As the Internet matures and becomes more crowded with services and data, startups building services to make better and more accurate sense of what’s out there are seeing their stars rise. In the latest development, SimilarWeb, an Israeli company that provides websites and mobile app publishers with intel about their own traffic and that of competitors, has raised $25 million in funding to continue building its business both through organic hires and acquisitions.

SimilarWeb is not publicly disclosing its valuation but we have confirmed with a source close to the company that it is $400 million.

The round was led by Naspers, the media conglomerate out of South Africa that is a very active investor in a number of startups globally including Tencent, Mail.ru, and Flipkart, with participation also from Lord David Alliance. To date, SimilarWeb has raised $65 million, with Naspers and Alliance also leading the company’s previous round of $15 million a year ago.

SimilarWeb is in “very high growth mode” at the moment, according to Ari Rosenstein, the company’s marketing head. He is not disclosing exact revenues except to say they are in the tens of millions of dollars, with thousands of paying customers, which include strong traction with e-commerce companies like Flipkart and eBay, as well as other verticals that have made comprehensive moves to the web as a primary platform for business, such as airlines. The funding, in fact, was raised largely to meet the challenge of that growth, he says.

It wasn’t always this way for SimilarWeb. The company first started in 2007 as a Firefox Internet plug-in that would track sites that an individual visited and then offer recommendations of other, similar sites to visit.

That didn’t really take off as a viable business, so the company, under founders Or Offer (now CEO) and Nir Cohen (CTO), decided to pivot in 2013. By tweaking their technology, the company was able to collect anonymised traffic data (it doesn’t pick up or use in any way any personal identification information) from sites that are visited by users, match that with data from other sites, to create something of a large genome mapping where people are going, and what is leading them there.

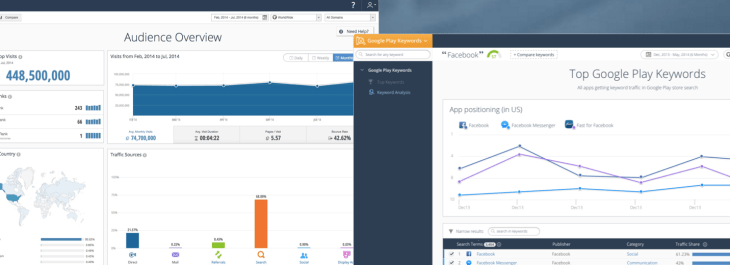

Today, the basic technology is supplemented by a lot more data from other sources to build a more complete picture. Rosenstein says that data from over 100 million devices and hundreds of thousands of sites is now fed and parsed by SimilarWeb for its analytics, which uses some 5,000 different pieces of software to compare and dig deeper into the raw data.

When I mention that it sounds like a play for market share from the likes of comScore, Rosenstein responded that in fact that wasn’t SimilarWeb’s main competition. A lot of our customers use us as well as comScore because we go further into competitive and market intelligence and have a much more global reach,” he said.

Rather, he said, Alexa with its web popularity rankings, is possibly more of a rival. “One thing that Alexa did well and really made its name was to make the web aware of website rankings,” he said. “We’re trying to do that and go one step further with an additional layer of transparency.” Other details that SimilarWeb provides to users free include details about search marketing, display, traffic and so on. “We want to keep that data free to use.”

The company makes money by charging for its Pro tier, which starts at $200/month for its most basic package and is based around modular pricing where you pay just for what data you need. He says the company has had deals that scale up as high as half a million dollars/month (other customers include large companies in the financial industry).

The plans are for SimilarWeb to hire more engineers on this side of the pond (Ukraine and Israel, specifically), as well as take on more sales and account management staff in New York, London and elsewhere globally. “We’re in a nice position right now where we need sales people, because we are getting more opportunities than we can manage,” Rosenstein said.

The company today — as you can see by its pricing structure — is targeting both small and larger businesses online, which is one of the reasons why it caught Naspers’ eye. “SimilarWeb enables businesses to make better decisions in today’s dynamic online and mobile world. Its products are uniquely capable of providing the insights necessary to create value for businesses of all sizes – from SMB to enterprise” said Larry Illg, CEO New Ventures, Naspers, in a statement. “Our New Ventures team at Naspers is always on the look out for opportunities to back exciting, game-changing companies and founders and help them scale globally. This latest investment underlines our continued confidence in the SimilarWeb team to redefine how the digital world is analyzed.”

The company also announced a new CFO. Jason Schwartz will join the company with a long track record as a CFO: including roles at Shopping.com (acquired by eBay), Cyota (acquired by RSA), Actimize (acquired by NICE Systems) and Clarizen.