When we observed an increase in Series A fundings in the first quarter of 2015, we had two theories as to what was happening.

First, people are attracted to the Series A figures more than Series B or beyond. This is similar to how people bid on mid-market houses in San Francisco, overbidding on houses around $2 million, but the $5 million houses see much less competition.

Second, we might see a cumulative impact, and this increase will carry on to Series B. This would create a wave effect, increasing Series B round sizes in the near future.

If our first theory was correct, Series B deals were a better bet than Series A. Instead of participating in Series A at X dollars, skip that, and participate in Series B at the same amount. You will receive less equity, but competition is less and the full failure risk is lower. (In our research, we found that the full failure risk drops by about 10 percent from Series A to Series B.)

The implication of the second theory is a bit more complex. In Q1, Series B was a safer bet than Series A. The level of Series B funding jumped more than 40 percent in Q2 compared to last year. This movement resembles more of a wave-like pattern rather than a bubble, and is worth investigating.

In a bubble, people watch and participate in some weird ecstasy until it pops. These conditions resemble waves rather than bubbles.

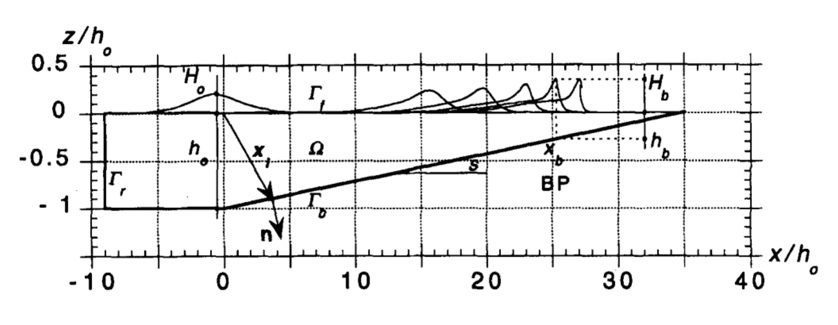

Modeling natural phenomenon is quite complex. In their academic paper “Breaking Criterion and Characteristics for Solitary Waves on Slopes,” Grilli, Svendsen and Subramanya attempt to figure out when and how a wave would break in the ocean as it approaches the shore. They discovered that there are two factors that determine the shape of the breaking wave: slope and the initial wave height.

The slope is the angle of the bottom of the ocean and the initial wave height is the height at which the wave approaches the slope. Grilli et al. concluded that no wave breaks when the slope is greater than 17 degrees. Wave theorists calculate that the breaking point occurs when H/h is around 1.3.

Let’s assume that as a company moves from one round to the next, the funding wave will resemble:

Let’s assume that as a company moves from one round to the next, the funding wave will resemble:

For simplicity, we’re assuming no friction at the bottom, and no lateral movement under the surface.

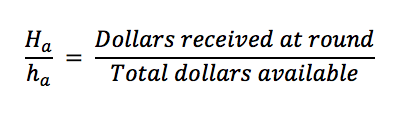

Now let’s take a look at Uber’s investment rounds. If we take the total dollars that went into a round over the total dollars available in venture capital altogether, we can calculate a ratio that’s similar to the height of a wave over the total height of the water under the surface.

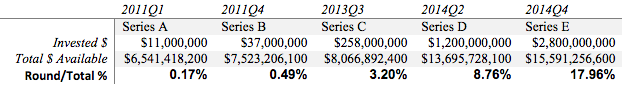

For Uber, the latest venture round attracted 17.96 percent of the total dollars available for investment in the entire industry. (Source: PwC Moneytree, CrunchBase).

The ratio that indicates the breaking point for venture capital is unclear. Still, Uber is getting pretty close as the ratio grew from 0.17 percent to 17.96 percent in about four years. The early entrants into the Uber wave are enjoying a nice ride throughout.

The late entrants, such as Microsoft, are the mavericks on for a thrill ride. It appears that the VC dollars are pretty much maxed out as far as Uber’s funding needs are concerned. But it’s no surprise that the latest investors in the company are private equity firms and sovereign wealth funds.

Think about a real wave in the ocean. It starts building, gets bigger and bigger, then reaches the shore with a lot of noise. There are those who invested in earlier stages and will be able to re-up. They will stay on top and will ride the wave nice and smooth.

There are others who invested early but can’t re-up, and those will have a nice “oooh” lift as the wave passes underneath them. They will enjoy the lift for a while, but then go back to where they were.

The most skilled ones, i.e., the “rads”, participate in all sorts of exotic waves and will have one hell of a ride, but won’t really benefit as much as the ones on top of the wave. But they will gain a lot of glory and fans. It takes guts and capital to ride the wave all the way through.

The late entrants want to overcome the wave and get on top i.e., get in on deals much later. Their success on getting in on the deals depends on how much capital they have. If they have a big boat that pulls them, they will succeed, and perhaps overrun a few surfers along the way. Others will be raked over.

And finally there are those who are sort of playing along the beach enjoying the sun. In surfer jargon, they are called the “paddlepuss.” Perhaps they rode an earlier wave and reached the shore, but now are quite comfortable where they are. Their peaceful fun will spoil when the wave breaks.

The sunny beaches of venture capital are far from what one might call safe. You have to stay in the game, get in on new deals or leave the beach at some point. We’re all talking about whether or not this is a bubble. In a bubble, people watch and participate in some weird ecstasy until it pops. These conditions resemble waves rather than bubbles.

And every wave reaches a breaking point sooner or later. The ones who enjoyed the ride will immediately want to get back in the water. Others won’t. The waves are always fun, but they are also unpredictable and turbulent.

As Jerry Seinfeld once said in response to the question on the longevity of a comedian, “You’re in it until you’re not.” Venture capital is just like that. It has its dangers, but it’s most dangerous if you’re a paddle puss.

Updates funding percent ratios.