eShares, a company trying to replace paper records for stock options and shares, has expanded its product lineup to include something called “409A-as-a-service.”

To be honest, until speaking with co-founder and CEO Henry Ward, 409A didn’t mean anything to me. Apparently it refers to a section of the corporate tax code around the valuations used for employee stock options. Ward suggested that these valuations can be a pain, not just because of the cost ($3,000 to $5,000) but also because they need to be redone periodically, unless the startup is willing to risk the wrath of the IRS.

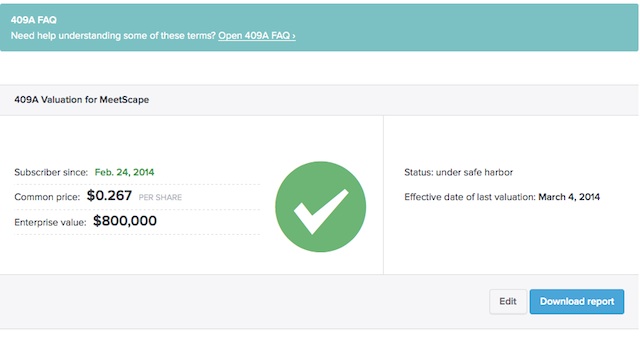

As the product name implies, eShares is trying to take a software-as-a-service approach to the problem. At a monthly rate of $159, Ward said the company’s 409A-as-a-service should only cost half as much as the traditional valuation process. Plus, in addition to getting a long report, eShares also provides a summary of the most important information. And perhaps most significantly, once a business starts paying the fee, they shouldn’t have to worry about performing any more valuations — it’s all handled automatically.

That’s because customers are already using the service to issue electronic shares, so eShares will have an up-to-date capitalization table in the system. Behind the scenes, while eShares is handling the technology, Ward said it has partnered with Preferred Return for the actual valuations.

Ward added that eShares signed up more than 200 companies in the first two months of 2014 and that it has issued 1.2 billion shares as of today.