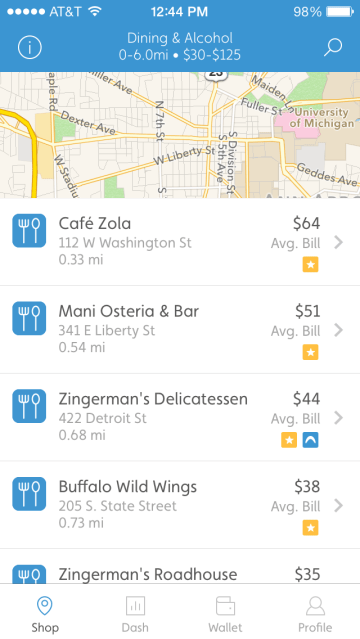

When looking for a new place to eat, drink or shop, most people turn to local recommendations services like Yelp, Google Places or Foursquare. A new mobile application called Wisely, launching today, has a different idea. Instead of user reviews, Wisely taps into actual transaction data, allowing you to filter searches by things like popularity or average bill size.

The app is the latest from a company called Glyph, which pivoted from its earlier efforts launched last year, which had been focused on helping you determine which credit card to use in order to earn better rewards. Explains CEO Mike Vichich, the company found that it was difficult to get people engaged with Glyph for a number of reasons. People use their credit cards for a number of things, he says.

“But we always felt like transaction data was really important, and told a story about the world we live in,” he explains. “If you’re able to view a map of how people swipe their cards, it’s a map of the economy – it tells you which places are quality, which places are popular, how expensive places are, which places are for locals versus tourists. We thought that was something valuable that didn’t exist,” Vichich says.

“But we always felt like transaction data was really important, and told a story about the world we live in,” he explains. “If you’re able to view a map of how people swipe their cards, it’s a map of the economy – it tells you which places are quality, which places are popular, how expensive places are, which places are for locals versus tourists. We thought that was something valuable that didn’t exist,” Vichich says.

In the new app Wisely, you can search for things like restaurants, shops or bars, for example, and see search results based on transaction data, not social mechanisms like check-ins or user rankings and reviews.

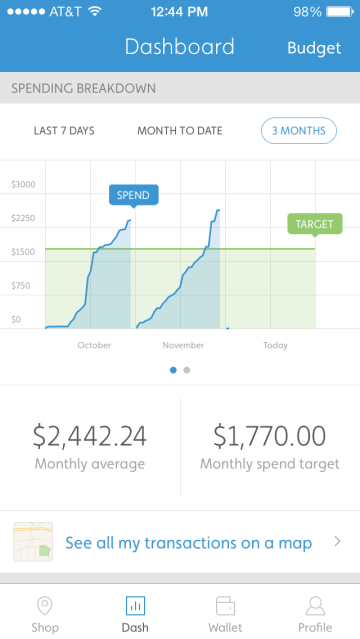

However, the app isn’t only focused on the “before” side of consumer spending – it also lets you store your loyalty and membership cards for easy access during your visits and helps you understand your spending behavior afterwards, similar to something like Mint. Like Mint and other mobile money management apps, Wisely lets you set a budget and then analyze your spending over time, examining the categories of your past purchases and even where they’re located on a map – the latter an easy way to spot a possible fraudulent transaction, Vichich claims.

At launch, Wisely only supports American Express cardholders, but it will include support for Chase and Bank of America by mid-February, and hopes to include support for 95 percent of transactions (credit or debit) in a year’s time.

The challenge here is that for each credit or debit card brought on board, the company has to write programs to clean up the merchant data, which takes some time, the CEO tells us. The end result, Wisely hopes, will be a platform for both mobile and web where anyone can access this kind of data.

“The mountain that we’re climbing is data democratization,” says Vichich. “One of our foundational beliefs is that payment data is really valuable to consumers and merchants.”

Future: Competitive Intelligence For Merchants

For consumers, the data can help them shop, travel, and dine “wisely” (get it?), but the real business model for the service is about providing this data to merchants, which the company plans to do in time as a SaaS platform. Here, Wisely would help merchants analyze what kind of spending takes place where, and even how their own sales look when compared with those of competitors.

In addition, merchants would be able to track their own customers’ loyalty in an anonymized way, and then offer their best customers some sort of reward via the Wisely platform. The merchant side of the business is something Wisely will begin to work on a bit further down the road, however.

In the meantime, the small, Ann Arbor-based company has added an undisclosed amount of funding on top of its earlier $500,000 angel round. They’re expecting to close on a seed round in Q1 2014.

Wisely is currently featured in the App Store under finance, and is a free download here.