How does a new venture capital firm go from a debut fund focused on seed investments, to becoming an established name that covers Series A and other rounds within just three years?

It’s a pretty tough feat to even become established at seed-stage, let alone jump down the line. But that’s the very route that Golden Gate Ventures, a now six-person firm established by three ex-Silicon Valley entrepreneurs, took when it opened up shop in Singapore in 2012.

Golden Gate Ventures began life focused on early stage deals in Southeast Asia, an area of 620 million people that is traditionally less visible than China and India, but last summer it announced a $50 million round to push on. TechCrunch spoke to one founding partner to get the low-down on what VC life and processes are like in this fast-growing part of the world.

Investing Across The Region

Late last year, Golden Gate Ventures confirmed six new investments — worth a combined $6 million — most of which had previously been under wraps, to take its total number of deals past 30. While it is growing fast, Southeast Asia’s startup ecosystem is still nascent, and Golden Gate Ventures has emerged as one of the more active investors in the region.

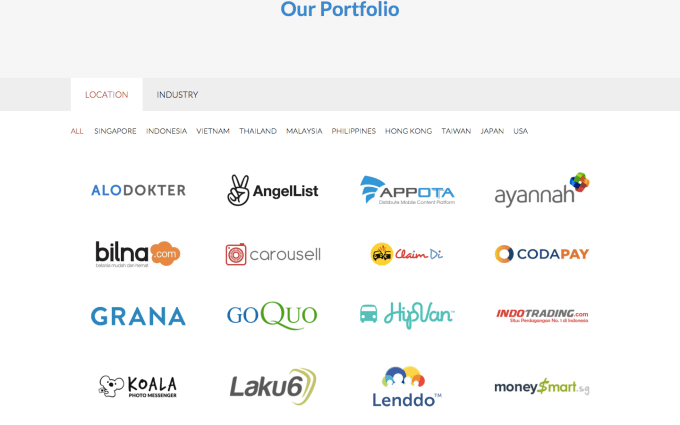

Its portfolio includes Redmart (recently raised $26.7 million), Hipvan (recently raised $3.3 million), Carousell (sources say is raising $50 million), Omise (raised over $2.6 million in 2015), and TradeGecko (raised $6.5 million Series A).

But, in addition to writing a significant number of checks, the firm has also covered a variety of different verticals and geographies. Golden Gate Ventures counts portfolio companies in Singapore, Indonesia, Thailand, Malaysia, the Philippines and Vietnam, in addition to close (but not technically Southeast Asia-based) countries Hong Kong and Taiwan.

In an interview with TechCrunch, founding partner Vinnie Lauria said that Laos, Myanmar, Cambodia, Brunei are the only countries in Southeast Asia where the firm is yet to invest.

Myanmar, a country that has opened up in recent years and just held its first democratic election, is one place where Lauria expects the firm to invest, but for now none of the other three countries have a startup scene of significance. Yet.

“These deals will happen over time,” Lauria. “We will look to position ourselves as we see that there are really good companies being started, then we’ll step in.”

Golden Gate Ventures’ founding partners (left to right): Jeffrey Paine, Paul Bragiel and Vinnie Lauria

Different Investor Dynamics

Lauria ended up in Singapore by chance. Kind of.

Backpacking through Southeast Asia with his wife, he took a liking to Singapore’s cosmopolitan mixture of Asian culture and a very Western approach to business. Sensing a change in the wind, and the potential for startups, he relocated to start Golden Gate Ventures.

Initially, the ‘from Silicon Valley’ branding helped open doors for Golden Gate Ventures, Lauria said. But these days, he said he believes that the company’s willingness to invest across Southeast Asia, and in businesses that have the ambition to expand regionally, are what he sees as his firm’s biggest appeal to founders.

That said, Southeast Asia really is nothing like the U.S. for investors.

