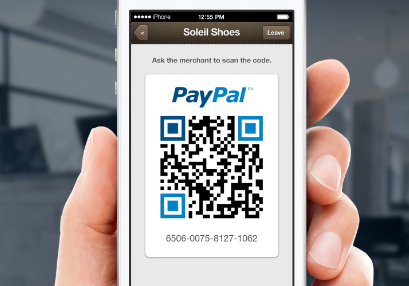

PayPal has been pushing ahead with its Here business, offering smaller businesses a way of taking card payments, processed by PayPal, by way of small readers attached to merchants’ smartphones. Today, the eBay division unveiled one of the new services it hopes will help it win with larger retailers. Payment Code is a new technology that PayPal is rolling out so that shoppers can pay for goods using apps that generate QR Codes readable by merchants’ existing scanning devices.

The idea behind Payment Code, unveiled at the Money2020 conference, is that while PayPal will continue to offer Here to target retailers who may not yet accept card payments, to get in with larger retailers, PayPal has to contend with the latter group’s tendency to move slower and the fact that they already have large investments in existing equipment. “There is a basic premise that we have, which is that you are not going to change behavior in the retail store sector very quickly,” Don Kingsborough, VP retail at PayPal, said in an interview. For those who do not have QR Code-reading scanners — with 40 million+ of these readers, this means “many, but not any,” Kingsborough tells me — Payment Code generates a four-digit code that can then be punched into a card-reading terminal. Less app-centric, but still relying on equipment already in the stores.

Kingsborough says that initially Payment Code with work with merchants who are part of the Discover Network “in a few million locations”, along with several banks like First Data, with more credit card partners getting added over time. As for retailers, PayPal declines to name who its partners will be when it rolls the service out at the end of the year, but Kingsborough notes that likely early partners will be those who already have rolled out other payment services with PayPal, such as Home Depot.

Payment Code is one way that PayPal is trying to break out of PayPal’s walled garden and into not just more of the physical store experience, but also its way of playing nice in the retailers’ virtual back yards.

On the physical side, to help lure customers into stores, Payment Code will push notifications to users when they are near them with offers. Once they are inside participating merchants, PayPal’s new Beacon Bluetooth LE-enabled hardware will automatically detect users and give them more personalised recommendations. This is because Beacon, used with the apps, is a way to collect a lot of information about shoppers. “We know your phone number and what store you are in at the time, and where you have been,” says Kingsborough.

When it comes to how Payment Code will be implemented in the virtual sense, this is also where things get more interesting. PayPal will offer the service through its own app, but it will also give retailers the ability to integrate it into their own, by way of a set of APIs. In the larger debate about who “owns” the customer, PayPal is willing to give more slack to its retail partners, in exchange for the chance to process the transaction. This will mean that PayPall will not only give users access to pay by their PayPal accounts, but also major credit cards, bank cards and private-label charging cards from the retailers themselves. It will also mean that PayPal will be able to integrate with retailers’ existing loyalty and gift cards — two more important pieces of the puzzle that stores are using to keep their customers close.

As for what PayPal will get out of those transactions, the percentages appear to be a moving target: Kingsborough says that the cut that PayPal will get is currently being negotiated on a case-by-case basis — a far cry from the transparency that has become the default of many of the SMB-focused mobile payment services that have been rolled out by the likes of Square, iZettle, Groupon and PayPal itself.

The app itself will not stop at QR Codes, either: soon to come could be barcodes (which PayPal has been working with in the UK) or whatever other graphic and numeric authentication services come along. That could include NFC, or not. The main thing is that by banking the concept on an app and not hardware, those specifics can be decided as PayPal and retailers go along.