In today’s startup environment, it’s become standard operating procedure for stock options to be counted as part of an employee’s overall compensation. And yet, most startup employees are totally in the dark about how many stock options they have, how many of those options have vested, and how much converting those options into stock will cost.

eShares wants to change that by pulling private companies out of the archaic world of paper stock certificates and helping them shift to electronic records. By doing so, it can make it easier for businesses to track everyone on their cap table, while enabling investors to see all their holdings in a single place.

It started with digitized stock certificates, but then moved on to offer electronic stock options, which in turn enables its clients to see their cap tables updates in real-time whenever an employee decides to exercise those options. That’s a big benefit for startups, as it removes a lot of the issues associated with managing the paperwork associated with stock options.

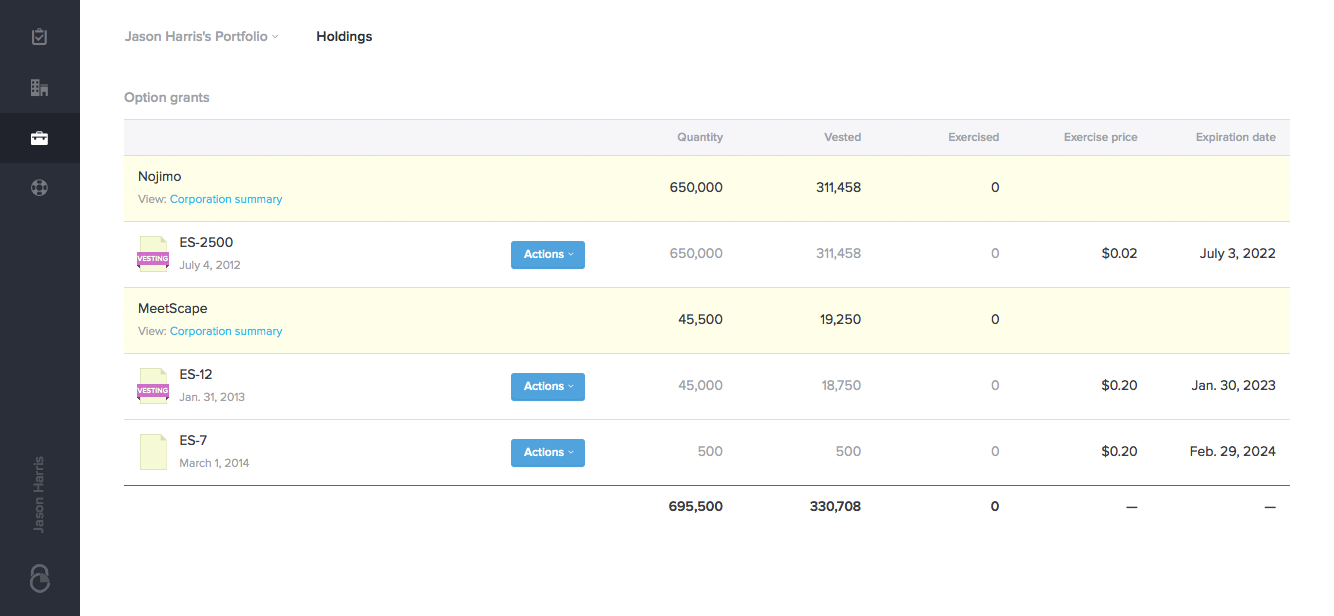

Now it’s extending similar benefits to startup employees, who will for the first time be able to keep track of their stock and options all in one place. Employees whose companies use eShares will now have a real-time dashboard that shows all outstanding option grants, their vesting schedules and their strike price.

For employees who have worked at different startups or advisors who have option grants from multiple companies, the platform even combines all of them into one place.

