Line, one of Asia’s top messaging app companies, got back to positive financial growth after recovering its first quarterly revenue drop. The Japanese company said its messaging app service grossed 32.2 billion JPY ($267 million) in Q3 2015, up 35 percent on one year ago and up 15 percent on the previous quarter. The company didn’t reveal a profit or loss once again.

Line’s revenues may be rising again, but overall momentum is most definitely slowing. The messaging firm is well short of doubling its revenues as it did last year but — more worryingly — user growth, the center piece of revenue generation, is flattening at an alarming rate. Line, which is owned by Korean Internet firm Naver, said today that it has 212 million active users (MAU) each month. That means it added just one million active users over the past three months, even fewer than the previous quarter’s meagre addition of six million.

That may have something to do with the company’s new focus on Asia. Previously, it had been keen to expand into Europe and the U.S., but, three months ago, CEO Takeshi Idezawa made the decision to concentrate on markets where it has the chance to gain the top spot. (Being the dominant player makes monetizing services a lot easier.)

The company today pointed to Indonesia, a fast-growing mobile market with a popular of 250 million that is attracting interest from Spotify, among others, as one target market where it is seeing “rapid growth.” To date, Line has been far too dependent on home country Japan, Taiwan and Thailand. It is the most popular messaging app in each of those countries, and collectively they accounted for half of its MAUs in the previous quarter. Now, in an effort to reflect its progress in Indonesia, Line said that Japan, Thailand, Taiwan AND Indonesia collectively represent 137 million MAUs — nearly two-thirds of its active userbase.

Nonetheless, Idezawa said in a statement that Line is “now venturing into various new initiatives to find that next country or countries where we can become number one.”

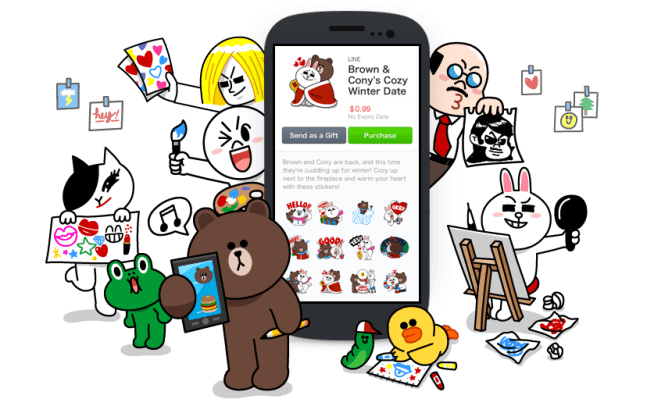

That, in case you didn’t know, means using services to gain popularity. Because, while Line may be struggling to add active users, it continues to monetize existing loyal fans better than any other chat app. That’s thanks to a collection of services like games (which account for something like half of all review), stickers, music streaming, payments, Skype-like global calling, Uber-style taxis on-demand, and more, and that aforementioned core audience in four countries.

Things would certainly be more severe if Line hadn’t already begun developing its services business — warning to other messaging apps out there! But, given the slowing revenue and user counts, Line isn’t about to become a global rival to WhatsApp or Facebook Messenger… and that may explain why it (once again) postponed plans to go public.