Apple has just released its fiscal Q1 2014 earnings, reporting $57.6 billion in revenue, $13.1 billion in net profit representing $14.50 per share. Compared to the year-ago quarter, it corresponds to a growth of 5.7 percent in revenue, and 5 percent in EPS, with net profit flat year over year.

Apple sold 51 million iPhones, 26 million iPads and 4.8 million Macs in the quarter. As the iPhone remains the big money-making device for Apple, analysts had expected 55 million iPhones. Apple fell below those expectations. Compared to Q1 2013, iPhone sales grew 6.7 percent (more than Apple’s overall revenue) while iPad sales grew 13.5 percent. Read all the details about hardware sales in our separate post.

Apple CFO Peter Oppenheimer said in the earnings call that they sold 26 million iPads “despite supply constraints.” It means that it could have sold more iPads if it had more inventory. “We exited the December quarter near supply/demand balance,” Oppenheimer said regarding iPad production.

“We are really happy with our record iPhone and iPad sales, the strong performance of our Mac products and the continued growth of iTunes, Software and Services,” Apple CEO Tim Cook said in the release. “We love having the most satisfied, loyal and engaged customers, and are continuing to invest heavily in our future to make their experiences with our products and services even better.”

Revenue Below Expectations, But EPS Above Expectations

According to Fortune, the consensus among analysts was for Apple to report earnings of $14.36 per share on $58.1 billion in revenue, with both revenue and EPS growing. The WSJ expected $57.46 billion in revenue and $12.68 billion in profit, this time with profit down 3 percent year over year.

Despite an all-time high in sales with more than 50 million iPhones sold for the first time, revenue is below the street’s expectations. On the other hand, EPS is above expectations with flat profit. Gross margin was 37.9 percent compared to 38.6 percent in the year-ago quarter. That’s why net profit is flat.

As a reminder, Apple reported $37.5 billion in revenue, $7.5 billion in profit representing earnings of $8.26 per share.

Guidance from its last earnings release forecasted between $55 billion and $58 billion in revenue, with gross margin between 36.5 percent and 37.5 percent. Over the past three quarters, Apple’s own guidance has been much more accurate, with the upper end of the forecast very close to what it actually reported.

Software revenue is up 26 percent compared to Q1 2013. iOS 7 is installed on 80 percent of compatible devices. “It’s the most popular operating system in the world,” Oppenheimer said. iWork apps are now free on both OS X and iOS, but it didn’t affect growth for now.

Overall, iTunes, software and services represented $4.4 billion of this quarter’s revenue.

The company’s cash on hand greatly increased from $146.76 billion to $158.8 billion. It remains a great strategic asset for Apple. Yet, only $34.4 billion is kept in the U.S.

Over the past couple of years, the company has become more generous when it comes to dividends and share buybacks, but it still managed to add $12 billion this quarter alone. Many tech companies would have loved to make $12 billion in revenue.

Bleak Guidance

Apple expects to have a revenue between $42 billion and $44 billion for the next quarter, with a gross margin between 37 and 38 percent again. The company reported $43.6 billion in revenue for Q2 2013. In other words, Apple expects more or less a flat quarter when it comes to revenue next quarter.

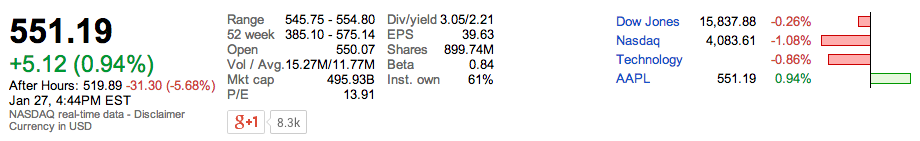

Apple shares are currently down 5.7 percent in after-hours trading, mostly due to next quarter’s guidance and not today’s earnings.

International Revenue

Revenue in Greater China and Europe continue to grow year over year while it’s more or less flat in other regions. Read more about international outlook in our separate post.