The IPO market cooled in 2015. There were fewer of them, they raised less capital and performance was down. Investor sentiment and a sideways public market were primary drivers, but the quality of the IPO merchandise needs to be examined, as well.

The IPO calendar thrives when investors chase growth and prioritize the topline over other metrics. The bull market since 2009 represented a very strong recovery fueled by that mindset. Concurrently, the percentage of companies profitable at time of IPO has trended down aggressively.

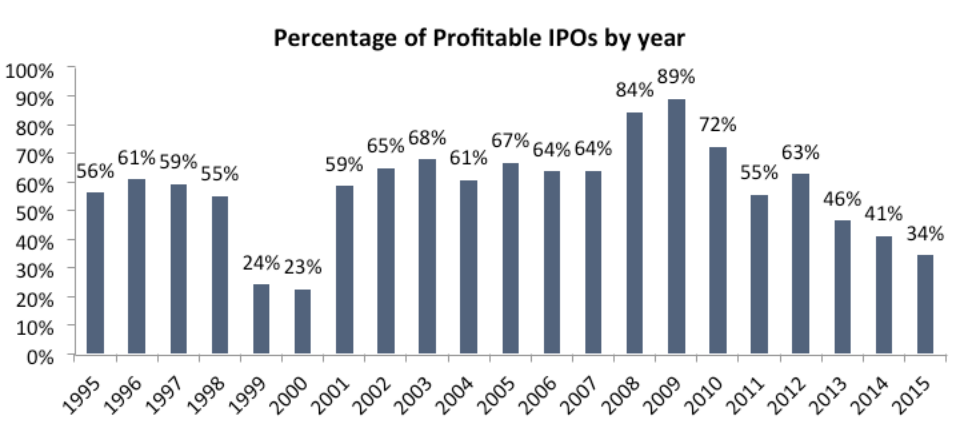

In 2009, 89 percent of companies were profitable at IPO, compared to 34 percent last year. In the last 20 years, only 1999 and 2000 saw fewer profitable companies at IPO: 24 percent in 1999 and 23 percent in 2000.

The chart below tells a clear story: Bull markets lead to aggressive IPO investing. In 2015, markets were the closest to “dot-com bubble” levels of company profitability since 2000.

Our data also shows recalibrations after each of the recent “crashes.” In 2001, companies profitable at IPO jumped to 59 percent (from 23 percent in 2000). Similarly, that number jumped to 89 percent after the crash in 2008, up from 64 percent. Both periods showed significant decreases in the amount of IPOs and proceeds raised from them.

Similarly, 2013 and 2014 delivered an extremely high volume of IPO filings and proceeds raised, while profitability declined. In 2015, IPOs floated dropped 38 percent and proceeds raised decreased 58 percent versus 2014.

We’ve long said the market isn’t in a bubble, which will pop, but rather a balloon, which will deflate. The seeds of that deflation clearly started in 2015. Overall flat performance broke a six-year uptrend, and the IPO market began to recalibrate via significant decreases in IPO issuance starting in the latter half of the year; prior to July, IPO issuance pace was similar to 2013.

There was a clear shift in investor sentiment. Prior to 2015, companies were encouraged to grow topline at all costs. The higher the growth, the more attractive the company. Investors favored companies aggressively taking market share versus showing an ability to make money.

The market isn’t in a bubble, which will pop, but rather a balloon, which will deflate.

This changed in mid-2015. Underwriters struggled to bring to market companies lacking profitability, with high debt or exhibiting other sustainability concerns. Hence, deal flow dried up.

Compare two examples: Atlassian and Square.

In December, collaboration software maker Atlassian priced its IPO 20 percent higher than the original price range. Shares further traded up 30 percent on Day One and have sustained those levels since. Atlassian is cash-flow positive and debt free, and has strong margins and a highly defensible story.

Square went public in November. It wasn’t profitable and did not have a direct path to profitability. The IPO was successfully priced according to investor interest. The midpoint of its original price range was 33 percent below their last private round and the actual IPO priced 25 percent below that.

Atlassian priced at 6.5x the initial 2017E sales estimate, versus 1.6x for Square, despite similar projected topline growth of 33 percent and 21 percent, respectively. Please note, however, that they are very different business models, which also impacts valuation.

So what should we expect in 2016?

The new mantra is for late-stage private companies to focus more on managing spend and profitability. “Many crossover investors would rather see a slightly slower growth business that has already demonstrated a working unit economics model over a high flier with widening losses,” said Anthony Kontoleon, the Global Head of Equity Syndicate at Credit Suisse Group AG.

IPO pricing will be driven by this revised investor sentiment in 2016. The percentage of companies profitable or near profitable at IPO will increase. However, some market observers think those without profitability, or a clear path to it, will struggle to gain IPO access.

Issuance levels will stay relatively flat, as underwriters will be more selective with the products they bring to market.

The market does not need to crash for the IPO market to correct itself, but the balloon will deflate. Quality companies with strong financials can and will continue to come to market to a receptive investor base.