Uber is synonymous with its cashless payment experience, but that’s about to change. At least in India, initially.

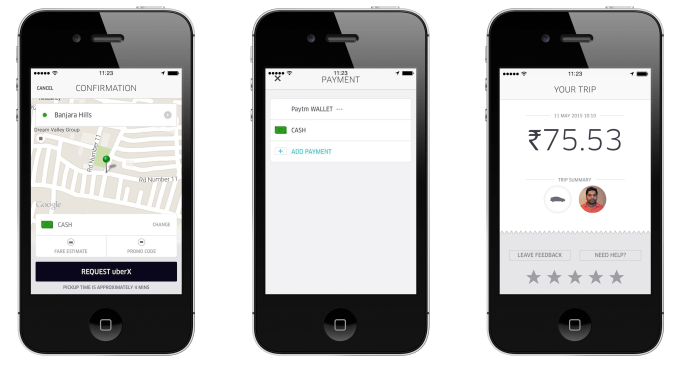

That’s because the ride-hailing giant has kicked off a pilot program testing cash payments in one city in the South Asian country: Hyderabad. There, Uber customers will be able to pay their fare in cash, using a new option that must be selected before requesting a ride.

Uber has hinted in the past that it would be flexible on payments in emerging markets — it added cash payments for auto rickshaw rides in New Delhi in April — and now it is fully kicking the tires with this pilot.

“Hyderabad was the only city specifically selected for this experiment because it provides us with the right environment to test a new payment option amongst a sizable and sophisticated rider and driver community,” Uber said in a blog post.

Picking India as a test bed makes sense for a number of reasons. Credit card penetration is as low as just 2 percent so cash opens its service up to potentially millions of customers who wouldn’t ordinarily be able to use it. That said, Uber has adopted Paytm’s digital wallet, which allows customers to deposit money into their accounts without plastic, but cash payments are synonymous with taking taxis — plus there’s no technology barrier to discourage would-be customers.

Uber currently serves 11 cities in India, while market leader Ola — which last month closed $400 million in new funding — is present in more than 110, with plans to reach 200 by the end of 2015. With a far smaller geographical footprint, Uber has thus far targeted an urban and more ‘premium’ customer base in India.

But, if this cash experiment is widened across the country, it might just be a sign that the U.S. company is keen to move beyond this initial, narrow focus.

As for the significance of cash payments, it’s worth noting that half of Ola’s payments come in the form of cash, according to comments made to BuzzFeed. So, while Uber is removing one of the core pillars that it’s known for — the company eulogizes the convenience of cashless payments — a more basic approach might help it win market share in India, and potentially other emerging markets in the future.