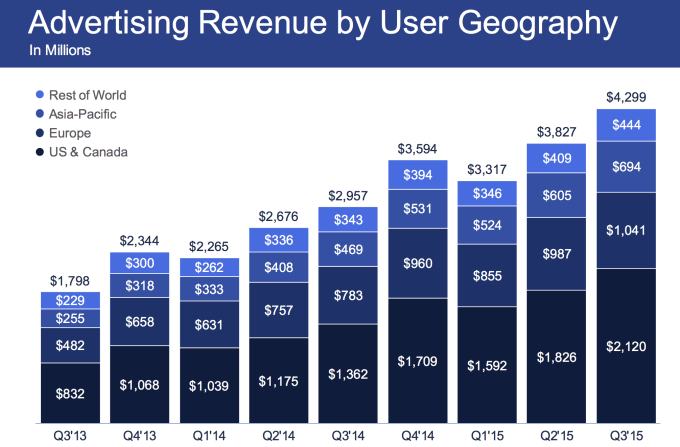

Facebook’s growth continues as it hit 1.55 billion users and beat the street’s estimates in its Q3 2015 earnings with $4.5 billion in revenue and $0.57 earnings per share, up a big 11.3% from $4.04 billion last quarter.

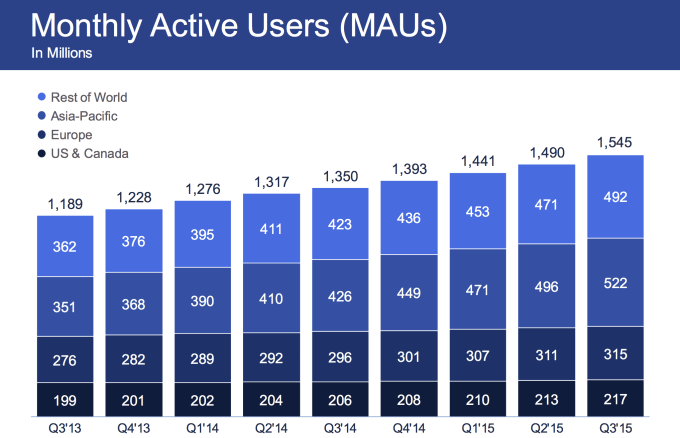

Facebook’s monthly user count was up sharply to 4.02% quarter over quarter from Q2’s 3.47% growth. That shows that while it might have hit sign-up saturation in its core markets, it’s still adding plenty of users in the developing world.

Analysts estimated Facebook would see $4.37 billion in revenue and $0.52 EPS.

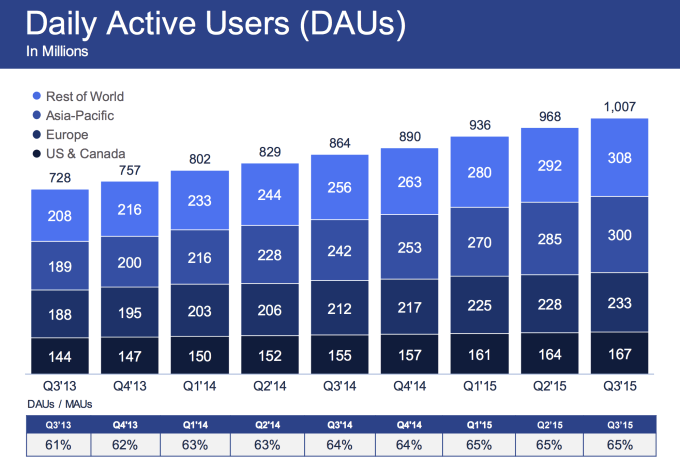

While Facebook’s total user count gets lots of attention, daily active user is a much more accurate reflection of its health. Facebook’s DAU hit 1.01 billion following a record 1 billion user day in late August, up from 968 million in Q2. That makes its DAU divided by MAU stickiness stat, or the percentage of monthly users that come back daily, a beefy 65.1%. That means despite never-ending claims that Facebook isn’t cool any more, most active users check it every single day.

Facebook now has 1.39 billion mobile monthly users (up from 1.31 billion in Q2) and 894 million mobile dailies (up from 844 million). Mobile now makes up a whopping 78% of Facebook’s advertising revenue, up from 76% in Q2. There are now 727 million mobile-only Facebook users.

Surprisingly, Facebook added 4 million users in its money-making core market of the US and Canada. That’s more in a quarter than any time in the last 2 years. That means Facebook is still converting holdouts, newly of-age teens, and seniors.

Facebook’s GAAP net income for the last three months, its real profit, was $896 million, compared to $719 million last quarter. That’s impressive considering the drag of Facebook’s big investments in artificial intelligence research in preparation for a wider launch of its Messenger personal assistant M. Facebook’s shares immediately shot up about 2.3% in after-hours trading following the earnings announcement.

Facebook’s ability to continue growing while keeping costs in check so profits can rise should boost confidence in a company determined to build futuristic technologies like AI and virtual reality.

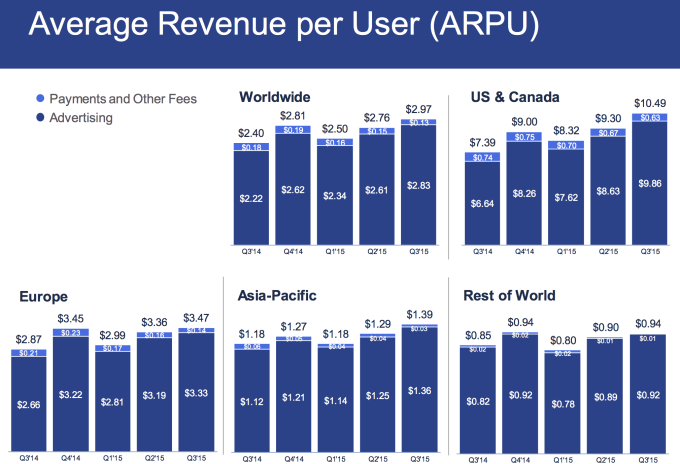

Perhaps the only dark spot on its earnings was the continued decline of payment revenue as Facebook’s web game platform dies off as users shift to mobile. But at $202 million, down from $215 million in Q2, payments make up less than 5% of Facebook’s revenue, so it’s not that big of a deal.

[Update: During the earnings call, the big announcement was that Facebook now sees an average of 8 billion daily video views from 500 million users, up from 4 billion views in April. Mark Zuckerberg also noted that Facebook Groups now have 900 million monthly users, and he sees that as a growing opportunity between wider sharing on Facebook and Instagram, and private sharing on Messenger and WhatsApp.]

As a whole, the quarter was more about Facebook investing in long-term product development and spinning up new revenue sources than seeing them come to fruition. It’s doing heavy testing around becoming a destination for both shopping and video viewership that primes the social network to run lucrative video ads.

Facebook also pushed on its hosted content initiatives, fully launching its Instant Articles program for making publishers’ news articles load faster inside Facebook’s app. One new ad format to watch out for is “Canvas”. I like to call them “Instant Ads” since they load rich-media marketing experiences quickly inside Facebook’s app when users click an ad. Since the format doesn’t interrupt the user experience by sending them to a browser, it could drive more clicks than normal ads and become a big cash cow for Facebook.

Facebook’s strategy involves trying to pull as much of the Internet experience inside its main app, while locking in users with Messenger. This ensures they spend as much time as possible where it shows ads in the News Feed. Meanwhile, it’s serving younger and international user bases with Instagram and WhatsApp respectively. This allows it to build up new userbases with different tastes without screwing up its core experience.

Now over 11 years old, Facebook seems to be weathering the tests of time quite well.