Among everything else that’s driving e-commerce growth in India, the ease of buying things sitting inside homes, avoiding the hazards of traffic snarls, worsening air pollution and finding a parking slot, will easily rank at the top, no matter how simplistic it sounds.

India’s e-commerce industry has seen its most action-packed period over past few months — several hundreds of millions dollars have been pumped in startups such as Flipkart, Myntra and Snapdeal, the world’s biggest retailers including Amazon, Walmart and eBay are scrambling to have their piece of the action, and two of the biggest players are close to crossing the magical $1 billion in gross merchandise value anyway. In fact, the country’s biggest e-commerce company, Flipkart has already crossed that milestone.

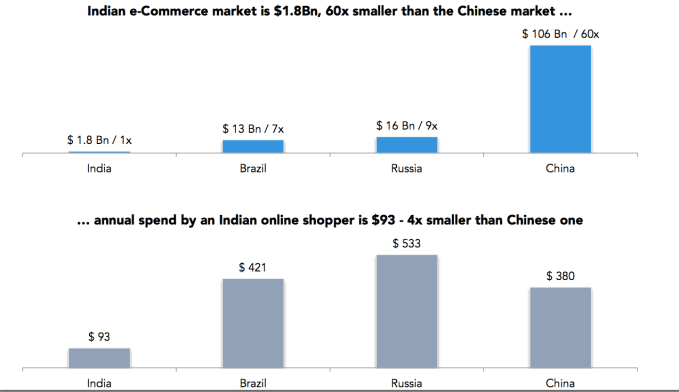

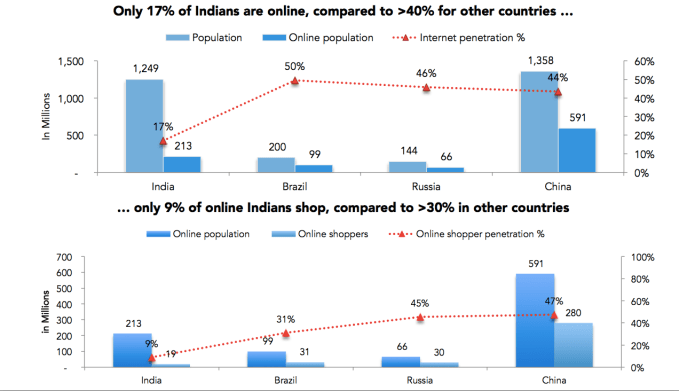

Indeed, India’s e-commerce market is projected to grow sevenfold to $22 billion in the next five years, as Internet infrastructure improves further, making it easier for the country’s nearly 200 million online population to shop on-the-go. India’s e-commerce market (sans travel sites) is currently worth $3.1 billion annually — just 1.5% of the value of China’s e-commerce sales, which are approaching $200 billion.

Behind this frenetic pace of growth are several drivers and inhibitors. Accel India, an early backer of several e-commerce startups such as Flipkart and Myntra in the country, has come up with a report that covers both the opportunities and the challenges. To be sure, Accel has made 13 seed stage investments and one growth stage (BookMyShow) over past few years in the Indian e-commerce industry, so a lot of what it has captured can be its own investment theses. However, the report does include some of the challenges that could hinder overall growth.

Here are some of the top predictions and highlights from the report:

- First of all, what took 8 years in the U.S. for B2C e-commerce to grow from 2% to 6% of the total organized retail (non-food retail sales), might just happen in 2016 for India, which is about 4 years. And by the way, China took just 2 years to reach that milestone. Accel predicts that the number of online shoppers will double from 20 million in 2013 to 40 million by 2016.

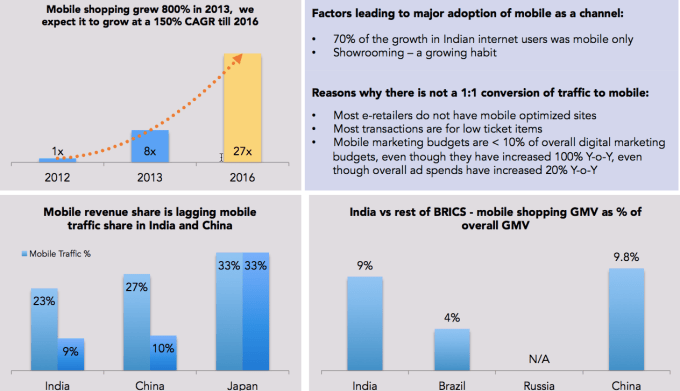

- Another important driver for Indian e-commerce is its fast growing population of first time Internet users, shoppers who are buying on mobile. Even if we consider a 20% quarterly growth rate, the mobile Internet users in India will reach 185 million from around 155 million currently. Also, most of these mobile shoppers are coming from India’s smaller towns. From around 25 million mobile Internet users in rural India during October 2013, it’s set to become 32 million by June 2014. Currently, around 130 million of the 213 overall Internet users are using mobile to access the web in India. By 2016, when India’s Internet user base reaches 400 million, Accel expects around 90% of them to access the web on mobile.

