App Annie, the nearly six-year-old, San Francisco-based app analytics firm that long ago became the first stop for developers, investors, and journalists looking to better understand app rankings and trends, has raised $63 million in Series E funding in “mostly equity” and debt, says cofounder and CEO Bertrand Schmitt.

The round was led by Greenspring Associates, with participation from earlier backers e.Ventures, Greycroft Partners, Institutional Venture Partners, and Sequoia Capital. The debt — raised to avoid diluting stakeholders unnecessarily, says Schmitt — was provided to the company by Silicon Valley Bank.

The financing comes almost exactly one year after App Annie closed on $55 million in funding and brings the company’s total funding to roughly $157 million.

The new capital is meant to fuel the company’s already rapid growth, says Schmitt, who says App Annie has reached breakeven cash flow at various points but isn’t profitable by design.

Part of that owes to overhead; in the last year, it has grown from 300 employees to more than 400 today, with 160 people in North America, 200 in Asia, and another 60 or so in Western Europe. It expects to have “way more” than 500 employees by year end, too, Schmitt says.

Schmitt also suggests that more acquisitions could be in App Annie’s future. Last year, the company paid an undisclosed amount to buy the mobile measurement service Mobidia, which itself had raised just more than $16 million in funding over the years. In 2014, it acquired its closest competitor with its purchase of Distimo. (Terms of that deal weren’t disclosed, either.)

“Acquisitions aren’t our main strategy, but it’s one of our tactics to get to our goal of ensuring we have the right offerings to satisfy our users,” says Schmitt. “Sometime we build internally, but if we can find good value somewhere else, why not? A bigger war chest ensures we can react quickly if we see interesting opportunities.”

Naturally, with more funding, the company also has more options, including to push off any thought of an IPO for another year. An IPO is definitely “not in the cards” for 2016, says Schmitt, though it’s worth noting that with App Annie’s new funding, it has also appointed NetSuite CEO Zach Nelson — who has overseen Netsuite’s rise from a startup through a successful IPO in 2007 — to its board of directors.

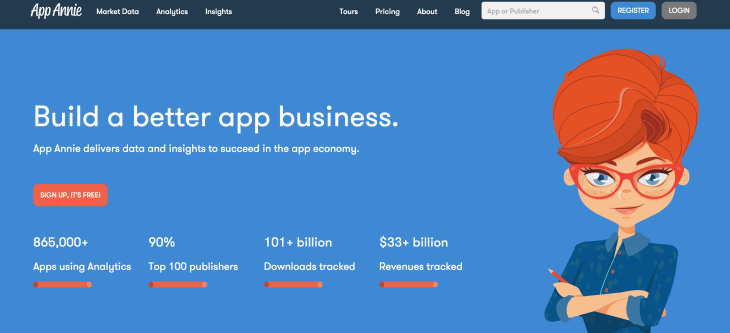

The round also gives App Annie more time to pull itself into the black, presumably. Though the company right now claims 500,000 registered members, “hundreds” pay the company a yearly subscription for its advanced analytics services, says Schmitt.

Fortunately for App Annie, even comparatively small numbers can add up to a big business, as long as the company continues to build on them. An average yearly contract costs a subscriber $80,000 per year.