Chances are you don’t like your current bank. German startup Number26 has been working hard for the past couple of years to bring a new banking experience to Europe. And now it has, using a novel approach to bank branches. Instead of playing catch up with good old brick-and-mortar banks, it is partnering with Barzahlen to turn retail shops into branches.

Starting today, you can go to 3,000 grocery stores, drugstores and other retail chains in Germany to withdraw and deposit cash. Withdrawing cash isn’t really important as you could already use any MasterCard ATM to get cash from your Number26 account. But depositing cash is a new feature for the company.

All you need to do is show up at a checkout register with your phone. Inside the Number26 app, look for the new Cash26 feature, enter the amount of cash you want to deposit or withdraw and scan a barcode. You then need to enter your PIN code. Cash deposits immediately appear in your bank account.

This feature is quite important as Number26’s home country has a heavy cash culture — people don’t use checks anymore and you can’t use your card everywhere. You could end up with cash that you want to put on your bank account, and you need to withdraw cash all the time.

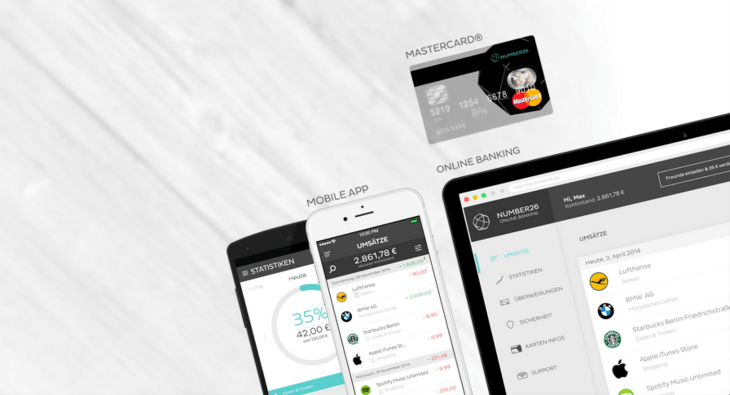

As a reminder, Number26 participated in our Battlefield competition at Disrupt London 2014. Creating an account takes minutes and everything happens on your phone. After that, you will receive a MasterCard that works particularly well with Number26’s app. For example you can disable features or set limits so that you don’t have any surprises. You can disable online payments if you don’t plan on using this card for your favorite e-commerce websites.

The app is also much better designed than your average banking app. Number26 is also launching an app update today with a new navigation, new stats, 3D Touch support on the iPhone 6s and more. You can expect other banks to add 3D Touch support in 2016 or 2017.

By partnering with Barzahlen, Number26 has more “branches” than Deutsche Bank and Commerzbank combined. So far, 50,000 people in Germany and Austria signed up for a Number26 account. The company now employs 65 people and raised $10.6 million back in January.

Barzahlen offers this kind of banking features to multiple clients, as well as a way to pay your utility bills and rents. When I first covered Number26, the startup told me that it wanted to partner with other fintech companies to provide more features to its customers. It looks like Barzahlen is the first partner, and I can’t wait to see what’s next for the company.

[gallery ids="1227510,1227511,1227512,1227514,1227515"]