Japan-headquartered e-commerce firm Rakuten has written down $340 million from a range of businesses, including its Kobo e-reader division and France-based e-commerce site PriceMinister, and announced plans to close a number of global operations as part of a new strategic focus.

Rakuten announced its latest financial results today, and they weren’t great. Net profit for the year slipped 38 percent year-on-year to 44.3 billion JPY ($393 million) on revenue of 714 billion JPY ($6.3 billion) — up 19 percent. Part of those results included a write-down of 38.1 billion JPY ($339 million) in consolidated impairment losses.

The changes come from Rakuten’s new ‘2020 Vision’ (PDF), a business realignment strategy announced today, and they break down as follows:

- Kobo, bought for $315 million in 2011: 7.8 billion JPY ($69 million)

- PriceMinister, bought for €200 million in 2010: 17.247 billion JPY ($153 million)

- Other unspecified businesses: 13 billion JPY ($116 million)

Rakuten added that the (non-consolidated) loss on valuation of stocks of subsidiaries and affiliates came in at 62.3 billion JPY, that’s around $554 million.

The company’s share price on the Tokyo Stock Exchange dropped seven percent in response to the news. Its total market cap stood at 1.436 trillion JPY ($12.75 billion) at the end of trading.

Rakuten’s share price over the last year

Explaining the measures, the company said in a statement that PriceMinister had been “affected by the competitive environment of the French e-commerce market,” while its write-down for Kobo was a result of “a slower start to the rise of the global ebook industry than we originally expected.”

That disappointment is tempered by some optimism. Rakuten said that PriceMinister has “an important position” in the European e-commerce space. Likewise, it is estimated its e-book division — which includes content platform OverDrive, bought for $410 million one year ago, and Kobo — will return to profitability in 2016.

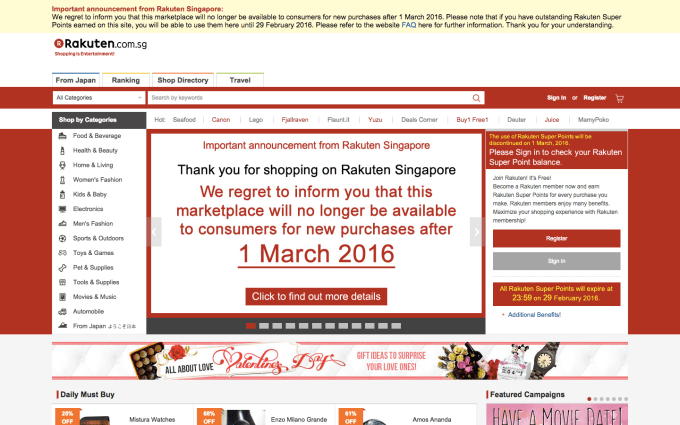

One line item filed under ‘other’ costs looks to be a restructuring of Rakuten’s marketplaces outside of Japan. The company confirmed in an announcement (PDF) that it will close down its e-commerce sites in Singapore, Malaysia and Indonesia next month, and it is looking to offload Tarad.com, the e-commerce company in Thailand that it acquired in 2010, too.

Those closures will mean that around 150 staff are laid off, Rakuten confirmed to TechCrunch, but the company will retain its regional office in Singapore, which will continue to house Rakuten Ventures and Rakuten Travel. Its e-commerce business in Taiwan, which appears to be performing far better, will also remain unaffected.

Rakuten Singapore’s website

These marketplace are being replaced by a new project in Southeast Asia, a consumer-to-consumer app called Rakuma which, Rakuten said, has grown 20 percent month-on-month in Japan. That concept sounds a lot like (indeed, the same as) Carousell, the app that Rakuten Ventures is an investor in. Singapore-based Carousell is currently in three countries in Southeast Asia but, as we reported late last year, it is trying to raise a $50 million round to expand its service significantly across Asia.

It seems a little odd to pit Rakuma against Carousell. When we asked Rakuten for more details about that, it told us that its “the plans are still under consideration and we look forward to sharing more detail on this soon.”

Beyond Asia, Rakuten will also shutter its marketplace business in Brazil, but Ikedia, its service that enables retailers to develop and manage their online commerce presence, will remain open. Update: Rakuten has not closed its site in Brazil, but it has shifted the model from a marketplace to a Saas-based approach. That’s powered by Ikedia, another Rakuten acquisition — the company bought a 75 share for an undisclosed sum back in 2011.

Rakuten has exited countries in Asia before — it quit a joint venture with Baidu in China, and dissolved a partnership in Indonesia in favor of flying solo — but these withdraws are far more strategic and wider reaching.

Chairman and CEO Hiroshi Mikitani, who took the step of addressing investors in Japanese not English as is usual on Rakuten results days, stressed that the 2020 Vision is based around three core principles: “strong, smart and speed.” Highlighting a number of new businesses that include acquisitions Viki, Ebates and Viber, Mikitani made bold growth predictions and hailed the disruptive potential of these mobile technologies when combined with Rakuten’s core e-commerce businesses.

But Rakuten’s main domestic business is stagnating. Its Japanese e-commerce division grew 10 percent on GMV — the total amount of goods sold on platforms — but profit was up just six percent and revenue 13 percent on the previous financial year. Rakuten’s Internet services division has expanded with some early promise in Japan — revenue grew 22 percent with profit up 45 percent year-on-year — but there’s also pressure on overseas investments to pull in cash to compensate.

Mikitani placed plenty of emphasis on Ebates, the cash-back website it bought for $1 billion in 2014, which Rakuten said “contributed significantly to the growth” of its overseas businesses, with GMV rising 43 percent annually to $4.9 billion. Under its new plan, Ebates is tipped to triple to $15 billion GMV by 2020.

That’s the model that the company is looking for, but it’s tough to find that in emerging markets like Southeast Asia and Brazil. Yes, millions of new Internet users are coming online via smartphones, but there’s plenty of competition in e-commerce (Rocket Internet alone has poured more than $1 billion into its two players in Southeast Asia) while buying online is not yet a mainstream trend among consumers. As a result, Rakuten looks to be clearing out its longer-term, less-certain bets and doubling down where it believes the healthiest chances of returns lie.

Note: The headline and article was updated to clarify that Rakuten has changed its marketplace model in Brazil. The write-downs on Kobo and PrimeMinister were also corrected.