Intuit is laying off 249 employees, mostly in the company’s Small Business Group, according to an internal memo from CEO Brad Smith reviewed by TechCrunch.

We first heard about the layoffs this morning, and Intuit confirmed the layoffs to TechCrunch. In June, Intuit laid off 399 employees as part of a company realignment. Last week as part of its quarterly earnings, the company said that it would divest several business units, including Demandforce, QuickBase and Quicken.

Accompanying layoffs are not uncommon as companies re-orient their strategies to focus on more successful products. Still, Intuit has had a tough run in recent weeks. Following its earnings report last week, the company’s stock fell sharply. Intuit also increased its cash dividend by 20 percent.

“In 2013, we kicked off a multi-year change journey designed to sharpen Intuit’s focus on and investment in businesses that strengthen the Intuit ecosystem and align with two strategic goals: to be the operating system behind small business success, and to do the nations’ taxes in the U.S. and Canada. Today we communicated organizational changes that continue to drive our transformation,” a spokesperson for Intuit said.

“Unfortunately, this included some reductions to our staff to ensure we’re structured appropriately and aligned with our priorities. We have great confidence in our strategy, our execution, and our trajectory as we build this company for the long term. These are tough choices, but we believe these are the right moves for a company that’s built to last and focused on the future.”

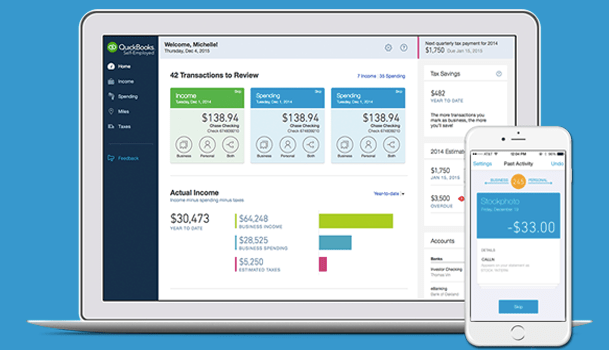

Intuit is known for its tax preparation services like TurboTax and financial services like QuickBooks. In January, the company partnered with Uber and Stripe to help those on-demand workers keep track of their finances. But it’s clear that the company is still trying to figure out what it looks like in 2015 as it focuses down on a smaller set of business tools.

Prior to the company’s earnings report, its stock has risen more than 28 percent on the year, making the company worth more than $28 billion based on its market cap. It’s now worth about $22 billion since that last earnings report. On the year, shares of Intuit are down around 3 percent, giving up the gains it produced leading up to its earnings report.