Anaplan announced a $90 million round today at a valuation of S1.09 billion after funding, putting the company squarely in unicorn territory, those companies with valuations of a billion or more.

What’s more, CEO Fred Laluyaux said this will be the last private round prior to an IPO some time in “the not-too-distant future.” To that end, he announced that the company has hired James Budge, former Genesys and Rovi CFO and COO, as its Chief Financial Officer. It is common for companies like Anaplan that are planning on going public to hire a CFO with public company experience before filing.

The company has reached a point where it wants the status of being a public company and that is part of what is driving the IPO talk, Laluyaux explained. “The largest companies in the world rely on us to run very core processes [around their financial planning and analysis]. We need to run as a public company and we aren’t afraid of that,” he said.

The company has been aware of the unicorn valuation for some time as it has received various unsolicited offer sheets, Laluyaux explained. With more unicorns than ever — Crunchbase currently lists 156 — some have questioned the high valuations of some of these companies, but being a billion dollar company (even on paper) still carries some weight.

As for the funding, the round was led by Indian firm Premji Invest with help from Baillie Gifford (a Scottish firm), Founders Circle Capital, and Harmony Partners, as well as Anaplan’s current investors Brookside Capital, Coatue Management, DFJ Growth, Granite Ventures, Meritech Capital Partners, Salesforce, Sands Capital Management and Shasta Ventures.

The most recent round prior to today’s was $100 million in May, 2014. Today’s investment brings the total across all rounds to a shade over $234 million.

Anaplan particularly liked lead investor Premji Invest for this round because of the clout it has in India, a market where Anaplan hopes to have a bigger presence in 2016. While Anaplan has over 400 customers in 20 countries, it’s looking to expand internationally and Laluyaux sees Premji helping the company gain a foothold in a big market where it currently only has a few customers.

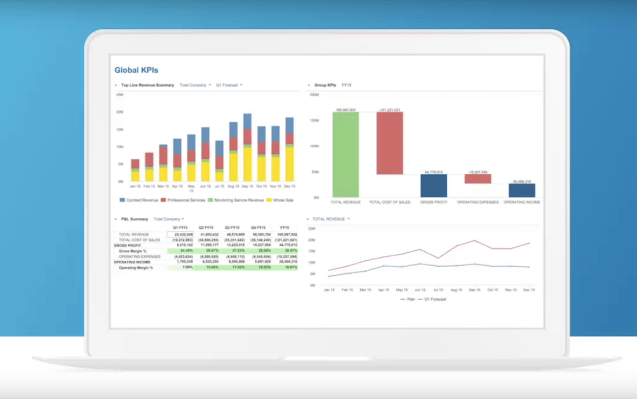

Anaplan, which sells financial planning as a service to large organizations, tends to compete with more traditional vendors like Oracle, IBM and SAP. To some extent, it also competes with Microsoft Excel, a tool that financial planning personnel are comfortable using.

Laluyaux acknowledges that Microsoft has come a long way when it comes to the cloud, but says it still lacks flexibility to share information with others and across different spreadsheets. Anaplan’s strength lies in its ability to share information among various interested parties in an organization and to move more easily among the different parts of the financial plan.

Over the next year, as they prepare to go public the company will continue to expand internationally and plans to add more engineering and go-to market personnel as well as build up the cloud infrastructure that supports the product. The company expects to have about 900 employees by the end of this year.