After all the VC deals that get done at Blue Bottle Coffee, it’s only fitting that Blue Bottle Coffee’s fundraising be one of them.

The tony coffee brewery announced its $25.7 million series B investment, completed at its flagship store in Oakland, earlier today. The investment was led by Morgan Stanley Investment Management, the same Morgan Stanley adviser behind the investments in Twitter and Facebook, according to a source.

(While Morgan Stanley Investment Management primarily invests in public companies, the 5 percent of the capital it is allowed to invest in private companies goes to stuff like Blue Bottle and Twitter, we hear. Morgan Stanley declined to comment.)

While Morgan Stanley getting into coffee does not seem that far-fetched, the list of names on the Blue Bottle term sheet also included a pack of tech founders and executives. In addition to former investors Index Ventures, Google Ventures and True Ventures, Instagram’s Kevin Systrom, Twitter and Medium co-founder Evan Williams, Twitter investor Chris Sacca, WordPress founder Matt Mullenweg, Flickr and Hunch founder Caterina Fake, investor Joanne Wilson (Fred Wilson’s wife) and a16z partner Lars Dalgaard joined the round.

Aside from Systrom, who was a trained barista post-Stanford, no one on the above list has any kind of coffee background. So why the tech pile on? Is Jon Shieber right? Is no industry safe from Silicon Valley?

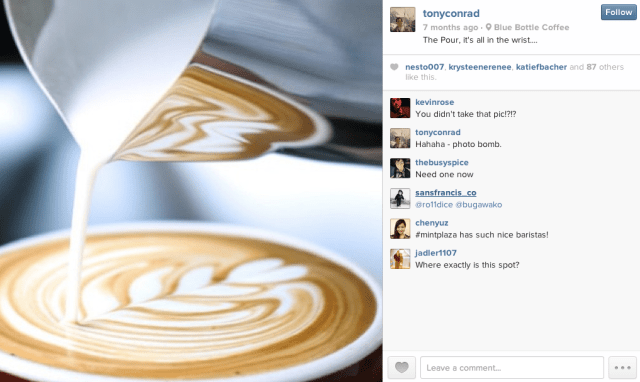

True Ventures partner and Blue Bottle champion Tony Conrad told us that the appeal of Blue Bottle was about entrepreneurial camaraderie. “Tech investors in particular are good at identifying these kinds of people,” he said, referring to Blue Bottle founder James Freeman.

“[Freeman] sounds like a Matt Mullenweg to me, or an Evan Williams or a Bre Pettis. The reason that True Ventures got into it was that I was considering it on a personal level. I have enough technology investments. From a tactical point of view, boy it’s diversified.”

There’s definitely a new breed of entrepreneurs in coffee.

Conrad is no stranger to atypical investments, having backed and seen multiple returns from an investment earlier in his career: Stoneyfield Farms yogurt. “That worked out pretty well,” he said.

“There’s definitely a new breed of entrepreneurs in coffee,” Blue Bottle Chairman Bryan Meehan explained, describing why the brick and mortar entrepreneurial spirit has found fast friends in tech. “Jack Dorsey [a Sightglass investor] hired his second employee, launched Square at Blue Bottle in Mint Plaza. Perhaps our tech investors recognize something in our brand and in James that they see in themselves?”

Or perhaps they just really like coffee?

“We could spin it and say that it’s tech, but that’s not the case,” Tony Conrad explained. “Investments like Blue Bottle and hair color startup Madison Reed are physical products. That amounts to about two percent of our portfolio. If you look at Sequoia and Greylock, they probably have a couple companies like this [in fact, Sequoia owns shares in The Melt, a grilled cheese company].”

He continues, “What does The Melt have to do with technology? Sequoia did that deal. Sure, our LPs want us investing in technology. And we respect that. But they also want us to be smart, and have an unfair advantage. We had access here that nobody else had.”

https://twitter.com/kevinroose/status/428621444269223936

If you boil venture capital down to a pure goal of getting in early on huge, scalable opportunities, specialty coffee roasting is definitely a large enough market. In terms of dollars spent, coffee purchases in the U.S. top $30 billion dollars a year, with the specialty market — including Starbucks, Peet’s, Stumptown, Fourbarrel, etc. — raking in about half that at $15 billion.

Starbucks revenue is about half the specialty market.

SF-specialty coffee shop Philz Coffee also raised an eight-figure VC round just last summer. When asked if he considered Starbucks Blue Bottle’s closest competitor, Meehan said no. “We’re so naive about competition. I pay close attention to Stumptown, Fourbarrel and Sightglass because I like what they do. All of us small companies are tiny, but one or two of us are going to be very big. Even $200 million in revenue would be 1 percent of the market.”

He wouldn’t tell me what their revenue is currently.

Meehan says the company will spend the money on developing its “ready to drink” iced coffee product, and building out more stores to sell fancy coffee and beans roasted fewer than 48 hours ago. He tells me Blue Bottle has just signed seven leases, with five more in the works.

And of course, Blue Bottle is going to vamp up its website, though Conrad holds that, despite being more tech-connected than a night at The Battery, Blue Bottle is not making an e-commerce play. “It’s a company that leverages tech. And it will have an increasing online component where people can order beans, etc. But that’s never going to be the motor of our business.”

For the record, Conrad’s favorite drink at Blue Bottle is the “SG – 120.”