It’s high time the cannabis industry got some serious attention from investors. So it’s a good thing that Privateer Holdings, a company focusing on producing, distributing, and educating consumers about legal marijuana, has closed on a $75 million round of funding it will use to create new brands of cannabis products.

Privateer is a holding company that was designed to create, incubate, and to acquire companies in the cannabis industry. Today it has three principal holdings:

- Leafly, which bills itself as the world’s largest cannabis information resource;

- Tilray, a company on Vancouver Island that produces, processes, packages and distributes pharmaceutical-grade cannabis all across Canada; and

- Marley Natural, a new brand formed in association with Bob Marley’s family that will produce medical cannabis, topicals, and accessories for the U.S. market.

That’s just the start, though. Privateer has big plans to expand and add new brands as time goes on. And it hopes that the brands it creates and incubates will not only appeal to customers, but will also help legitimize the cannabis industry.

“We’re in this really interesting stage at the end of prohibition,” Privateer CEO and co-founder Brendan Kennedy told me. “Our focus is on creating brands that fuel change, that change perceptions of the product and user — brands that inspire trust, and brands that create legitimacy.”

That’s a mission that Privateer has been working on since 2010, when Kennedy and two friends decided to quit their day jobs and to focus on funding products that would move the industry forward. But they soon realized that just purely making investments in the usual VC or private equity model wouldn’t make sense in a fragmented market with few standards.

Instead, they decided to build a portfolio of products users could identify with and build an affinity toward. In that way, they’re not so different from P&G, General Mills, Nestle, Coca-Cola, PepsiCo., or any of the other big conglomerates of consumer-facing brands out there today. The only difference is that they’re building brands around a market that is not totally legal today. But that’s quickly changing.

“This is the next logical step in the transformation of this industry, as it changes from a market that operates in the shadows to a fully transparent market that’s out in the open,” Kennedy said.

A lot of progress has happened in the five years since Privateer was founded. As Kennedy notes, in 2010 medical cannabis was legal in just 15 states, and only about 29 percent of the U.S. population lived in areas. But now medical cannabis is legal in 23 states plus Washington, D.C., and fully legal in another four states. Today more than 72 percent of the population lives in areas where some form of marijuana is legal.

The broader availability of legal marijuana today means not just a bigger market opportunity, but also the chance to be a front-runner in standardizing how people buy — and really, how they think about — marijuana, whether it’s for medical or recreational use.

“Our thesis was that this will be a mainstream consumer product used by mainstream Americans, and they will be looking for mainstream professional brands that don’t insult or offend them,” Kennedy said.

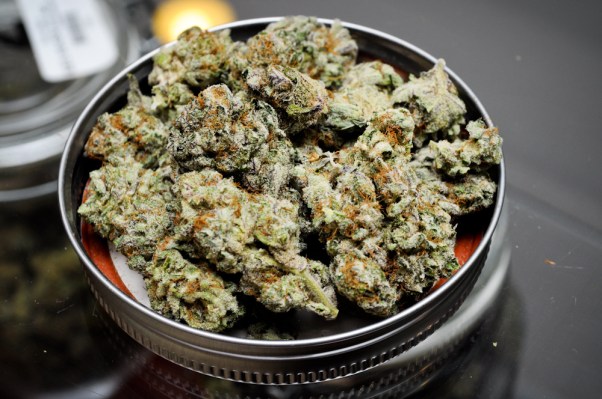

Indeed, the days of buying a nondescript baggie of weed from a local delivery guy on a bike are coming to an end. Today’s cannabis buyers are increasingly sophisticated, educated and discerning consumers who have more information than ever about the particular strains of marijuana available to them, as well as their effects.

The first company in Privateer’s portfolio, Leafly, was all about helping to educate users on available cannabis products. When Leafly acquired the business in 2012, Leafly had about 100,000 visits a month and no revenue. Last month it hosted over 5 million visits and is now profitable.

More important to Privateer than simply providing an online resource for potential customers, Leafly also produces a large amount of data that can be applied to the company’s other lines of business. From Leafly, it knows what kind of people are searching for cannabis and medical cannabis, when they are searching for it and where they are searching for it.

Leafly “really informs us of the most popular strains and the most popular retail locations around the world,” according to Kennedy. Today about 75 percent of those searches occur in the U.S., with the remainder happening internationally.

That information will help inform the types of products produced by its existing brands, Tilray and Marley Natural. And it will probably be used to help build other brands over time.

Kennedy said he could see Privateer creating brands aimed at high-end cannabis connoisseurs and those on the value side of the equation. He compared it to the beer market, where there’s a segment for Sam Adams drinkers, and one for Heineken drinkers. And sometimes those brands end up being owned by the same company.

For now, though, the $75 million investment seems to legitimize what has been seen as a poor investment opportunity for years. And it was all anchored by Founders Fund, which announced its participation in January. Since then, the company has had a much easier time closing its round.

While other investors have come on board, they didn’t want to be named in the announcement. It turns out that some VC firms, high net worth individuals, and family trusts still don’t wish to be associated with a drug that is still illegal on a federal level.

“I said in January that the announcement by Founders Fund would give other smart investors permission to look at this industry,” Kennedy said. “That was unfathomable five years ago.”

According to him, those investors are betting that Privateer will be able to build four or five billion-dollar brands in the cannabis space. And based on how things are going, they just might be right.