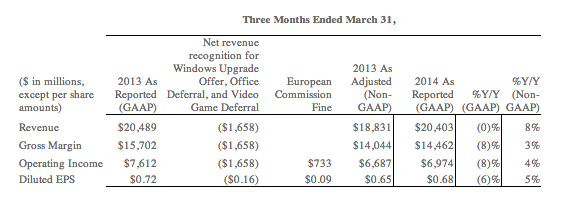

This afternoon Microsoft published its fiscal third quarter 2014 financial results, with revenue of $20.40 billion, and earnings per share of $0.68. Analysts had expected the company to report $20.39 billion in revenue, and earnings per share of $0.63.

Surface revenue was slightly soft, Office 365 uptake remains solid, and Azure grew quickly. The company also reported 1.2 million Xbox One sales in the quarter, along with 800,000 Xbox 360 sales.

In regular trading, Microsoft was up a fraction in line with the markets. In after-hours trading, the company is slightly up following its earnings beat.

Microsoft had operating income of $6.97 billion, and net income of $5.66 billion in the period. Here are the raw numbers compared to the year-ago period:

Windows revenue in the period was strong: “Windows OEM revenue grew 4%, driven by strong 19% growth in Windows OEM Pro revenue.” This was somewhat expected given that Windows XP finally died, forcing many companies to upgrade.

The company reported Surface revenue for the period of $500 million. That compares to the past two sequential quarters of top line from the tablet-hybrids of $893 million and $400 million. Surface revenue is a bellwether of sorts for the company’s attempt to become a devices company. The quarter’s tally feels slightly soft.

Bing advertising revenue popped 38%, while Xbox Live transactional top line expanded 17%.

Office 365 is key to Microsoft’s services strategy. The company reported that there are now 4.4 million Office 365 Home subscribers, up “nearly” 1 million in the quarter. Office 365 revenue on the Commercial side of Microsoft’s business “grew over 100%,” compared to the year-ago period.

Another key part of the ‘new’ Microsoft, Azure, grew its revenue by 150 percent. This revenue growth is key for Microsoft. The following comes from the company’s slides:

That right there is how Microsoft can grow in the short and medium term.

Devices and Consumer revenue grew 12 percent to $8.30 billion, while Commercial revenue at the firm grew 7 percent to $12.23 billion. Microsoft ended the period with cash, equivalents, and short-term investments of $88.4 billion.

Microsoft’s deal with Nokia is expected to close tomorrow, putting it outside today’s report. Microsoft CEO Satya Nadella will take part in the earnings call this afternoon.