Last week at Disrupt SF, DataFox pitched what it called a “predictive intelligence” service, aimed at bringing a wealth of data concerning corporations — their landmarks, hiring trends, funding and valuation — to everyone. For a deep dive into how the product works, who is on the founding team, and what it costs, TechCrunch has you covered.

Today the company dropped its alpha tag, and opened its beta doors. DataFox was in alpha for around a year, the company told TechCrunch.

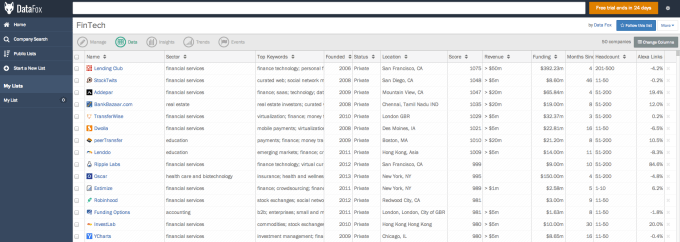

What’s new in the beta release that wasn’t in the alpha build? A feed of events for corporations that DataFox claims can “replace” the standard role of an analyst. It’s a large claim, with the company arguing that its “matrix of algorithms that mine millions of pieces of open-ended content,” such as news articles, can surface the important pieces that a user would want to see.

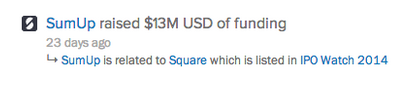

DataFox gave an example that it might bring up a funding update from a rival company if I were tracking Square:

Also featured in the beta is a suggestion tool that helps users find concerns that are similar to companies that they are interested in, including related keywords that might also turn up other corporations. Using an earlier build of DataFox, I did have some trouble filling in new lists of companies to track, so this tool would have been useful.

Core to the DataFox product are lists of firms that you can track. Think of them like Spotify playlists, but for corporations. The stronger a user’s lists are, the more useful the product will be for them. In keeping with that fact, DataFox also added the ability for users to collaboratively build lists in its beta release.

The move from alpha to beta for DataFox seems to be a feature upgrade, as opposed to a more general shift in its overall structure or availability.

DataFox competes with Mattermark, another startup that is looking to provide deep information and insight into hundreds of thousands of private companies. Mattermark has raised more money, most recently raising a $2 million round in June. Both companies claim that they absorb information from myriad sources and boil it down using automated systems to provide their users with the data they need.

Competition is always a good thing. I’ve used both, and I like both. Let’s see who wins.