Another acquisition for Yandex, this one to help the online search giant — known as the Google of Russia — build out its Yandex.Market shopping portal. It has bought Sovetnik, a Russian startup that has developed an e-commerce browser extension of the same name. Sovetnik (which means ‘advisor’ in Russian) currently has 2 million users. It tracks products that people are looking to buy online and then, by way of an on-screen widget, offers them an alternative of where to buy it for less money.

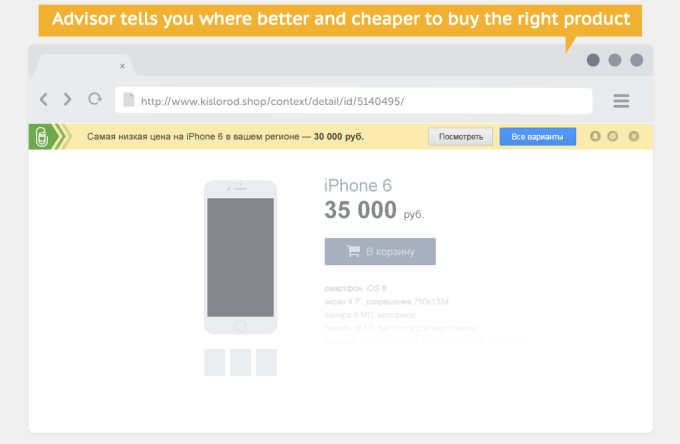

The result looks like this:

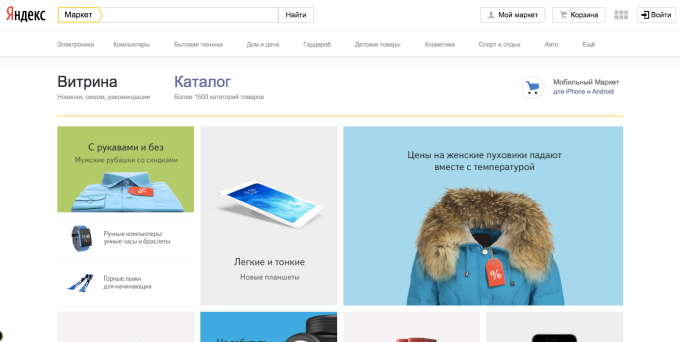

The idea longer term will be not just to use Sovetnik technology for Yandex.Market products but for other goods and services that people search for and eventually buy online:

Specific terms of the deal are not being disclosed. Runa Capital invested $1 million in the startup when it was originally called Metabar — the startup’s only VC funding — and says it made a “multiple return on investment.” Metabar/Sovetnik was profitable, the founders say.

Sidenote: Russia’s Runa Capital was founded in 2010, and Metabar was actually the firm’s first investment. It’s also Runa’s first exit in Russia, with other sales including the French startup Capptain selling to Microsoft, and StopTheHacker selling to CloudFlare.

Yandex’s decision to acquire Sovetnik makes sense on a couple of different levels.

First, there is the business of Sovetnik itself. The company’s original incarnation as Metabar had created an on-screen content recommendations toolbar, in the same vein as Meebo (acquired by Google) or Conduit or Outbrain. Later, when it pivoted to using that technology specifically for online shopping recommendations, it built the solution first to work with Yandex.Market, the search giant’s shopping portal pictured above.

Yandex, like Google, positions itself as more than just a place for general search: the promise is for more intelligent searches finding what you really want — whether it is directions on a map, or an app, a particular video, or something that you want to buy. In that regard,giving users, by default, a way of shopping more easily on its shopping portal Yandex.Market, as well as elsewhere on the web, is a logical way of building out that business.

It’s also not surprising to see Yandex building out more services to diversify its revenue streams. The company currently controls about a 60% of all online searches in Russia — a rate that has been very stable for a while now. To grow, Yandex needs to develop other services to improve its margins and break into new product areas.

Second, there are the trends affecting the bigger business of e-commerce and online shopping recommendations. There has been a lot of consolidation among businesses that aggregate online shopping offers for similar products — most recently, Connexity acquired Become.com to add to an already-large portfolio of sites that aggregate offers, including sites like Bizrate and Shopzilla.

The reason for the consolidation is because not only are these sites not getting nearly as much traffic as they used to, but people are turning to sites like Google and Yandex for the same kinds of recommendations — or simply just going straight to Amazon, eBay, Russia’s Ozon, or another large marketplace filled with multiple sellers. And to get the traffic that they used to, the aggregating sites are advertising on sites like Google and Yandex, cuts even further into their margins.

That means that the main business model for aggregators — built on getting referral commissions — becomes even less lucrative. That is driving more of them to consolidate to improve scale — or simply sell to one of the bigger companies (like Yandex) that has already managed to wrest away their traffic.