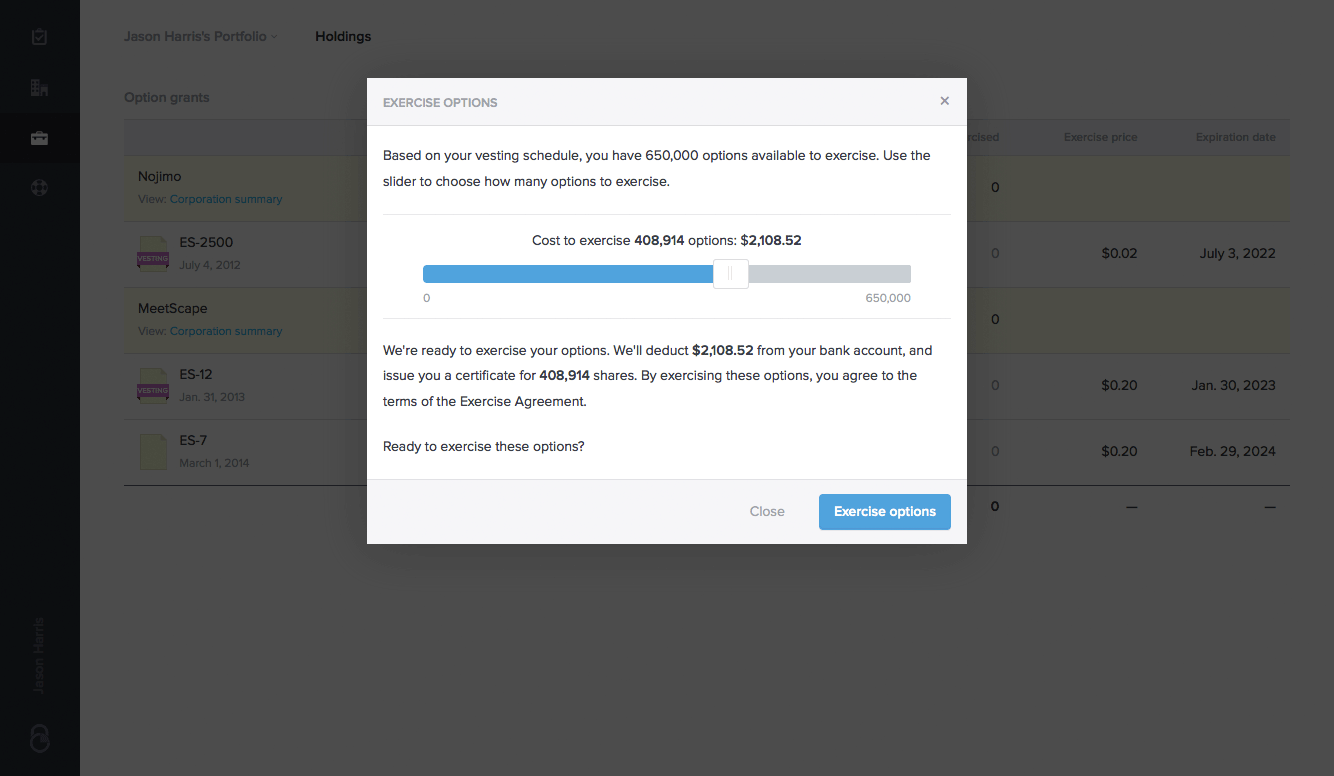

eShares also provides employees with an online calculator to show how many options they have vested and how much it would cost to exercise them. And if they’re ready to, they can do so directly from within their account.

Employees need only connect their checking account to eShares and the platform will deduct the necessary funds to exercise options. Or, they can send a check to their employer. Either way, once the funds are transferred, the stock will be automatically shown in their account. eShares even generates a personal 83b filing to send to the IRS for those who exercise early.

The benefits for employees are obvious. According to eShares CEO Henry Ward, about 85 to 90 percent of all options are never exercised. In part, that’s because it’s a huge pain for everyone involved, and companies usually discourage exercising options due to the costs involved with doing so.

Once you remove those costs, there’s more reason for startups to want their employees to own more stock and fewer options. According to Ward, a lot of the companies that eShares works with see its dashboard as a way to differntiate themselves and recruit and retain employees.

eShares has raised $1.8 million in funding from investors that include Draper VC, Expansion VC, k9 Ventures, Elefund, Subtraction Capital, Scott Banister, XG Ventures, Kima Ventures, Andy Palmer, and Structure Capital.