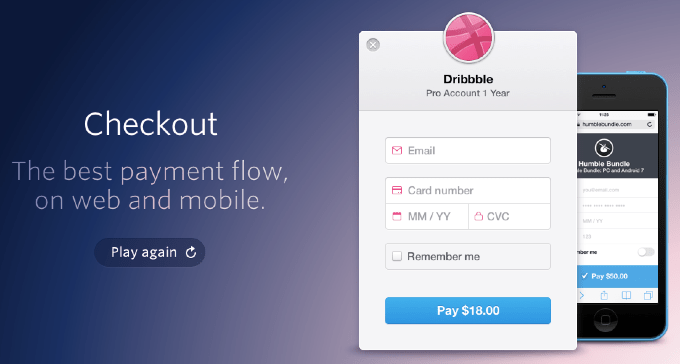

Stripe is debuting a new seamless checkout experience on mobile and web today, which enables one click-payments for the first time on the payments platform. The new version of Checkout allows for an embeddable payment form for desktop, tablet, and mobile that doesn’t take customers outside of a merchant site, and also allows them to pay without being redirected away to complete the transaction.

From the site, “Checkout is built on Stripe.js and generates a normal Stripe token. You can use the token to charge a card, create a customer, start a subscription.” At first glance, this new version of Checkout with the one click-payments experience could solve a big problem of friction in the mobile payments world for merchants.

The first time a purchaser pays via Stripe Checkout on their phone, Stripe will ask the customer for their credit card info. Stripe will also ask if the customer prefers for Stripe to remember the information, and will require customers to input their phone number. A single-use SMS code will be sent to the user which they can input to complete the checkout. In all subsequent transactions using Stripe (even on different apps and sites using Checkout), the customer can input their email, and a code will be automatically sent via SMS to the phone number attached to the email. You input that code, and the customer can checkout without having to re-enter their card information across sites and merchants.

Stripe says this version of Checkout is already deployed on thousands of sites and has handled millions of transactions (including Dribbble, WillCall and Humble Bundle).

Creating a native checkout experience is something that could be a game-changer for reducing friction in the payments experience, especially on mobile devices and tablets. PayPal is also working on its own integrated checkout experience as well, which is set to be released this year.

With both Stripe and PayPal approaching this in their own unique ways, the idea of attaching credit card identity to your login across devices and merchants is something we’re going to see more of as even Apple joins the payments race.

While the competition is heating up in the payments world, many investors are betting on Stripe to become a powerhouse — Khosla Ventures, Sequoia Capital and Peter Thiel’s Founders Fund all put more money into the company this year at a $1.75 billion valuation.

Thiel’s involvement in Stripe is particularly interesting, as he was one of the co-founders of PayPal, which is currently one of Stripe’s largest competitors. And Thiel actually bet on Stripe early — a few years ago — as an angel investor. We followed up with Thiel shortly following Founders Fund’s most recent investment in Stripe in late January to hear his thoughts on the company’s opportunity.

As he explained to me, “Stripe is rethinking the entire payments system as a whole stack offering to companies. This is not just processing, and they are looking to build up an entire suite of services.” He adds that because it is a simple, straightforward product, Stripe’s been able to capture mind share amongst the developer community early on.

“This is a different world than when we started PayPal in the 90s. There are far more people on the Internet, and connecting commerce to this is a vastly bigger world than it was during the PayPal days.”

As for Patrick and John Collison, brothers who are the founders of Stripe, Thiel sees something in them that is rare in entrepreneurs. Though young, they have a comprehensive understanding of all the layers of business, from product to engineering, to hiring, to managing people, he told me.

“The best entrepreneurs are ones that have panoramic understanding of a business,” says Thiel. “And while they are confident, they also have the ability to take feedback and listen.”

Thiel admits himself that innovating in payments is a huge challenge, but “when it works, it works well.”