“Some of our companies like BookMyShow are seeing mobile transactions greater than 40%, a 800% growth YoY – a large part of this growth in mobile transactions is coming from tier-2 and tier-3 towns – where the consumer is a mobile first consumer,” said Prashanth Prakash, a partner with Accel India.

Opportunities in mobile commerce are also encouraging startups such as Paytm to talk about reaching audacious goal of processing 1 million orders in a day by 2016 before any of the bigger, established e-commerce rivals reach that milestone.

- Like with any nascent market, Indian e-commerce is growing because its share of offline retail is still very, very small (8.7% of the total organized retail in 2013). When Motorola was launching its Moto G in India, it ditched offline retail stores and partnered exclusively with Flipkart. The results were impressive, making it among the fastest sales ramp-ups for Motorola anywhere in the world. However, of the total 247 million mobiles sold in 2013, only 4 million were bought online. Books remain the biggest category for e-commerce with online platforms accounting for 45 million (7%) of the total 600 million books sold last year.

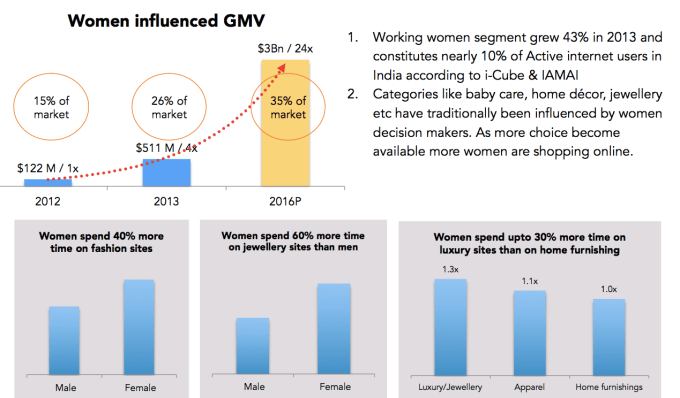

- An important factor helping e-commerce growth in categories such as fashion, home decor, jewelry and baby care, is growing influence of women shoppers who accounted for a little over quarter (around $500 million) of the total e-commerce sale in 2013. Fashion for instance, a category led by Myntra, nearly doubled in value from $278 million in 2012 to $559 million in 2013.

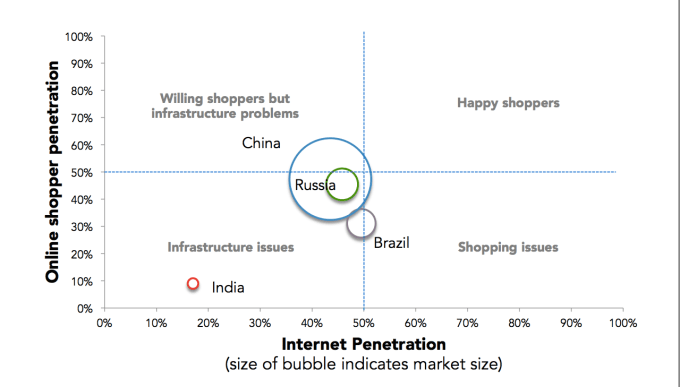

Meanwhile, there are several bottlenecks threatening to slow down India’s e-commerce growth. As pointed in my earlier story, the biggest challenge facing Flipkart and others is to grow the number of transacting users. And much of this is because poor Internet infrastructure.

Finally, the biggest bottleneck for online retail or any other Internet business in India is going to be the existing regulations and legal regime that don’t seem to be in sync with the newer business models. As this report from the Global Network Initiative pointed out yesterday, current legal regime in India – namely Section 79 of the Information Technology Act and the 2011 Intermediary Due Diligence Rules – does not offer adequate protection and legal certainty to online platforms.

Lead image credit: IndianSide.com via Flickr