CommonFloor, which claims to be India’s largest online real estate platform, has raised an undisclosed amount of new funding from Google Capital. What’s notable about the funding is that it marks Google Capital’s third investment in Asia since the firm, which focuses on startups in the mid-to-late stages of growth, launched in February.

Google Capital has invested in 10 companies since its inception, and its interest in Asia is yet another promising sign for startups in the region, where venture funding for post-seed stage tech companies is often difficult to come by.

That appears to be changing gradually, as funds backed by large tech firms, like Google Capital, SoftBank, and Rakuten, as well as VC firms such as Incubate Fund begin to pour more money into startups in China, India, and Southeast Asia. In addition, South Korea also recently saw a flurry of funding activity.

Though Asian startups have been frustrated by lack of VC-backing and opportunities for exits, it’s not surprising that firms like Google Capital are turning their attention to the region, especially since Asia is set to become the world’s largest e-commerce market, with plenty of room left for growth, especially in India and Southeast Asia.

Before its investment from Google Capital, CommonFloor, which was founded in 2007, had already raised $47.9 million from Tiger Global and Accel Partners.

India’s real-estate market has suffered from too much supply and low sales, but the government wants to give it a boost with an ambitious new program that aims to make housing affordable for all people by 2022 by investing $2 trillion in real estate over the next eight years, as well as lowering interest rates on home loans.

CommonFloor hopes that increase for real estate will drive more users to its platform. Other companies that would benefit from India’s potential housing boom include Housing.com, which recently raised $90 million from investors including SoftBank.

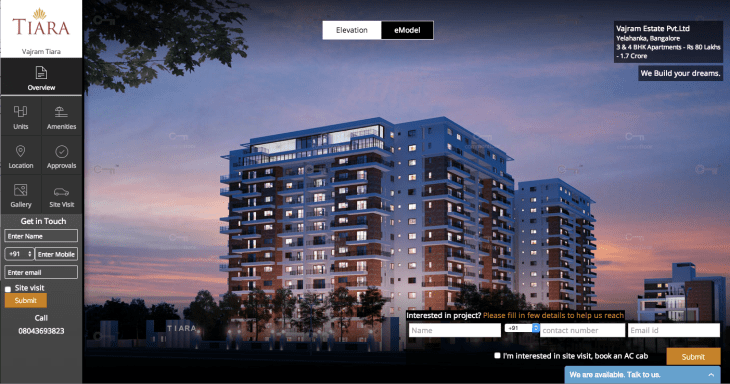

Founder Sumit Jain says having Google Capital onboard will give CommonFloor a chance to take advantage of the tech giant’s technical and operational expertise as it continues to scale up its business. CommonFloor currently has 200,000 properties posted directly from real estate owners in India, but it seeks to be more than just a listings site.

Jain says CommonFloor’s data tools help potential buyers and renters find the best neighborhoods for them to invest in. (The company, which has more than 1,000 employees, has already mapped 10 million homes for its listings and says it wants to eventually map every property in India). Then, after a deal is closed, owners can continue to use CommonFloor to manage their rental properties.

In addition to working on its platforms, CommonFloor will also grow by making acquisitions. Yesterday, it announced the purchase of Bakfy. Though Bakfy is an anonymous social gossip app, CommonFloor is more interested in its local and social search capabilities, which can help people find new apartments in their neighborhood. Jain says CommonFloor plans to make more acqui-hires, but it hasn’t decided on any companies yet.