Kakao, South Korea’s dominant mobile messaging app that merged with Internet company Daum in a $3 billion deal in 2014, is pinning its international expansion hopes on music after it announced plans to spend $1.5 billion buying a majority stake in Korea’s top online music service.

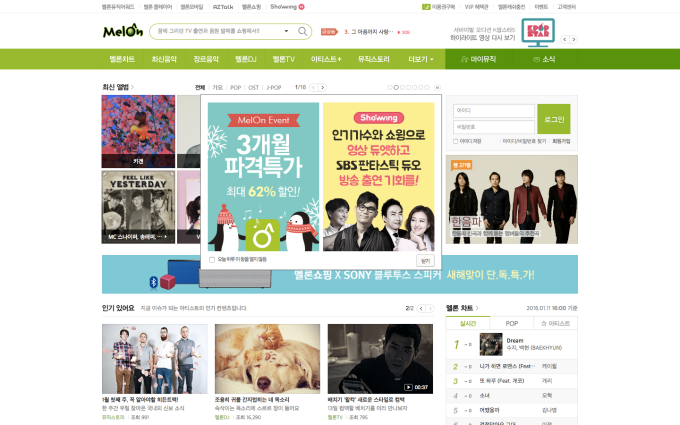

The company is investing 1.87 trillion KRW (around $1.54 billion) in exchange for 76.4 percent of Loen Entertainment, the company behind streaming and download service MelOn, which claims 28 million users in South Korea.

The deal is being pegged as the largest tech acquisition in Korean history and, in order to finance it, Kakao is selling 750 billion KRW ($620 million) in new stock to a range of investors, including Loen’s previous majority shareholder. Kakao previously acquired Path to help grow its footprint in Indonesia, a key market in Southeast Asia with a population of over 260 million people.

Messaging apps in the U.S. and other Western markets are beginning to move into content and services, primarily via programmable bots, but Kakao was one of the early pioneers of the ‘messaging app as a platform’ strategy, along with fellow Asia-based companies WeChat and Line. Over the past year or so, Kakao has introduced its own mobile payment system, a YouTube-like TV service, and a taxi on-demand service to rival Uber, which has had its own problems in Korea.

Now under the leadership of thirty-something CEO Jimmy Rim, Kakao is moving into music and entertainment. That’s an obviously strategy to maintain Kakao’s influence in Korea, but beyond that, as Rim pointed out in a statement, it could help the service expand overseas and into markets where Korean culture and music — like K-Pop — are hugely popular.

“Music is one of the most loved content genre in the mobile era. It is also incredibly powerful in that one song can set trends for an entire generation and highly influence the global pop culture,” Rim said. “By combining Kakao’s various platforms and content services and Loen’s leading music content, we expect tremendous synergy that could establish a strong foundation for global expansion.”

As for the immediate plans, Kakao said it will stoke demand for music services by adding them to its existing services. In particular, it is aiming to create new services that run across social networks, create music communities across Kakao services and curate ‘smart’ music playlists and selections via user data. Korea’s top artists are already on Kakao, so the synergy could act much like Line and its Line music service, boosting both the chat and music services by enabling users to get closer interaction with their favorite artists via Kakao.

Kakao confirmed also that it plans to “service international markets [further] down the line.” That’ll be interesting to observe since it failed to export its success overseas, despite being a mobile messaging pioneer. Even WeChat and Line have cut back on their global expansion plans of late, due to hugely competitive markets and the requisite sums of investment, but it seems Kakao believes it can ride the waves of K-Pop by aligning its service closely with music. Time will tell.