Bright*Sun is a U.K. fintech startup that’s making a business out of helping VCs decide which startups to invest in. That means it inevitably has to tread a fine line when it comes to sourcing external investment in itself — to avoid potential conflicts of interest — which may be part of the reason why it’s steered clear of external funding up to now.

Since starting the technical work to underpin its startup business, back in 2011, Bright*Sun has been privately funded by its three co-founders, who have a background in hedge fund management and quantitative finance (quitting their city day jobs to jump into the startup world). But it’s now taken in $200,000 in Angel funding from the team of investors at London Venture Partners that invested seed funding in gaming startup Supercell (which went on to pull in $1.53 billion from Softbank).

The LVP investors in question, Paul Heydon, David Gardner and David Lau-Kee, are investing in Bright*Sun in a personal capacity, i.e. as Angel investors, rather than the firm itself investing; fintech not being an area LVP generally invests in.

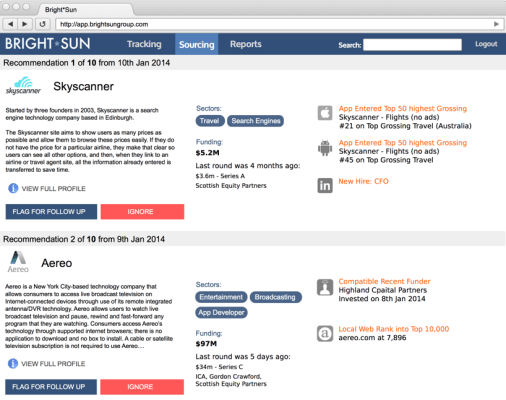

Bright*Sun’s three co-founders have developed a proprietary algorithm that’s powering its investments recommendations service for VCs which is fed by a variety of data sources — including industry news, databases of company funding such as CrunchBase and AngelList, hiring indicators, app store and Alexa rankings, and social media sites, to name some of the chatter Bright*Sun is listening to to ultimately distil valuable investment suggestions for its clients.

It’s playing in a space with the likes of startups such as MatterMark, another data-signalling platform for VCs, as well as contending with doubters who question the value of an algorithmic deal-sourcing investment approach at all, when it comes to sifting useful investment signals from so much noise.

“Fundamentally we collect lots of data from different places. We collect news, we have hundreds of different news feeds that we scrape for interesting information about companies, stuff on LinkedIn, on CrunchBase, on AngelList, jobs information, so who’s hiring what specific positions and in what geographies, Alexa, iTunes, Android, and then we use that and we derive signals from that and put them together to drive algorithmic recommendations for different funds,” says co-founder and CEO Stephen Piron.

To tailor its recommendations to a particular client, Bright*Sun also uses data provided by its investor customers to zero in on the sectors and startups they are most interested in.

“What a fund provides to us is a list of companies they are currently tracking, and that informs what specific recommendations that fund would get,” says Piron. “Funds all have slightly different methodologies but they’re pretty close so they’ll have a priority list of interesting investments — like hot investments that they might want to sign a term sheet with, medium/warm investments, and then cool ones they just want to watch and see what happens.

“That’s important input for us — and the recommendations [we provide to our clients] are, broadly speaking, two sorts: ones that are like things that they are already tracking, and that’s easy to validate because it’s things that may have slipped through the cracks. So they might be looking at Scandinavian games companies and we might have spotted two more that for whatever reason they just didn’t see. And then companies that might be at an earlier stage than some of the hot companies that they are already tracking. Which are the more interesting ones but harder to verify.”

Bright*Sun kicked off a beta version of its deal-sourcing service around February last year, launching a full paid offering at the start of July. Since then it’s managed to acquire around a dozen VC customers, from the U.K. and the U.S., according to Piron.

In terms of quantifying the potency of Bright*Sun’s algorithm and the value of its investment recommendations, well that’s always going to be tricky. Especially as even large VC firms don’t make that many investments per year — so there’s not a lot of hard data-driven decisions to go on.

“It’s hard to point to one clear example,” concedes Piron, when asked what evidence he can point to to support the value of Bright*Sun’s algorithmic approach.

“The success is that people are using it and buying it, and some of the big firms are using it every day. And it’s an important part of their deal flow,” he adds. “We get feedback that they have seen something that was a recommendation, and then they learn a couple of weeks or maybe a week later that somebody else has invested in it. And they’re like ‘well this is good, we just got there too slowly’.”

Piron does stress that he does not see algorithmically powered investment decisions ever entirely replacing the human VC. The point of Bright*Sun is thus not to compete/replace VCs, but to sell them a useful supplementary service that can do wide-scale market monitoring to underpin and support human investor decisions.

“There are certain things an algorithm can’t replace,” he tells TechCrunch. “We can never really look into someone’s eyes and assess if they’re a person you trust, right? But it does make their job easier, I hope. Some VCs are more responsive than others… it’s a delicate conversation to have.”

And while some VC firms are trying to do more data-powered algorithmic deal-sourcing in-house, a trend Piron describes as hottest in Silicon Valley (vs Europe), he does not see that as undermining the specialist service Bright*Sun can offer — because “this is all we do”.

“A lot of the bigger VCs have tried this internally, and they’ve been frustrated by how difficult a problem it is. And fundamentally they are not software houses, they are not scientists or data scientists; they’re VCs, and their frustration comes from the under-estimation of how difficult a problem it is,” he says.

Difficult, or perhaps impossible — depending on your view of the signal to noise debate. But then value and the perception of value are inextricably linked, so even if Bright*Sun’s algorithm can’t distil intrinsic value, if it can at least sift sentiment from the big data static it is probably creating something of value anyway. (Plus, if Bright*Sun’s VC customers think its service is valuable to them, even without hard data to back up that gut-feeling, then it has a value.)

“If people think something is important, it tends to become important — even though it’s not intrinsically important,” adds Piron. “The background that we all have is that we worked in the quantitative finance world. So I’ve worked at a big hedge fund where the job was figuring out the signal from the noise — it was for the capital markets, the futures markets, and quant trading and effects trading. Which is different but there’s a lot of similarities in that there’s a lot of noise and you’re trying to figure out where is the fundamental signal in that noise?

“Stocks, by the way, also have all of these weird feedback loops. If people think a stock is going up then it tends to go up just because people think it goes up.”

One signal Piron says Bright*Sun can (sometimes) distinguish is when a startup is faking it — be it by buying social media followers, or manipulating app store rankings to artificially inflate the popularity of their app, for example.

“We can kind of figure out — to some extent, and not perfectly — legitimate traction on these metrics vs artificial metrics. So you can see sometimes there’s very steady rises [in usage/adoption],” he says. “Some of these social media things you can see that they’re buying them, or that they’re not authentic. Even in the iTunes Store, actually. We can do some of that, although that’s also a very difficult problem. No one can do it perfectly.”

Bright*Sun will be using this first external cash injection from the trio of LVP Angels to expand its three-man-strong team (with a “handful” more hires, as Piron puts it), and also to carry on building out its technology. When you’re trying to pull signals for noise, that’s inevitably an ongoing tech challenge.

Ultimately, he says he sees a future for Bright*Sun beyond just targeting technology VCs — even if that is where it’s squarely focusing its efforts for now. “For now the early adopters are technology VCs but we do have aggressive plans to expand out into a larger private equity world, and different kind of less techie verticals — or not only just focusing on tech verticals. So things like pharmacy and more of these finance and private equity firms,” he adds.