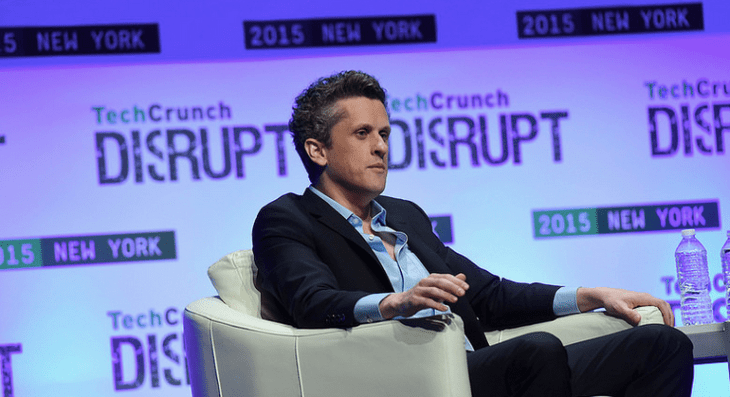

Tomorrow is the best day of the quarter. Why? Because Box will report its financial performance and everyone has a hot take on Aaron Levie’s enterprise collaboration firm. I may be guilty of that as well.

Since its IPO, Box has reported earnings a single time. It didn’t go particularly well, due at least in part to some technical issues regarding collated analyst expectations that led many to think that Box missed its numbers. The company actually beat on profit and revenue during its last fiscal period, but still saw its shares slip sharply.

So, what’s on tap for tomorrow? Street expectations are an adjusted loss of $0.31 per share, on revenue of $63.70 million. For comparison, the sequentially preceding quarter included $62.6 million in revenue. The company guided for between $63 and $64 million in top line for its fiscal first quarter, placing its own guidance nearly precisely in line with market expectations.

Box shares fell in regular trading today, shedding around 4.6 percent on the eve of its earnings day.

Beats, Momentum, And Winning

Box as a company has attracted a cadre of doubters, mostly people who pointed a finger at its stiff losses incurred as the enterprise-focused company scaled. Box, and its defenders, have mostly waved charts of quick revenue growth in response.

Box is currently predicting to grow around 30 percent this year. A fine figure, but down from its 2014 tally of 74 percent growth. Box’s continued losses — the firm expects a negative adjusted operating margin of 50 to 52 percent this year — are more difficult when weighed against the slower revenue growth figure.

That makes tomorrow’s report more interesting than most quarterly downloads — Box has a chance to silence its critics, or underscore their fears. For a company as young as a public company as Box is, the early innings are key.

There are other numbers to keep in mind. How much cash did Box burn in the quarter on operating expenses? The company went through $15.59 million in its fiscal fourth quarter, down from $22.65 million in the year-ago quarter. If Box can continue to shrink that figure, it will help the company make the argument that its losses are investments for future incomes.

And it would not hurt Box to post a declining year-over-year net loss, measured using traditional accounting techniques. In its preceding quarter, Box’s net loss grew by a mere few million, implying that the company could be nearly past that particular inflection point.

Regardless, tomorrow is a big day for the now-former-startup. I’m chatting with Box’s leadership after the report, so expect a full regala of nerdery.