Editor’s note: Nino Marakovic is the CEO and managing director of Sapphire Ventures.

Much has been learned and written about the significant cash consumption associated with high-growth SaaS companies. But just how does one achieve rapid growth in a SaaS business while maintaining capital efficiency? By focusing on the timing of cash collection, not just cash spend.

Over the past several years, Sapphire Ventures has invested in dozens of SaaS companies, including Box, ExactTarget, DocuSign, Krux and Socrata, and evaluated hundreds more. As a result, we’ve developed a strong understanding of best practices and gained knowledge of the benchmarks and metrics that actually matter when it comes to running a SaaS company.

What we’ve noticed is that the timing of cash collection can drastically influence the cash consumption of a high-growth, recurring-revenue business significantly beyond what one would intuitively assume. This ultimately has implications on the attractiveness of a business or, at a minimum, the level of shareholder dilution it experiences over time and will become an increasing area of focus as the period of cheap growth capital slowly comes to an end.

Minding the Gap in Cash Consumption

The “cash-for-growth tradeoff” is a well-known question confronting most SaaS companies. Software subscription businesses incur expenses today to make sales that translate into revenues over some future period of time. This can create a timing mismatch between when cash expenses are incurred (e.g. sales and marketing) and when cash receipts are collected from customers. This also explains why SaaS companies often consume lots of cash and show significant P&L losses during high-growth phases. So what does the timing of billings and cash collection have to do with all of this?

For starters, the impact of cash collection on cumulative cash needs is vastly underestimated by many practitioners. There are also other important considerations associated with upfront cash collection.

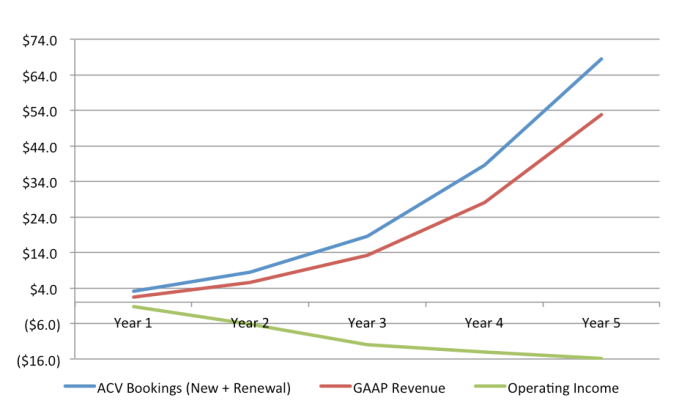

Let’s take two hypothetical early-to-mid stage, high-growth, recurring-revenue SaaS businesses and model them over a five-year period. We assume each company admirably grows annual GAAP revenue from $2M-$6M-$13M-$28M-$53M and enjoys a 100 percent annual renewal rate. Both companies have identical aggregate cost structures that are well over 100 percent of revenue, which is benchmarked on dozens of recent high-growth SaaS businesses we’ve evaluated or invested in, or that have gone public. As illustrated below, the two companies thus have identical GAAP bookings, revenues and operating income.

Bookings, Revenue and Operating Income of Both Businesses: Same

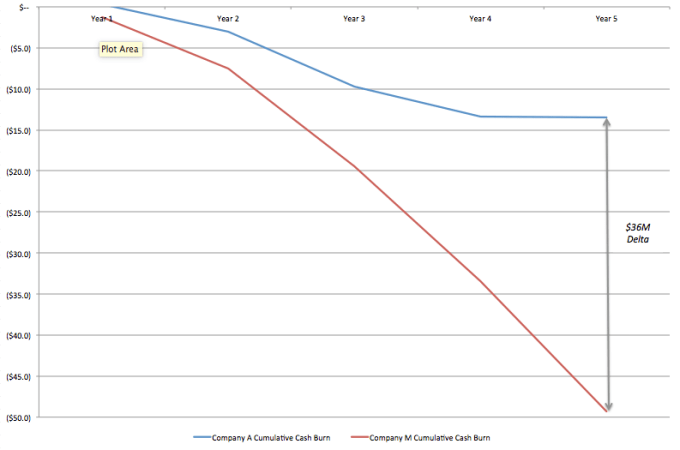

The only difference is that the first company, Company M (“monthly”), is like most SaaS companies in that it gets paid cash monthly and ratably over the one year contract period. The second company, Company A (“advance”), collects the full annual contracted value in advance.

