OpenTable, which first announced its mobile payments pilot program this February in San Francisco, is about to speed things up. The company said this morning that it’s now expanding its mobile payments service to a number of restaurants in New York and plans to introduce payments to 20 more cities before the end of 2014.

The service competes with similar efforts from a number of companies ranging from smaller startups to payment giants like PayPal, all of which have been experimenting with mobile payments tableside in restaurants for much longer. In some cases, those payments are accepted via an app installed on consumers’ smartphones, while in other cases, the business offers a tablet at the table that may also include the restaurant’s menus and promotions, or even games to play while waiting for your food.

Many restaurants have embraced the interactive tablets, such as Applebee’s, which signed a deal with E la Carte late last year for its Presto tablets. The restaurant chain said the tablets would help reduce print collateral, which had before included a number of extra menus, inserts and table caddy menus. Other startups working on their own bill tallying and splitting solutions for diners include MyCheck, Dash, Cover and TabbedOut, to name a few.

Meanwhile, larger chains like Starbucks and McDonald’s have begun tests of order-ahead technology, which also includes a bill-paying option.

For OpenTable to compete in this crowded landscape, it’s leveraging one of its biggest advantages over the many newcomers: Its app is already installed on a large number of consumer smartphones, and the company is something of a household name for making reservations.

Today, OpenTable says it seats more than 15 million diners per month, but declined to say how many phones currently have its app installed.

But one can read between the lines of its public figures to see that mobile has been a growing business for the company: In 2010, OpenTable sat 2 million diners per month via mobile apps, and by last summer, mobile devices were accounting for 36 percent of OpenTable reservations. The app is installed on millions of Android phones, according to Google Play data, and on iOS that number would be higher.

OpenTable customers won’t need to make radical changes in order to take advantage of the new service beyond adding a credit or debit card to their account. Unlike some of the competing solutions, there’s no table number to enter and no barcode to scan in order to settle their check, and they don’t need to install a new app or “check in.” Meanwhile, restaurants already on OpenTable can dip their foot in water with mobile payments without committing to new hardware.

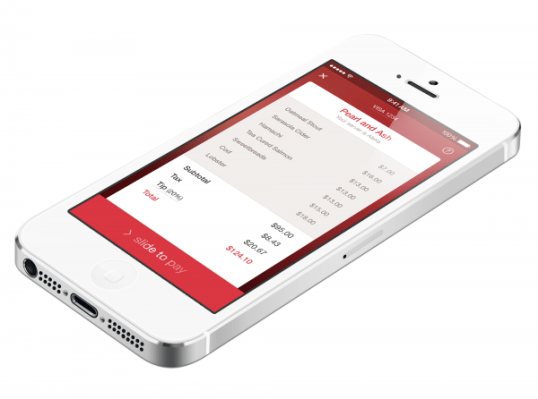

Mobile payments are currently supported via OpenTable’s iPhone app, which offers a detailed view of the bill with line items, adjustable tips (by percentage), emailed receipts, and the ability to use payments cards that may include those the restaurant itself does not take.

Dozens of restaurants are now accepting OpenTable payments in New York, after a more limited trial with 18 restaurants in San Francisco.

While OpenTable wouldn’t reveal details surrounding those tests, it would say that the early data suggests faster turn times for restaurants and “encouraging trends in tip and check size.”