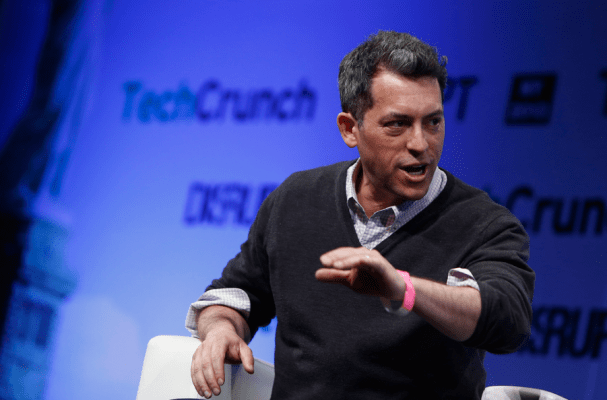

“At some level, it is still contrarian,” Accel Partners’ Andrew Braccia admits about leading a $40 million fourth round of funding in Vox Media, the publisher of hundreds of major league sports fan blogs as well as tech/culture site The Verge and gaming site Polygon. Coming on top of $30 million in previous rounds, the Washington, DC-based company will have the most venture backing of any high-end content creator when the round is finalized in the coming weeks.

There are precious few other examples on this scale. Viral-oriented Buzzfeed has raised nearly $50 million in total. Politically-focused Huffington Post had reached $37 million before Aol (TechCrunch’s parent company) bought it. Silicon Valley investors, at least, are still not very optimistic about startups that put content first.

But Braccia has been leading venture rounds in Vox since its first in 2008. What does he like? Vox’s long-term strategy, which it has been building out for a decade.

It was founded in 2003 by Markos Moulitsas and others from The Daily Kos, his namesake political commentary blog. That site had grown into a pillar of the progressive blogosphere in that turbulent political era because it focused on big issues and let readers publish their own posts. But instead of expanding into other parts of the political world, the founders stepped back and wondered how the model might apply more broadly.

The answer they found was sports. Co-founder and sports writer Tyler Bleszinski decided to focus on a personal passion, Oakland baseball, and launched Athletics Nation. Readers loved it, and from there the company slowly built out a content management system, more sports sites, the start of an ads business, and eventually attracted a former Aol executive, Jim Bankoff, as an advisor. Braccia, who is known in these parts for finding unusual, big-time deals (Braintree, Lynda.com and 99Designs are some fresh examples), first met the company through Bankoff when Vox had around 75 sites.

He quickly got the big idea, he tells me today, as he’d already been a long-time reader of two of the sports sites, McCovey Chronicles for the S.F. Giants baseball team and Golden State of Mind for the Golden State Warriors basketball team.

“Building a media company is not as well understood in Silicon Valley as building a software company, or building other types of companies that scale differently based on network effects, virality, or whatever it might look like,” he explains. “You have to take a longer view of this category, and fundamentally ask the question: ‘Billion dollar media franchises have continued emerging through all the technology change over the last 50 years, so why should the next 5 to 10 years be any different?'”

When Vox raised venture money and made Bankoff the CEO in 2008, the focus went towards building out the tech and ads. Today, the manifestation of the plan includes Chorus, a versatile software system featuring content management, forum software, analytics, site layout formats, and much more. Its advertising, meanwhile, is comprised of traditional inventory like banners and background takeovers, as well as newer products like sponsored video series — Vox added its own in-house agency earlier this year to help with that effort.

On the content side, the plan was always to look at other big verticals outside of sports, where the community + tech + brand ads formula could apply. The Verge launched in 2011 and has distinguished itself for tech reporting, commentary, production quality plus traffic and monetization growth, as somewhat direct competitors like me are obliged to acknowledge. Polygon, launched late last year for the video gaming world, appears to be on a similar track.

Overall traffic has been booming, too, with web measurement firm Quantcast now showing nearly 60 million global monthly unique visitors to Vox properties (this number is more reliable than most third-party stats because Vox uses Quantcast tracking software to directly measure its own traffic). Bankoff also confirms to me today that Vox will hit profitability this year, repeating his promise from when we’d talked at Disrupt New York in April.

So Vox’s odds of survival — a big question at most media companies — look good, particularly with all this extra money in the bank. It has the tech built out even as many companies struggle with older systems. It has the in-house ads system running pretty well, apparently, which should help the company continue making money as more of its content is read on mobile devices, even as many publishers face new business struggles because of poorly performing mobile ads.

Vox will be investing the new money in its current products and properties, particularly in its new focus on video and video ads, Bankoff says.

The question will be if it, or really any content site, can actually get to the size that it dreams of.

“It’s about that moment in time, about capturing emotion with a certain voice,” Braccia says about the media companies that reach the billion dollar mark. “In my generation it was MTV. For my parents it was Time and Life and magazines like that. In this next generation, it’s Vox Media, TechCrunch, Gawker, Buzzfeed.” The lower production and distribution costs of online media, and the hoped-for eventual migration of brand advertising from TV to web and mobile, are what he thinks will make the difference.

All of these sites still have a long way to go for that sort of valuation. Many other types of companies could eat into that kind of potential ad revenue, for starters. But whatever competitiveness we all might feel, the fact that tech investors are going all-in is a great sign. As Bankoff puts it, “VCs aren’t for or against media or any other industry, they look for companies that use tech and innovation to disrupt existing industries, including media and brand advertising. No one has really approached it the way we have.”

Accel isn’t the only Silicon Valley firm putting money into Vox. $33 million of the planned $40 million round has closed already, and Bankoff confirms that long-time existing investors Khosla Ventures and Comcast Ventures are both participating. He won’t say who else, though, and won’t say whether any of the other participants are strategic or not.

What about the specific liquidity event, that any investor has to care about? With around $70 million in venture money, Vox’s valuation is likely too high for what most potential buyers would want to pay, leading many to speculate that an IPO is the plan. Bankoff demurred on that question, too, so I bet some people will be watching to see if any new strategic investors are added before close.