Shares of Infoblox fell sharply today, to the tune of 36.84%. The networking company reported disappointing earnings after the bell yesterday, along with the coming departure of of its CEO.

How bad were the earnings? The company reported $61 million in revenue for its fiscal third quarter (2014), up a mere 5% on a year-over-year basis. The company lost $7.4 million the period on a GAAP basis, a larger deficit than the year-ago period. The company’s non-GAAP earnings also slipped, from $6.0 million to $3.8 million.

Nearly flat revenue, widening GAAP losses and falling adjusted profit isn’t great for a company valued on growth.

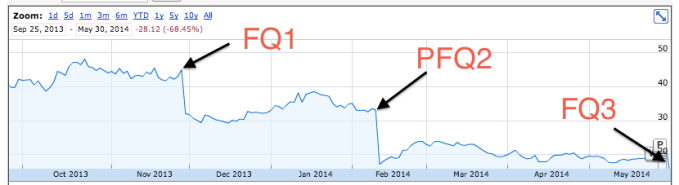

Shares in Infoblox closed today at $12.96. The company’s 52 week high is a stunningly different $48.97. That peak was reached in October of last year, a period in which a number of other technology firms saw their share prices skyrocket, only to come back to earth in the new year.

The company has seen massive losses in its value tied to its earnings in the preceding quarters as well. In short, for the past three consecutive calendar quarters, Infoblox hasn’t impressed the street.

The company released preliminary results for its second fiscal quarter on the 10th.

A third-party press release out yesterday indicates that an “investigation” into “possible violations of federal securities laws and focuses on the Company’s business and financial performance” is being undertaken by an external legal group.

The company’s guidance doesn’t inspire either, with expected fiscal fourth quarter revenue commensurate with the recently reported period.

The company gets what’s wrong: “Clearly, our top priority is to reaccelerate top-line growth and we are taking actions to improve sales execution.” Yes. The company’s GAAP gross margin of 77.4% is holding steady, implying that if the firm can get its growth engine back track, the company could be profitable in the future.

However, to get growing again, Infoblox may have to spend heavily, increasing short-run losses that could spook investors. The company’s roughly $260 million in cash and short term investments mean that it has plenty of cash-on-hand to pursue a variety of growth scenarios.

However, it will due so under new leadership. Instead of being forced out, CEO Robert Thomas is leaving of his — reportedly — own volition. The company’s Chairman of the Board stated in the company’s release that it “would be pleased if he would continue as CEO.” He’ll stick around until a new leader is found.

Hundreds of millions of dollars in market cap were lost today. Not the best day for Infoblox, or its formerly high-flying stock.

IMAGE BY FLICKR USER ED SCHIPIUL UNDER CC BY-SA 2.0 LICENSE (IMAGE HAS BEEN CROPPED)