There’s been some significant consolidation among the rush of on-demand cleaning and home services startups. Now one of the companies vying to end up on the top of the heap is expanding into a new category. Handy — the New York-based home services startup is active in 28 cities and has raised $64 million — is launching Handy Delivery, a delivery and assembly service, starting with furniture.

Debuting initially in NYC, the first items on offer will be a selection of bedroom, living room and other furniture from Ikea, which you actually buy through Handy’s own site. If there is an Ikea item that you want that is not listed on Handy’s site, Handy says you can email a list of items to them and they will buy and price out the delivery items for you directly.

The items come as soon as next day and with a two-hour window for delivery time.

Handy Delivery comes amid some other interesting developments for the company. Bloomberg reported last week that Handy is raising $50 million at a $500 million valuation — a round that we’ve heard may actually be higher when it’s closed. And we’ve also heard from reliable sources that a potential deal to acquire Homejoy, which has been ongoing since May, is now dead.

While the new service will effectively sell the Ikea furniture that Handy is offering to deliver and assemble, the idea is not to become an e-commerce portal, says Handy’s CEO and co-founder Oisin Hanrahan.

Rather, it’s to take some of the hassle out of buying things like flat-pack furniture that needs to be put together yourself. While items bought online will often have an option for delivery and assembly, Handy is hoping to undercut when those services are offered as ad-ons by stores and provide an option in those cases where there is no assembly or delivery offered at all.

“The aim of the new service is to make customers happy. This about taking something people are doing — buying furniture that needs to get to their homes and be assembled — and making it into a great experience,” Hanrahan said in an interview.

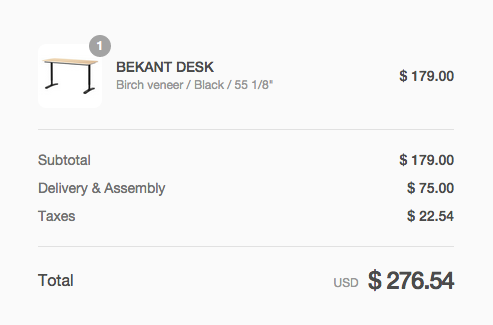

To that end, the price for a piece of furniture as it is being sold on Ikea is the same on Handy. The mark-up comes in taxes and delivery and assembly.

To that end, the price for a piece of furniture as it is being sold on Ikea is the same on Handy. The mark-up comes in taxes and delivery and assembly.

Handy is not directly working with Ikea (or any future retailer) as a partner, Hanrahan noted, and longer term the idea will be to add more stores and more categories to the mix.

“Imagine Instacart and what it offers in its [aggregated] booking experience,” Hanrahan said. “This is what we want to do here.”

The service, if successful, could boost Handy in two ways. It will help the company increase its contact points with existing customers, who might be more likely to turn to Handy as a one-stop shop for home services. That, in turn, can help the company’s margins on those customers.

And it will widen the funnel for more people to come into the Handy platform to begin with. While you may not be the kind of person who pays for housekeeping, you may have no interest in putting together Ikea furniture. But if you pay for one service and like the experience, you may be more likely to try out the other one.

There have been a lot of startups flocking around the on-demand model, from transportation to delivery and cleaning and all tasks in between. But there has been skepticism over the viability of many of them.

Some have raised questions about margins as many services market themselves aggressively but fail to scale and develop enough high-margin products to offset the cuts it takes on cheaper, competitive ones. That’s not helped by the presence of companies like Amazon that are also targeting home services.

The scaling issue and how it impacts on margins appears to be at the heart of some of the problems Homejoy has faced. Our sources say the Handy deal to buy them died because of issues similar to those that Homejoy faced in a failed acquisition by Germany’s Helpling.

Handy itself, however, appears to have been on a roll in terms of its growth.

In addition to passing $1 million/week in job bookings in March, the company is now clocking around 100,000 bookings each month, with 80 percent of them coming from repeat users. (No specific comment on margins except to say that the company is happy with them.)

Another issue hitting several on-demand startups has been employment, since many of the workers that make the wheels of these startups turn are contractors.

Handy itself has been the subject of lawsuits that TechCrunch understands are either in arbitration or moving in that direction, and the company in the meantime is trying to work with its wider network on a way forward. It’s also faced some criticism for its customer service.

“At Handy we are dedicated to helping connect our customers with trusted, effective professionals for common household services. At the same time, we are focused every day on attracting the best network of high-quality independent professionals, which means giving them the opportunity to make good money and provide for themselves and their families,” Hanrahan said.

“Our independent professionals make on average over $17 an hour per job using the Handy platform, which offers them great flexibility in how and when they work.”