Recent Y Combinator grad DataRank, which helps companies track online conversations related to their brands and perform other competitive analysis, has closed on $1.4 million in seed funding, the team is announcing today. The funding is led by New Road Ventures, and also includes participation from FundersClub and other angel investors.

Founded in October 2011 by Ryan Frazier, Chuong Nguyen, and Kenny Cason, and headquartered in Fayetteville, Ark., DataRank lives far outside the Valley, but its unusual home base is one that turned out to be more practical over the years, as the company shifted from its original focus of being a financial tool to one tracking data for consumer product companies.

That’s because the world’s largest brick-and-mortar retailer, Walmart, is also headquartered in nearby Bentonville. Today, there are roughly 1,400 consumer product companies with research teams in the area surrounding Walmart, explains Frazier, who is DataRank’s CEO. “Being able to walk into those places – sitting down, showing them your product and getting immediate feedback, has been immensely helpful,” he says.

That being said, DataRank later joined Y Combinator to expand its network in the Valley, allowing it to compete for the engineering talent it needs to grow. The 11-person company recently hired four additional engineers, and is now looking to grow out its sales team.

As for the product itself, DataRank offers companies a way to track conversations around their product shared across thousands of sources on the web and social media, including well-known outlets like Facebook, Twitter, Pinterest, and YouTube as well as blogs, forums, e-commerce stores’ review sections, and more.

After first signing up to use DataRank, the company will pull in six to 12 months of historical data, then establish the product or brands and competitive topics the customer wants to track.

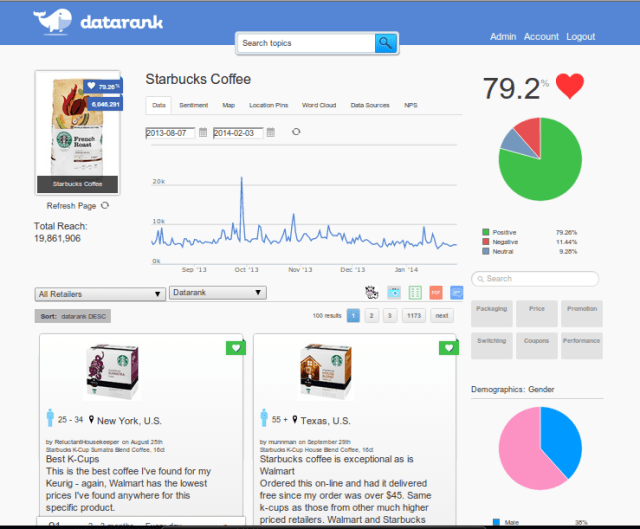

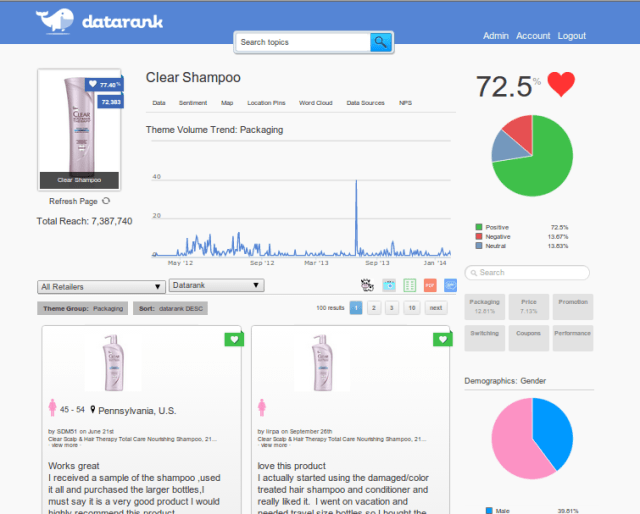

For instance, DataRank can be used to track the volume of conversations, total reach, sentiment, and demographics surrounding a brand, digging into details about who uses the products, where they live, how old they are, their gender, and other factors. It can also compare how various product features (e.g. packaging, product features, coupons available, etc.) compare with competitors’ products, as well as how new products from the competition are performing. In fact, notes Frazier, a larger share of the company’s revenue today comes from this competitive analysis.

Today, DataRank counts 14 enterprise customers including Clorox, Callaway Golf, ConAgra Foods, and others under NDA. It charges anywhere from $500 per month for smaller companies up to $10,000-$20,000 per month for its enterprise customers.

Customers access the service via an online dashboard where it can pull in the company’s internal business or sales data to combine that with its own findings, as well as export data back out via a JSON API or CSV download.

But what makes DataRank stand out versus its larger competitors, like Radian6 (acquired by Salesforce) for instance, is the way it prioritizes the data it pulls from around the web.

“If you think about the competitive space, it was basically like if when you were on Google, it returned results based on date and time,” explains Frazier. “What we think is a better way of doing it – which is the way Google actually does it – is if you run a search for a topic, it returns the most relevant or useful links first. That’s what we do with all this conversation and unstructured data, is provide structure to it so it can be used to make decisions.”

The historical data the company provides is also important for doing research, he adds. And that will come into play even more in the future, as DataRank plans to build out the workflow between research and marketing even further by performing more predictive analysis and recommendations.

“Our first focus is getting the highest quality data, but then, with that, we see the potential to really make decisions and create campaigns without an entire research team telling you what to do,” says Frazier.

The company was recently profitable, though it’s not currently as it’s trying to expand and hire. But it has been growing steadily around 20 percent month-over-month for the last 12 months, and grew over 300 percent last year, we’re told.