beyond software, there’s not a ton to analyze, it’s the team and the code. In consumer you have data, where are they selling, how quickly is it selling, what’s the price point, what’s the experience of the team, and so on, and you can make a much more informed decision.”

One example of that shift, Eakin said, is a company like Shake Shack going after McDonald’s and other fast-food burger chains. Collaborative Fund plans to focus on multiple different areas — like child development with its partnership with Sesame Street — with Collab+Consumer being another focus area that is coming out of its third fund today.

Collaborative Fund’s funding sweet spot sits somewhere between companies that seek to generally improve the world around them but will also offer a good return for the fund. Some investments the firm has made in the consumer-goods space include the SOMA water filter and Blue Bottle Coffee. The firm has also invested in companies like Lyft and Kickstarter.

All this boils down to increasing competition in the consumer-goods space — which could require firms to re-think their investment strategies and find new areas of focus. In part, this is a response to other firms going after that similar sweet spot, making it important for Collaborative Fund to drill down on certain sectors, Shapiro said.

“Fortunately or unfortunately, the world has really evolved, there’s a lot more savvy investors that are talking about a lot of the same things we are,” he said. “This is a way to say, this is an area we really want to own, we want to be the best investor in this category, and consumer is the next.”