Grain, a Singapore food tech startup, has landed funding to build out its “full-stack” approach to food deliveries in the Southeast Asian city-state. The Series A round is officially undisclosed, but TechCrunch understands that the total amount raised is SG$2.45 million, or US$1.7 million.

The financing was provided by a collection of investors, including NSI Ventures (lead), Ivan Lee (who founded and sold Thai Express in Singapore), 500 Startups and Digital Media Partners (DMP).

Rocket Internet-backed FoodPanda dominates the food delivery industry in Southeast Asia, the wider Asia continent and other emerging markets thanks to a major acquisition spree last year that saw it acquire nine competing startups worldwide. FoodPanda and its ilk act as a middleman between restaurants and consumers, but Grain differentiates itself by handling all stages itself — from preparation and cooking to order management and the delivery itself. That makes it more comparable to Munchery in the U.S. and other global players, like India’s Yumist, which recently raised $2 million.

“What we’re building is a bit more nuanced [than services like FoodPanda],” Grain co-founder Rifeng Gao told TechCrunch in an interview. “We’re like a restaurant on the cloud, [when] you want good food that’s convenient, we want Grain to be the first thing that you think about.”

Singapore is many ways an ideal city for this kind of service. The business hub of Southeast Asia, and a major global financial base in its own right, it’s chock full of office workers, many of whom earn Western-level salaries which gives them the cash to be selective about what they eat.

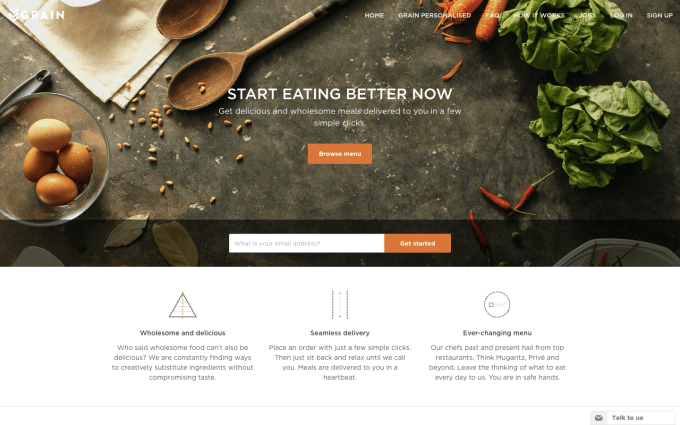

Grain keeps its menu deliberately narrow with four different meals available each day on a selection that rotates weekly. Meals are priced between SG$9.95 and SG$12.95 (approximately US$6.90 to US$9) with a varying delivery fee. Customers in the busiest areas don’t pay anything for delivery and have no minimum spend, but those in quieter zones are charged and must hit a minimum spend.

That model enables the company to be unit profitable, Grain co-founder Yi Sung Yong said, which is something which FoodPanda isn’t able to do. (FoodPanda splits its orders into buckets: those it loses money on, those it breaks even with, and those it is profitable on.)

A significant portion of this new funding for Grain will go toward making those operations more efficient. The company plans to introduce multiple mobile distribution hubs to cover 2.5km squared areas more effectively. These are essential vans which can keep food heated and chilled as necessary, and can enable Grain’s last mile fleet of scooters, bicycles and footmen to get meals out to customers quicker. This introduction — which is powered by predictions around meal demand — may also enable to company to increase its selection to six meals per day, Yong said.

Hiring is, not surprisingly, also a focus for Grain. It plans to increase its headcount of 50 — 10 of which are tech — by adding more developers and other positions.

Market expansion is always a focus for companies in Southeast Asia, a region with a cumulative population of over 600 million, but Yong said Grain is still focusing on developing its operations and business model in Singapore. That said, he anticipates that the service will expand to Hong Kong, a city with similar dynamics to Singapore, before the end of the year. Shenzhen and Beijing may be future stops in addition to Indonesia, although the latter is a market that Grain believes will need some time to develop before it can expand there.