Out of all the financial planning apps I’ve tried, Level is one that I like best. The app, which bills itself as a “real-time money meter” has data visualizations that let me know at a glance how much money I have left to spend and still stay within my budget. I also appreciate the way it automatically draws up a recommended financial plan that includes recurring payments from my bank account because that helps me track my student loans, as well as subscriptions to services like Netflix and Oyster. So I was glad to learn that the app, which TechCrunch first profiled when it launched in October, is releasing an Android version and adding new features.

Since its release, Level’s iOS version has been downloaded 400,000 times and managed a total of over half a billion in consumer spending among its users, CEO and founder Jake Fuentes told me in an email. The app connects to 70 U.S. banks, which means it can cover over 85% of accounts in the country. The startup’s growth is being fueled by a $5 million Series A round led by Kleiner Perkins Caufield & Byers (KPCB).

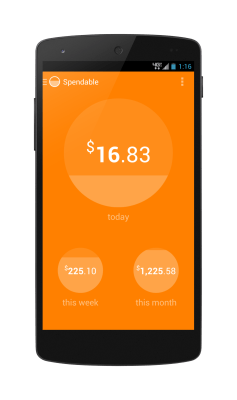

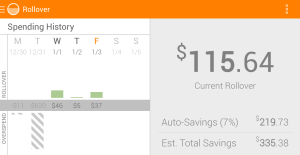

“Since October, we’ve found that the core of the application, the Spendable tracking feature, is by far the most popular. Our members also enjoy the ability to monitor all transactions across their accounts, using an interface that is much more friendly than most banking applications,” Fuentes says. “Finally, our Rollover Cash feature, which projects how much you’re on track to save this month, was surprisingly popular–there’s more to come on this feature.”

Level is targeted at people in their twenties and early thirties (i.e. Millennials) who want to figure out how to balance student loans and other major expenses with a realistic savings plan. The Android and iOS version now have several new features, including support for more banks, more accurate algorithms, and the option to set a PIN code.

“We assume some percentage of income (7% is recommended) goes toward savings and we help manage spending so we can hit that goal. Saving won’t always happen each month, but when it does, we’ve taken the first step towards building long-term financial success,” says Fuentes. “For those with student loans or other debt, we make it crystal clear how much of each month’s income goes towards those bills so our members can make smart decisions accordingly. We focus on the small, easy decisions which can make a big difference in the long run.”

Features in the pipeline include the ability to set specific savings goals, as well as recommendations for what to do if you have some extra cash left over at the end of the month. For example, Level will suggest if you should put that money toward an extra loan payment or invest it. On the other hand, it can also reassure you if have you enough to splurge on a treat. Fuentes says those tools will be available later this year.

One thing I’d like to see Level is a simple tracking tool so I can see how my spending breaks down in different categories across the month, but right now I’m happy using Dollarbird, another app TechCrunch profiled, to keep on top of my daily expenses.

When TechCrunch wrote about Level four months ago the startup was working on a monetization strategy. The team is still figuring out ways to make revenue, but Fuentes says that the app will always remain free.

“If we focus on doing what’s right for our members, we’re sure there will be ways we can monetize in a responsible way,” he tells me. “We’re not sure exactly what that looks like yet, and we’re remaining keenly attentive to what our members are asking for and we’re focused on taking our first steps at this point.”