Square filed an updated filing with the Securities and Exchange Commission today that showed slowing revenue growth and a widening net loss in the third quarter this year.

The company reported a net loss of about $54 million, with Starbucks transaction costs hitting about $41 million in the third quarter. It reported transaction revenue of about $281 million in the third quarter this year, and net revenue of $332 million this quarter. In the previous quarter, the company had net revenue of $227 million and a net loss of $37.7 million.

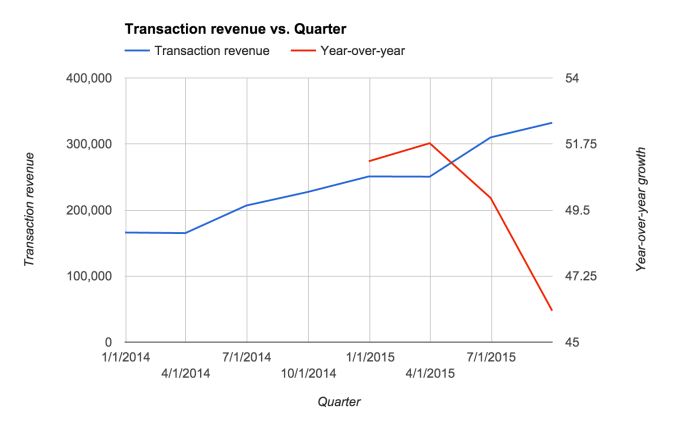

However, what this is showing is slowing transaction revenue growth — which, as the company prepares to go public, is not necessarily the strongest sign for investors. Then again, as companies grow, their revenue growth will continue to slow. But the IPO market is a little shaky given the weakness of First Data’s IPO that this might be enough to have a material impact on the company’s public debut.

Initially, from the company’s first filing, Square’s financial performance didn’t look all that bad: for the first half of 2015, it had revenue of $560.6 million, and a loss of $77.6 million. In the six-month a year earlier, it had $371.9 million in revenue, and a slightly steeper $79.4 million in losses.

The company’s operating expenses accelerated more in its most recent quarter than its revenue. That increase in cost of doing business led Square to its highest GAAP net loss in the periods that it reports, going back to the fourth quarter of 2013. In fact, the company’s net loss in its third calendar quarter was nearly twice the deficit it ran in its second quarter — Square’s business is highly seasonal, but that air gap up could spook investors who have become more wary of firms that promise high growth at the expense of cash.

On an adjusted EBITDA basis — something investors may pay attention to in the company’s IPO — Square went south again, posting a loss of $15.8 million after turning a $859,000 gain in the previous quarter. It’s worse than the same quarter last year, as well, when the company posted a negative EBITDA of $13 million.

The company’s operating expenses also continued to expand. Square said its third-quarter operating expenses were $148.5 million in Q3, compared to $97.1 million in the same quarter a year earlier.

Square is one of the most-anticipated upcoming IPOs for a couple of reasons, one of which is that its CEO, Jack Dorsey, is basically running two companies — Square and Twitter. In recent weeks, Dorsey has returned shares to Twitter employees, and it was revealed that he owns more than 20 percent of Square, still leaving him with quite a fortune if the company does well as a public company.

One other quick note (spotted by Forbes): Vinod Khosla has chosen to step down from the board of Square.

Mr. Khosla has previously expressed his desire to step down from our board of directors immediately prior to our initial public offering, consistent with his stated preference not to serve on the boards of directors of public companies, and has tendered his resignation from our board of directors to take effect upon the effectiveness of the registration statement relating to this offering. He will remain an advisor to the board.

We’re sifting through the filing right now and will update this post with more information as it comes in.