Today Uber made a key move to help offer more assurance and support to its drivers, and also to customers of its mobile-app-based car service: it will start to offer insurance to its drivers to extend their own personal coverage, aimed particularly at times when there are no passengers in their cars.

The aim, the company writes, is to cover any “insurance gap” that might arise. This issue became a flashpoint for all ridesharing services after an accident in San Francisco earlier this year, involving an Uber driver who was not carrying passengers hitting a girl. The accident highlighted the fact drivers who are not riding with a passenger in their car, but are available for hire, are still effectively on Uber time, even if Uber’s insurance wasn’t covering that scenario.

The move comes after Lyft also announced a similar move last night — possibly to pre-empt its arch-competitor’s announcement. Lyft’s news was the basic announcement but was sparse on the kind of detail that Uber has provided today.

Uber says its new insurance policy comes into effect starting today, and is for now only valid in the U.S.

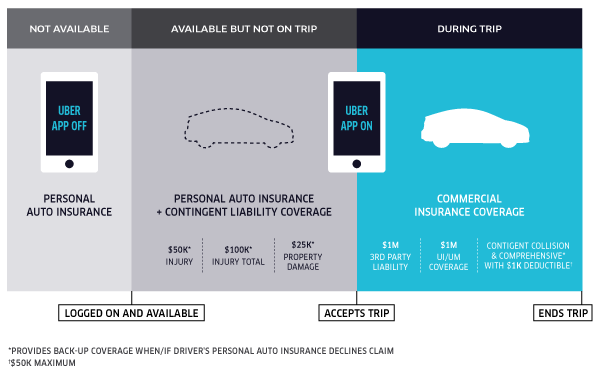

“If a driver’s personal insurance policy is found not to cover an accident during this period, this new policy will provide contingent coverage for a driver’s liability at the highest requirement of any state in the U.S,” the company notes. The coverage goes up to $50,000 for individual/incident for bodily injury; $100,000 for total/incident for bodily injury and $25,000 for incident for property damage,” writes Uber’s Andrew Noyes, in a blog post.

He also claims that “the first and only company to have a policy in place that expands the insurance of ridesharing drivers to cover any potential ‘insurance gap’ for accidents that occur while drivers are not providing transportation service for hire but are logged onto the Uber network and available to accept a ride.”

“Since Uber started offering a ridesharing option in the U.S. more than a year ago, our commitment has been to provide riders with the best possible user experience – one they weren’t getting from a taxi. In that time, we have revolutionized how people move around their cities with access to the lowest cost, most reliable, safest ground transportation out there. Our uberX offering is almost 50% cheaper than taxis in some cities and has seen massive growth as a result,” he notes.

Uber also sought in its blog post to clarify how the rest of its insurance policy works.

“From the time a driver accepts a trip request through our app until the completion of the ride, our partners have $1 million of coverage for driver liability. We were also the first ridesharing request service to include $1 million of coverage for uninsured/underinsured motorists, meaning that passengers and drivers are covered for injuries regardless of who is at fault,” Noyes writes. “This $1 million coverage from trip acceptance to drop-off is consistent across cities. This coverage kicks in regardless of whether the driver’s personal insurance applies to the trip. We have also added contingent comprehensive and collision insurance during trips, up to $50,000/incident with a $1,000 deductible.”

Here’s a layout of how the insurance will work. In effect, a driver’s personal insurance will only kick in now when he/she is driving with the Uber app off.