Comparison of Cumulative Cash Burn: Drastically Different

The difference in cash consumption between the two companies is staggering. Company A would have burned $36 million less cash over the five-year period due to growing deferred revenue balances, to achieve the exact same revenue and bookings trajectory as Company M. This gap in cash consumption can be the difference between success and bankruptcy or moderate versus significant dilution for the founders and early investors.

Company M burned more than three times the amount of capital as compared to Company A despite identical bookings, revenue growth and operating expenses. Who can afford to ignore this?

(The full underlying P&L and cash spreadsheet is available here.)

Is Now Soon Enough?

Improving cash flow isn’t the only benefit of collecting cash upfront.

The additional cash generated by advance collection can be deployed to fuel accelerated revenue growth and, as a result, be used to generate potentially even more cash. This virtuous cycle widens the top-line and cash disparity between a monthly and advance collection model.

Second, businesses that collect cash in advance typically have higher customer retention than those that don’t. The reason is simple: customers who commit cash upfront are financially more committed to the ongoing use of the product, and the very fact that they are willing to pay upfront signals a higher level of comfort with the purchase. Also, it doesn’t hurt that customers who pay annually in advance are subject to one, rather than potentially 12, discrete renewal or renegotiation decision points over a year.

On The Other Hand…

Despite the significant advantages of cash, retention and growth that accrue to advance collection SaaS businesses, the discussion would be incomplete without outlining the potential tradeoffs involved.

The hardest part about collecting cash upfront is that customers need to agree to pay upfront. Notwithstanding charming and convincing sales executives, a customer will typically look for some incentive to pay upfront. This often manifests in the form of a discount, perhaps 5 percent to 20 percent, which is typically offered in order to acquire the same volume of customers while keeping sales cycles at reasonable levels. Relatedly, proof-of-concept or free trials along with retraining of sales reps may be required.

Secondly, a critical yet unintended consequence of advance cash collection is that companies may be tempted to spend more money in a less prudent manner than they would otherwise, simply because they can. While a company might mask over-spending by continuing to book new customers and retain existing ones, if business slows down, cash limitations and shortfalls may ensue.

So although the “payback period” on sales and marketing in upfront cash collection models is de minimis, the importance of understanding the longer-term and ongoing consequence of billing in advance can’t be overstated. Once cash is collected upfront, the subsequent cash burn will be greater than that of a monthly model that doesn’t collect upfront but burns less (or generates more) cash thereafter.

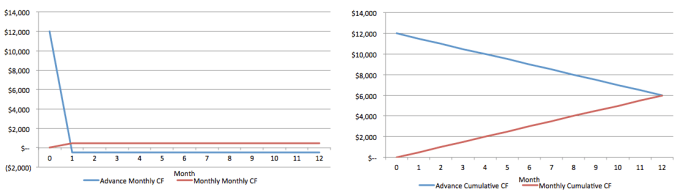

To illustrate this point, Figure 3 compares the monthly and cumulative cash flow from one sample $12,000 ACV contract in an advance and monthly collection business:

Comparison of Monthly Cash Flows of One $12,000 ACV Contract (Represents 50% Net Income Margin Business)

Finally, because customers commit upfront and no longer have a monthly catalyst to potentially churn, SaaS practitioners should be careful to measure the churn rate for customers up for renewal rather than month-to-month, as would be done under a monthly billing regime. This will provide a more realistic view of the retention performance characteristics of the business.

Ultimately, there isn’t necessarily a right or wrong answer when it comes to the timing of billing customers. Businesses that collect cash monthly can be very capital-efficient by keeping a close eye on traditional sales efficiency ratios and other measures, and businesses that collect cash in advance may burn cash due to a bloated cost structure. What’s most important is keeping in mind the near and long-term financial, business and even psychological impact and tradeoffs of both models.