“Every potential investment [in the U.S.] comes to [meet investors at] Sand Hill Road,” Lauria said. “Here in Southeast Asia, the better VCs are constantly on the move and in a different country every other week. Someone from Golden Gate Ventures is somewhere else every week.”

No firm or founder (or even journalist!) can be omnipresent, so, in diverse and geographically challenging markets like Southeast Asia, the network is hugely important. In that respect, firms like Golden Gate Ventures use their portfolio for business and lead-generation purposes. Again, that’s very unlike what is commonplace in Silicon Valley.

“Our portfolio companies are more like local on-the-ground partners in each country,” Lauria explained. “For example, we introduced [Singapore-based online grocery startup] Redmart to our companies in Indonesia to give an intimate view of how operations are done in different countries — we get CEOs to help each other.”

That help isn’t just limited to meetings in person. That’s because the firm also runs a group on Slack, the chat service that is seemingly ubiquitous among tech firms.

“Everyone can talk to everyone, and there are private channels,” Lauria explained, adding that founders often discuss business such as hiring, tech or legal with others from the firm’s portfolio. “In the U.S., one partner does a deal, but here our firm is just one point of entry.”

Another area where investment in Southeast Asia differs to the U.S. market is when it comes to other, competing investors. In the U.S., early-stage investments fight tooth and nail to get in on promising startups, and invest sizable resources trying to locate promising investments.

Lauria, though, explained that often investors work with startups to essentially help them pitch other potential sources of cash. That’s another nuance that is quite different to the U.S. or even the more developed startup ecosystems in Europe.

“If you look at any of the larger branded VC firms [in the West,] they try to be the only one in the deal. But we have to privately look for co-investors [who are] often not sophisticated in the internet space,” Lauria said. “Sometimes we are literally on the same side as the startup helping them make a pitch.”

A snapshot of some of Golden Gate Ventures’ investments

Investors Scaling Like Startups

While some of Golden Gate Ventures’ partners may have less direct tech experience, the firm still seeks local partners in deals because Lauria and his colleagues believe that having someone with local know-how and contacts is essential. Even if it means adding a small investor, the American investor said his firm very much favors a joint approach, particularly in early-stage deals.

But, in general, he has observed the investor base in Southeast Asia growing in maturity just like the very startups that they are funding.

Golden Gate Ventures isn’t the only one that has ‘grown up.’ North Star, Jungle Ventures and others also started out as early-stage vehicles but are now focused on cutting larger cheques for Series A rounds and beyond.

“We have all raised Series A money because we can show these large global investors that there are Series A deals out there in Southeast Asia,” Lauria told TechCrunch “[These new funds are] a lot more money because of the quality of companies, we went out to market and sold that.”

Lauria believes that there are investors out there raising even later stage funds, to keep pace with where the market is headed, while others will morph into Series B focused funds too. But, despite the potential to go out there and follow that lead, he said Golden Gate Ventures has found its spot and intends to remain there.

“We’re going to stay where we are,” he explained. “We like the early stage. We love the earlier, more raw companies… it’s where we naturally find ourselves fitting.”

While India may be the region in Asia where investment capital and attention is growing at the quickest pace, Lauria believes that there’s an increasing interest in Southeast Asia particularly given the stock market issues that have occupied China and the Chinese tech community.

“Most people have invested in China and India, but they’ve seen the market get way too overvalued,” Lauria said “Southeast Asia is the next opportunity. We’ve worked with partners who have invested in Asia for a long time, they like and really believe in Southeast Asia.”

As an investor who is active in Southeast Asia, Lauria has every reason to big up the region. But still, it is hard to ignore the steady growth that the region is seeing, particularly given the aforementioned issues that have worried investors and startups in China over the past year. Southeast Asia is still growing, albeit from a smaller base than India or China, but the growth in investors this year has certainly signaled both confidence from LPs and others funding the funders, and that there is pathway for promising companies to continue to grow in this part of the world. Now we must wait to see how things will play out, but 2016 is looking like another exciting year.