Millennials may be slowly forgetting that their mobile phones make calls, but there’s still a good amount of cash/intelligence to be had in gathering enterprise call statistics to gain more complete portraits of customers.

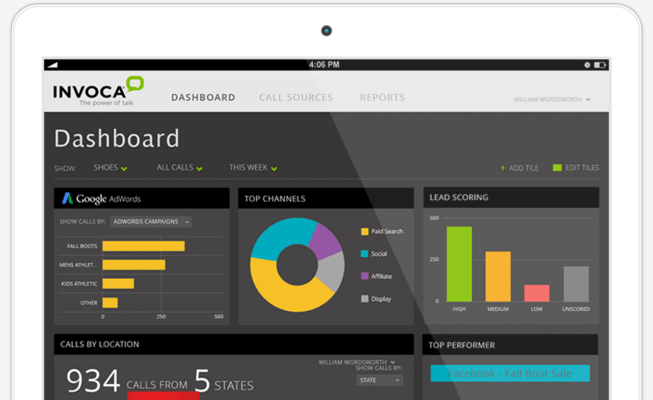

Invoca is looking to help companies measure analytics on live inbound calls just as easily as they’d measure page views on their websites.

Invoca has been gaining some major integrations with key marketing cloud programs over the past several months, just last week the company announced Invoca for Adobe Marketing Cloud. Salesforce, Google, Oracle and Marketo are also current Invoca partners.

This morning, the SaaS company announced that it had completed a $30M Series D raise led by Morgan Stanley Alternative Investment Partners. Also participating in the round were existing top-tier investors Accel Partners, Upfront Ventures, Rincon Venture Partners, Salesforce Ventures and Stepstone. This round puts Invoca’s total funding raised to date just north of $60 million.

“Invoca has built a platform that addresses the top concern for enterprise CMOs today — delivering personalized customer experiences across devices and channels,” said Jamey Sperans, Morgan Stanley Alternative Investment Partners’ Managing Director, in a statement. “We are thrilled to partner with a proven team, other world-class investors, and an already impressive list of enterprise customers who are finding success with Invoca.”

Invoca developing a close relationship with Morgan Stanley obviously brings about major suggestions for the company’s future and the likelihood that an IPO is imminent.

Invoca CEO Mark Woodward came on this past July, with his notable experience of having already taken two companies through the lengthy IPO process being referenced explicitly as a reason for his appointment.

Woodward had a good deal to say about the fickle nature of timing when it comes to IPOs, speaking to his past endeavors having had both positive and negative experiences with the process in regards to timing.

“Certain aspects of taking a company public are out of your control,” Woodward told me. “But this funding gives us the option [to go public] in 2017.”

“In today’s investment climate, only true category leaders are in a position to raise capital,” said Mark Suster, Upfront Ventures’ Managing Partner, in a statement. “This round is a testament not only to the massive market opportunity, but also to Invoca’s performance to date as the pioneer, innovator and leader in helping enterprise brands bring phone calls into the digital realm.”

Woodward further noted that at this point his company is “completely self-funded,” so it has a bit more freedom in deciding what its next move ends up being. Even with many apparent signs pointing towards an IPO, Woodward said that “if something else comes along that makes more sense, we’ll run with it.”