The number of startups hoping to break through into the world of payments appears to be shrinking a little bit more. Flint Mobile, a startup backed by the likes of Verizon and True Ventures, has ceased payment operations, and this week it started directing its customers to use Stripe for payments services.

The shutdown has been slow and confusing, it seems. We have been trying to reach out to Flint Mobile several times, through several channels, but have not had any responses. But, according to multiple customers who have emailed TechCrunch, Flint first issued a note earlier this month telling users that it is transitioning to a new platform and that it would disable card payments during that time:

Starting today, Flint is transitioning to a new platform. During this period, you will not be able use Flint to process credit or debit card transactions. However, you will have continued access to your past transaction data and other Flint features.

We apologize for any inconvenience this causes and we will keep you updated about card processing availability for your account. If you have any questions, please contact our support team.

At the same time, it suspended new sign ups.

No further details were supplied in the wake of that first note until earlier this week, when users began to note that they received instructions to use Stripe for payments instead, with a timeline for Flint’s full shutdown. Flint is also referring users to Stripe support on its own support page.

Payments comparison site Merchant Maverick posted the text of that note:

Tuesday, February 16, 2016: We will send instructions on how to connect your account to Stripe. It will be immediately available for use as a replacement processing platform with the Flint app.

6 PM PST Thursday, February 18, 2016: Payment acceptance on Flint’s current processing platform will be de-activated. Note: you will receive deposits for outstanding settled transactions.

6 PM PST Saturday February 27, 2016: Flint services will go offline. If we are able to extend operations beyond this date we will let you know as soon as we can.

To be clear, this is not part of any kind of asset transition to Stripe, just a suggestion to users where they could go in the wake of Flint’s closure for payment services.

“We’re in a similar boat as you re: Flint Mobile,” a Stripe spokesperson told TechCrunch when asked about what was going on with Flint. The company it seems only became aware of the Flint directive after Flint’s ex-customers contacted Stripe with questions.

Flint was founded in 2011, and in that time the company had raised just over $20 million, with its last round led by Verizon in 2014, when it also expanded its payment service to the web alongside its point-of-sale solution.

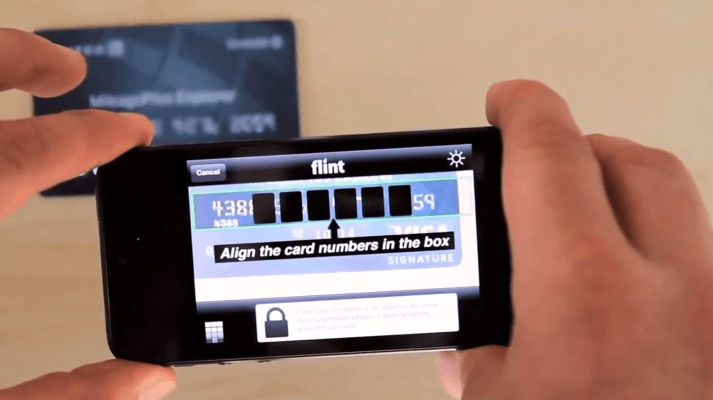

As we have pointed out before, Flint stood apart from the likes of Square by offering software-based options for payments initially using photos of cards rather than dongles for taking card details at the point of sale.

It’s unclear how many users are affected by the closure. CEO Greg Goldfarb told us in 2014 that Flint had merchant and business customers in the “high tens of thousands,” with average transactions in the range of $120.

But with margins on payment services too thin for most companies to make a return, it looks like Flint has been one of the companies to have fallen through the cracks. Others that have called it a day on the mobile POS side include Amazon Register, which also shut down this month. And Square, one of the larger of the payments businesses, went public last year but it is has been struggling to excite investors.

Ironically, some startups’ loss are other startups’ gain. Stripe has also been gaining customers from other payments businesses that have shut down, such as Balanced.

We are continuing to try to contact Flint and will update this story as we find out more.